GBP/JPY Price Forecast: Hesitates around 199.00 in risk-off markets

- The Pound appreciates for the second day in a row, but is showing signs of hesitation above 199.00

- The cautious mood ahead of Powell's speech, due later today, is adding weight on the pair.

- Technical indicators show a weak bullish momentum below the 199.45 resistance area.

The Pound has returned above the 199.00 mark against the Japanese Yen after pulling back to 198..85 lows on the early European session. The pair is showing hesitation with Wednesday 20 highs, at 199.45, capping bulls, and a moderate risk-aversion prevailing ahead of Fed Powell’s speech at Jackson Hole.

The GBP/JPY is trading higher for the second consecutive day on Friday, regaining lost ground after bouncing from three-week lows right below the 198.00 line, boosted by strong UK CPI data to retrace a significant reversal in the first half of the week.

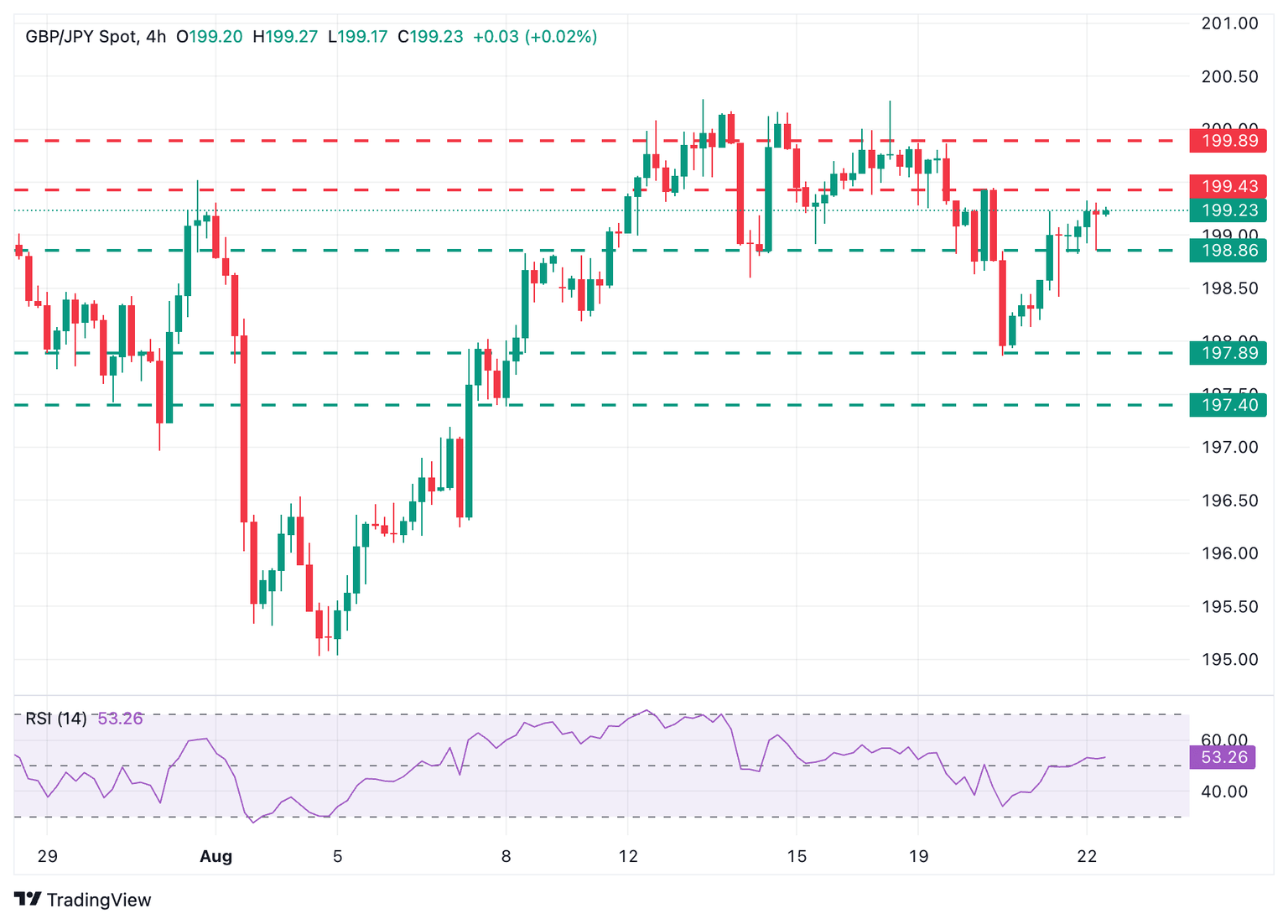

The technical picture is mixed today. The 4-hour RSI is losing momentum right above the 50 level that divides bullish from bearish territory, while the daily MACD shows an impending cross below the signal line.

The long wicks in the 4-hour chart reflect hesitation at current levels, with the risk-averse mood adding weight on the Pound. A break of the mentioned 199.45 level is needed to confirm the bullish momentum and set the focus on the August 19 low, at 199.90.

To the downside, immediate support is at the intra-day lows of 198.85, ahead of the August 20 low, at 197.90, and the 197.40 intra-day level.

GBP/JPY 4-Hour Chart

Pound Sterling Price Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Swiss Franc.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.12% | 0.00% | 0.18% | 0.03% | -0.03% | 0.15% | 0.20% | |

| EUR | -0.12% | -0.09% | 0.02% | -0.08% | -0.20% | 0.04% | 0.09% | |

| GBP | -0.01% | 0.09% | 0.12% | 0.00% | -0.11% | 0.14% | 0.18% | |

| JPY | -0.18% | -0.02% | -0.12% | -0.14% | -0.19% | -0.08% | -0.02% | |

| CAD | -0.03% | 0.08% | -0.00% | 0.14% | -0.11% | 0.13% | 0.17% | |

| AUD | 0.03% | 0.20% | 0.11% | 0.19% | 0.11% | 0.25% | 0.29% | |

| NZD | -0.15% | -0.04% | -0.14% | 0.08% | -0.13% | -0.25% | 0.04% | |

| CHF | -0.20% | -0.09% | -0.18% | 0.02% | -0.17% | -0.29% | -0.04% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.