GBP/JPY Price Analysis: Bulls eye 175.00 while above 173.00

- GBP/JPY bulls eye the 175.00 level.

- 173.00 is key support and eyed on the hourly correction.

GBP/JPY is well on its way towards the 175 area having climbed sharply in a continuation of the 2023 bullish trend. The following will illustrate prospects for the price meeting 175.00 in due course.

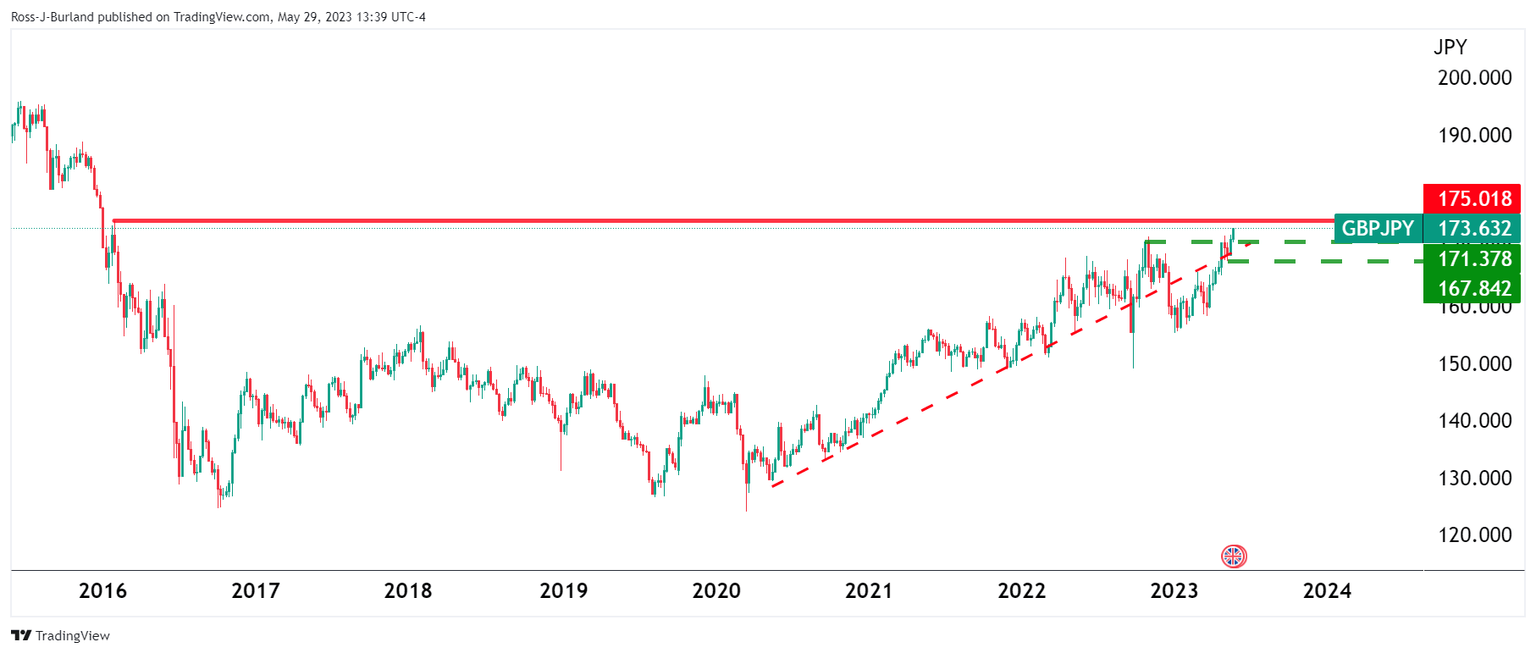

GBPJPY weekly charts

175.00 was a key resistance in 2016.

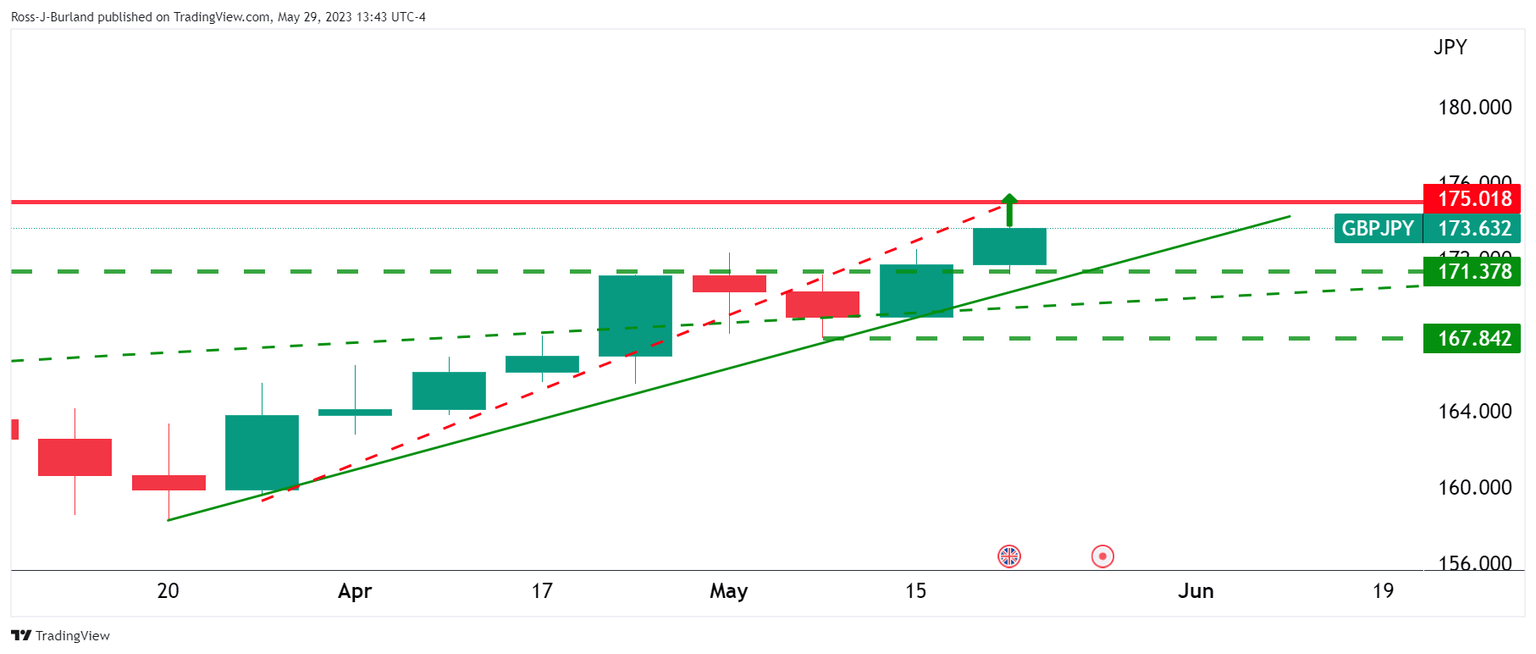

GBP/JPY daily chart

The start of the week has seen the bulls in control with little signs of a deceleration so far.

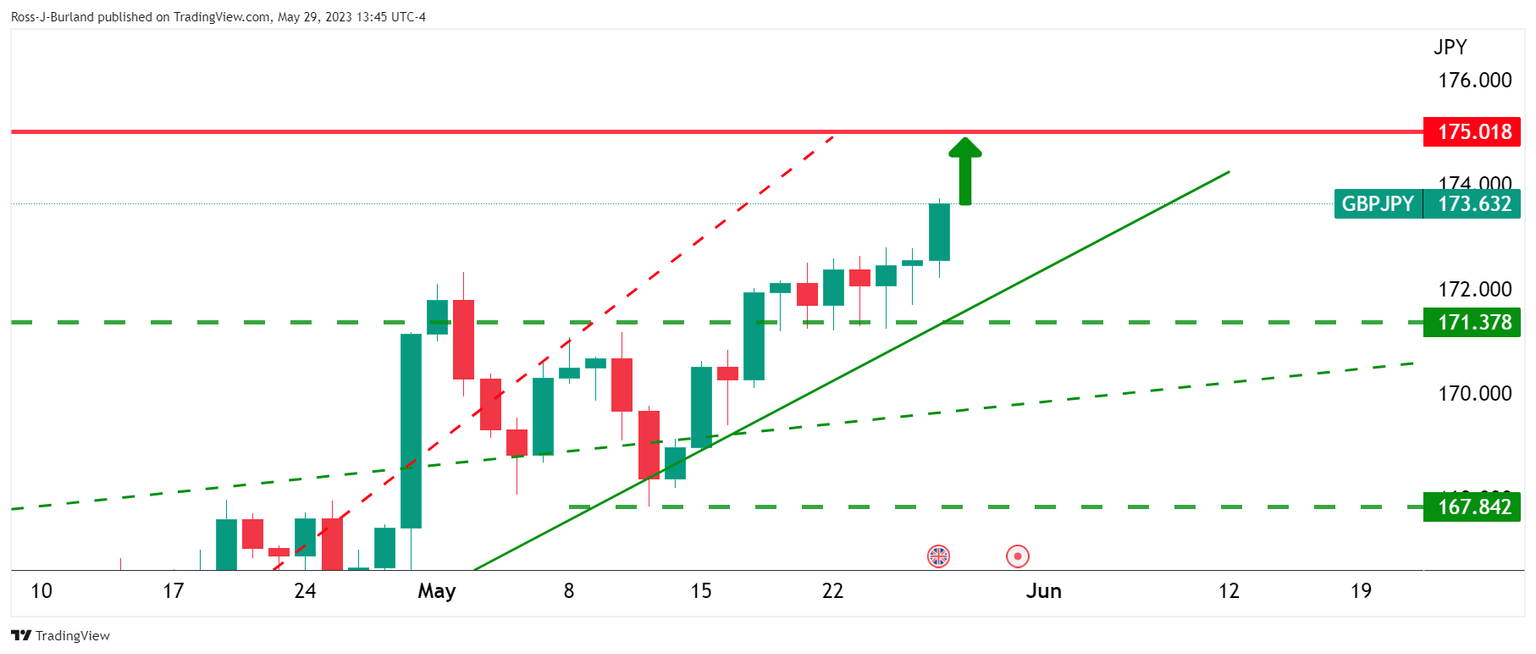

GBP/JPY H4 chart

The trendline support remains intact, so far.

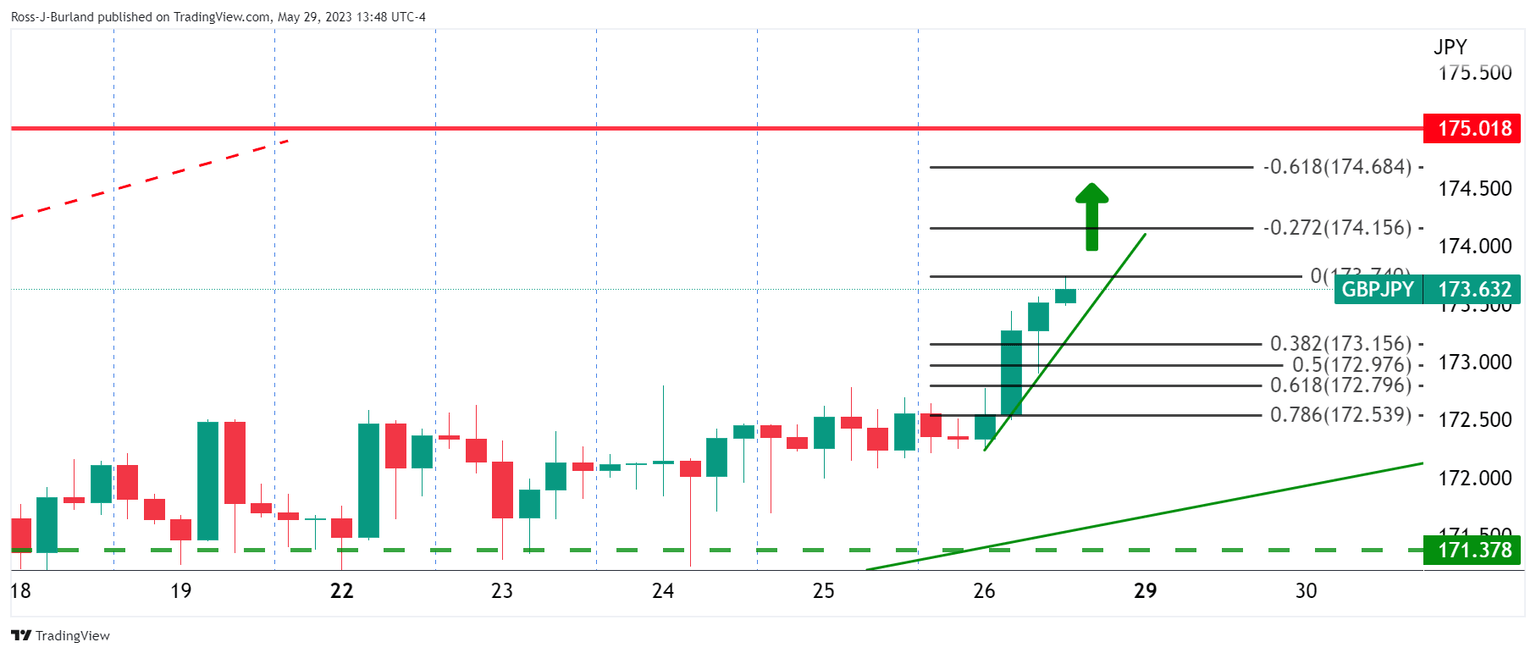

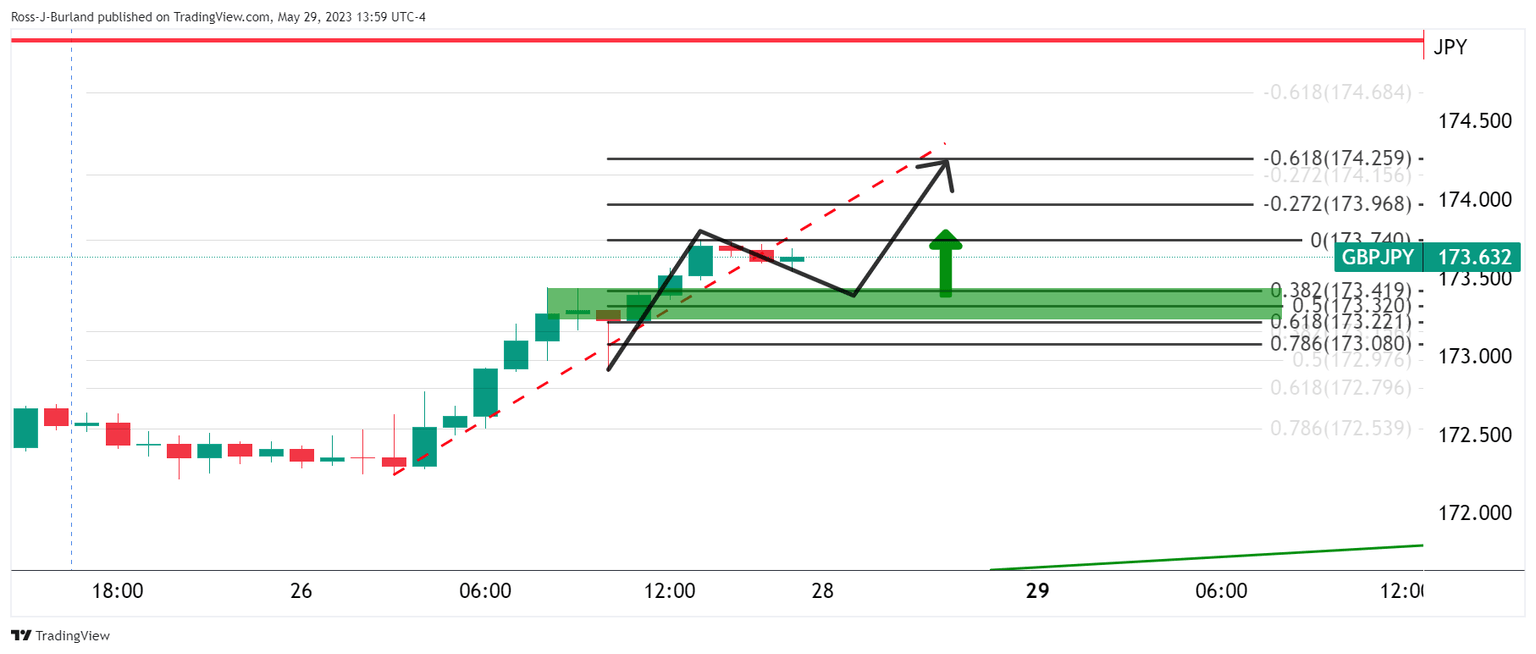

GBP/JPY H1 chart

The hourly chart shows that the price is moving to the backside of the trend but should the bulls commit to above 173.00, there will be prospects of a continuation of the bullish trend.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.