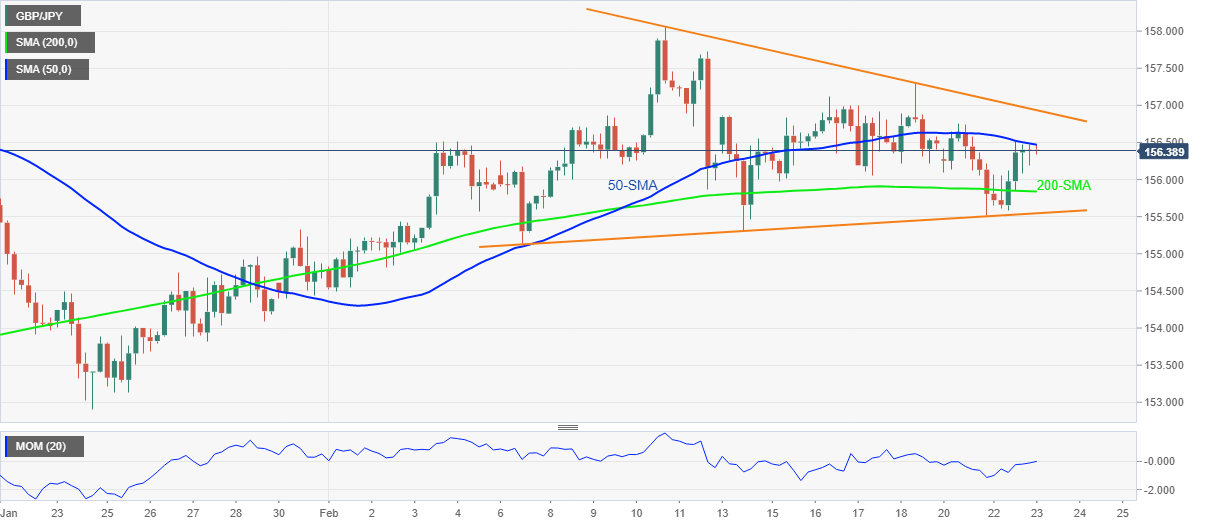

GBP/JPY Price Analysis: 50-SMA probes buyers inside 12-day-old triangle

- GBP/JPY holds onto the previous day’s bounce off one-week low, retreats from daily top of late.

- Firmer Momentum, sustained trading beyond 200-SMA hints further upside.

- Bears need validation from 155.00 before retaking controls.

GBP/JPY edges higher around the weekly top, sidelined near 156.35-40 during Wednesday’s Asian session.

In doing so, the cross-currency pair battles 50-SMA resistance around 156.50 to justify the upside momentum portrayed by the Momentum indicator, as well as the pair’s ability to stay beyond the 200-SMA.

However, the upper line of a three-week-long symmetrical triangle, near 157.00 by the press time, challenges short-term advances of the GBP/JPY.

In a case where the quote rises past-157.00, the monthly high of 158.06 and October 2021 peak surrounding 158.25 can act as buffers during the rally targeting the 16.00 threshold.

On the flip side, pullback moves may initially aim for the 200-SMA level near 155.85 before directing the GBP/JPY sellers towards the stated triangle’s support line, near 155.50 at the latest.

Even if the pair drops below 155.50, the early February lows near 155.00 will offer an additional downside filter to the traders.

GBP/JPY: Four-hour chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.