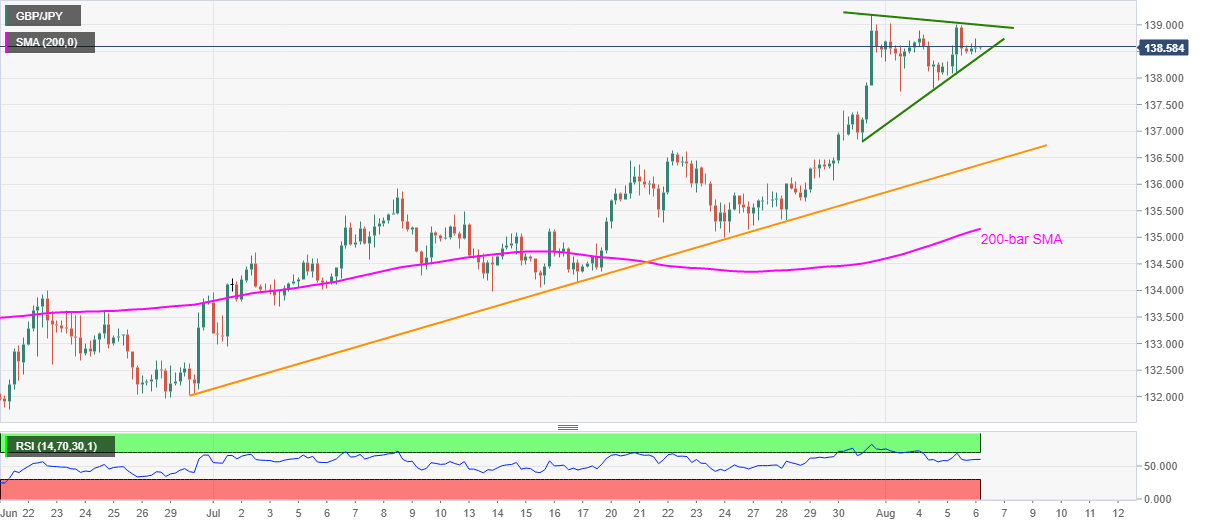

GBP/JPY Price Analysis: Portrays bullish pennant below 139.00 ahead of BOE

- GBP/JPY marks repeated pullbacks from 138.60 following its bounce off 138.47.

- RSI conditions support the bullish chart pattern but BOE could become a spoiler.

- An upside clearance of 139.00 will attack the 140.0 threshold.

- An ascending trend line from June 30, 200-bar SMA may please sellers.

GBP/JPY seesaws around 138.55/60 before the UK markets open for “Super Thursday.” The pair prints a bullish formation ahead of the Bank of England (BOE) monetary policy meeting.

Read: When is the Bank of England rate decision and how could it affect GBP/USD?

RSI is in favor of the bullish pennant to suggest the pair’s rally to 140.00, on the break of 139.00. However, the pair’s further upside will not hesitate to challenge the early-February low near 140.92.

In a case where the bulls remain strong past-140.92, 141.00 may offer an intermediate halt during its northward trajectory towards February 18 low near 142.30 and February 2020 high near 145.00.

Meanwhile, a disappointment from the BOE, which can’t be ruled out, may drag the pair below the immediate support line below 138.40. The same will defy the bullish pattern and can fetch the quote to a five-week-old support line around 136.35.

Should the bears refrain from respecting 136.35, a 200-bar SMA level of 135.16 may gain the market attention.

GBP/JPY four-hour chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.