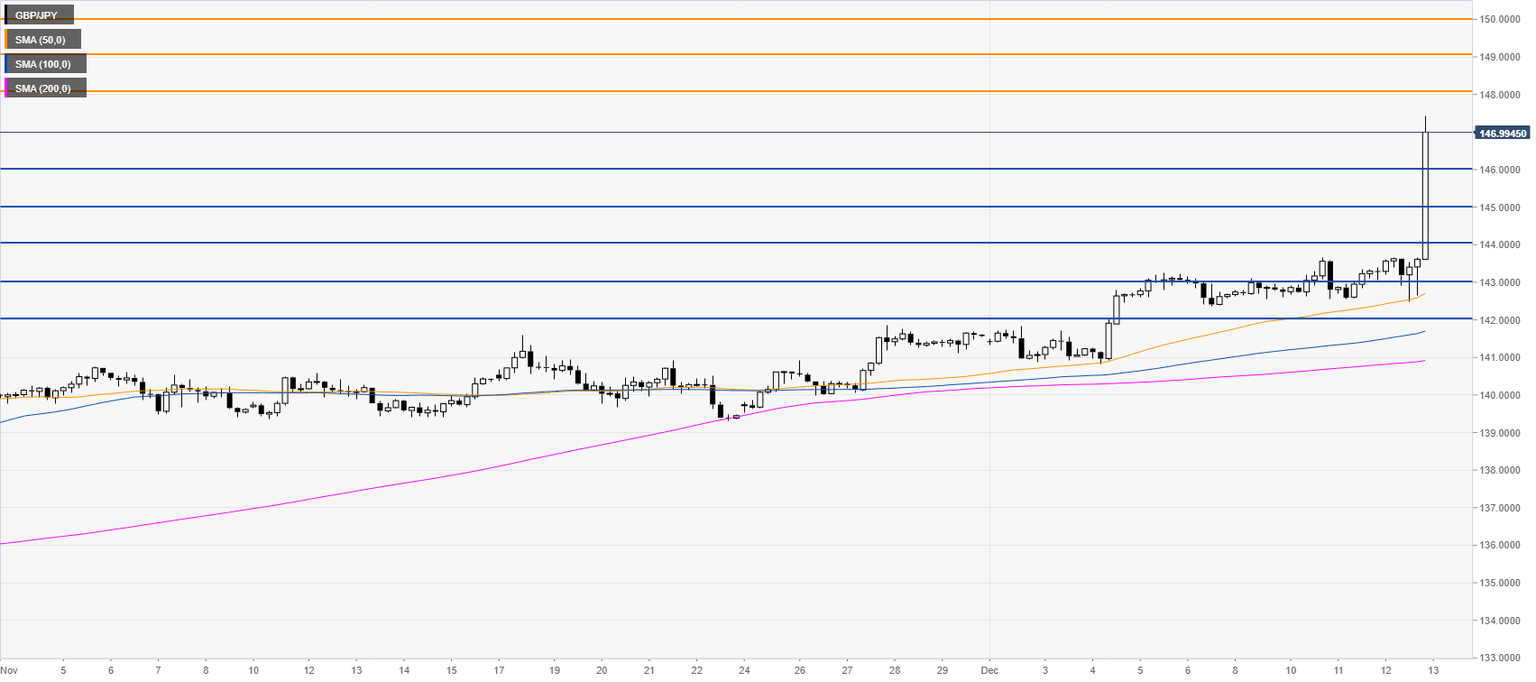

GBP/JPY Price Analysis: Pound goes ballistic against yen on UK elections

- GBP/JPY bulls are in full control as the market is having a massive breakout.

- The level to beat for bulls is the 148.00 resistance.

Additional key levels

Author

Flavio Tosti

Independent Analyst