GBP/JPY Price Analysis: A bullish harami looms as the pair records gains in March

- The GBP/JPY falls on sour market sentiment, courtesy of Russian President Putin, while the conflict persists.

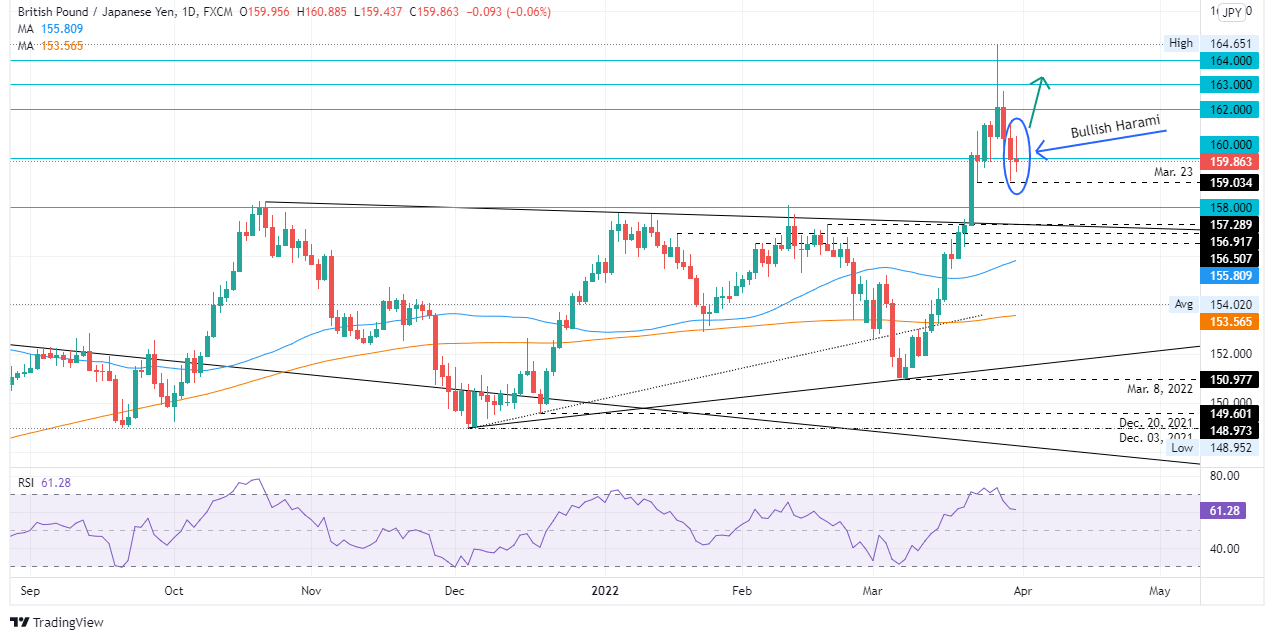

- GBP/JPY Price Forecast: The cross-currency pair is upwards and just formed a bullish harami in the daily chart.

GBP/JPY slides for the third consecutive trading session amid a risk-off market sentiment, courtesy of the extension of the Russia-Ukraine conflict, now hitting five weeks of hostilities. At the same time, Russian President Vladimir Putin is likely to force Eurozone countries to pay for natural gas in roubles. At 159.84, the GBP/JPY portrays the appetite of safe-haven peers, particularly the Japanese yen.

What appears to be a market sentiment move could also be influenced by fiscal, quarter, and month-end flows towards the Japanese yen. However, the GBP/JPY posted its biggest monthly gain since October 2021, with the pair up near 3.7%.

Overnight the GBP/JPY rallied towards the daily high around 160.88, but once the European session began, a shift in market sentiment propelled a fall towards the daily low at 159.79.

GBP/JPY Price Forecast: Technical outlook

The GBP/JPY is in an uptrend, and Thursday’s price action is forming a “quasi” gravestone doji, which means indecision amongst traders after Wednesday’s 200-pip average daily range (ADR). Also, the combination of both days’ candlestick’s formed a bullish harami, also known as an inside bar, meaning that the GBP/JPY would resume its uptrend.

Additionally, the Relative Strength Index (RSI) is at 61.12; although aiming lower, it just got out of overbought conditions, it remains in the bullish territory (above 50-midline).

That said, the GBP/JPY first resistance would be 160.00. A sustained break would expose March 30 daily high at 161.36, followed by 162.00, and then March 29 daily high at 162.71.

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.