GBP/JPY Price Forecast: Slides below 193.00 ahead of BoE; set up warrants caution for bears

- GBP/JPY extends the overnight pullback from the vicinity of over a two-month high.

- BoJ rate hike bets and the flight to safety underpin the JPY, exerting some pressure.

- A mixed technical setup warrants caution for bulls ahead of the BoE policy decision.

The GBP/JPY cross attracts sellers for the second successive day on Thursday and extends this week's retracement slide from the vicinity of the 195.00 psychological mark, or over a two-month high. Spot prices weaken further below the 193.00 round figure during the Asian session and seem vulnerable to slide further amid a broadly stronger Japanese Yen (JPY).

Expectations that strong wage growth could boost consumer spending and contribute to rising inflation give the Bank of Japan (BoJ) headroom to keep hiking interest rates. Apart from this, the uncertainty over US President Donald Trump's trade policies and geopolitical risks underpin the safe-haven JPY, which, in turn, is seen exerting pressure on the GBP/JPY cross. The British Pound (GBP), on the other hand, struggles to gain any traction as traders opt to wait for the Bank of England (BoE) decision.

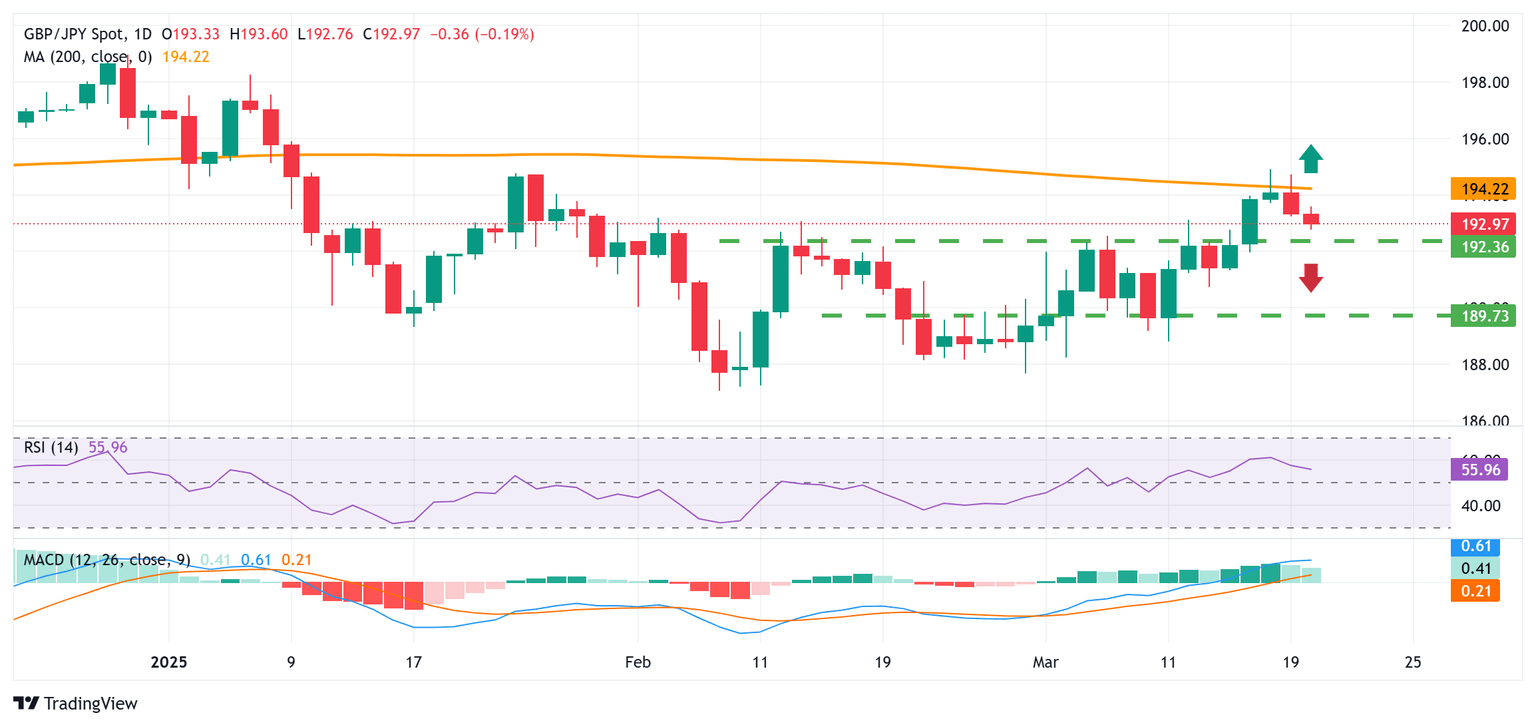

From a technical perspective, spot price earlier this week struggled to find acceptance above the very important 200-day Simple Moving Average (SMA) and the subsequent fall could be seen as a key trigger for bearish traders. That said, oscillators on the daily chart are still holding in positive territory. Adding to this, the recent breakout through the 192.50 horizontal resistance warrants some caution before positioning for any further depreciating move heading into the key central bank event risk.

In the meantime, the aforementioned resistance breakpoint could protect the immediate downside, below which the GBP/JPY cross could accelerate the slide towards the 192.00 mark en route to the 191.35-191.30 support zone. Some follow-through selling has the potential to drag spot prices below the 191.00 round figure, towards the next relevant support near the 190.45-190.40 area en route to the 190.00 psychological mark and the 189.70-189.65 region.

On the flip side, any positive move might now confront resistance near the 194.00 round-figure mark ahead of the 200-day SMA, currently pegged around the 194.30 region. This is followed by the 194.90 region, or a multi-month peak touched earlier this week, which if cleared decisively should pave the way for additional gains. The GBP/JPY cross might then climb to the 196.00 mark en route to the 196.40 horizontal zone before aiming to reclaim the 197.00 round figure for the first time since January.

GBP/JPY daily chart

Economic Indicator

BoE Interest Rate Decision

The Bank of England (BoE) announces its interest rate decision at the end of its eight scheduled meetings per year. If the BoE is hawkish about the inflationary outlook of the economy and raises interest rates it is usually bullish for the Pound Sterling (GBP). Likewise, if the BoE adopts a dovish view on the UK economy and keeps interest rates unchanged, or cuts them, it is seen as bearish for GBP.

Read more.Next release: Thu Mar 20, 2025 12:00

Frequency: Irregular

Consensus: 4.5%

Previous: 4.5%

Source: Bank of England

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.