GBP/JPY: all set for a slide to 182.00 as Yen traders try to stage a recovery

- The GBP/JPY slides on Thursday, giving up more ground.

- The Pound Sterling is struggling to hold onto gains against the Yen.

- 2023 has been a solid year for the Guppy, but difficulties remain looking forward.

The GBP/JPY pair has slid to a new five-week low after tapping into 182.51 on Thursday, falling away from the 184.00 handle heading into the last trading session of the week.

The Pound Sterling (GBP) has struggled to develop further momentum against the Japanese Yen (JPY) recently, with the Guppy flagging towards the 50-day Simple Moving Average (SMA) after failing to maintain a hold of the 186.00 major level in late August.

The GBP/JPY marked in 2023’s low early in January when the pair traded into the 156.00 region. The GBP has done a decent job capitalizing on JPY weakness ever since, with the Guppy still up around 17.50% for the year.

Economic calendar remains light for Friday for GBP and JPY

Consumer Inflation Expectations for the United Kingdom (UK) will be landing during the Friday trading window. The indicator last printed at 3.5%, and markets don’t have typically have a forecast for this data. However, it’s worth noting that British consumers last saw inflation in the UK rising 3.5% over the next twelve months at the indicator’s last reading in June, and inflation expectations are down from the September 2022 reading of 4.9%.

GBP/JPY technical outlook

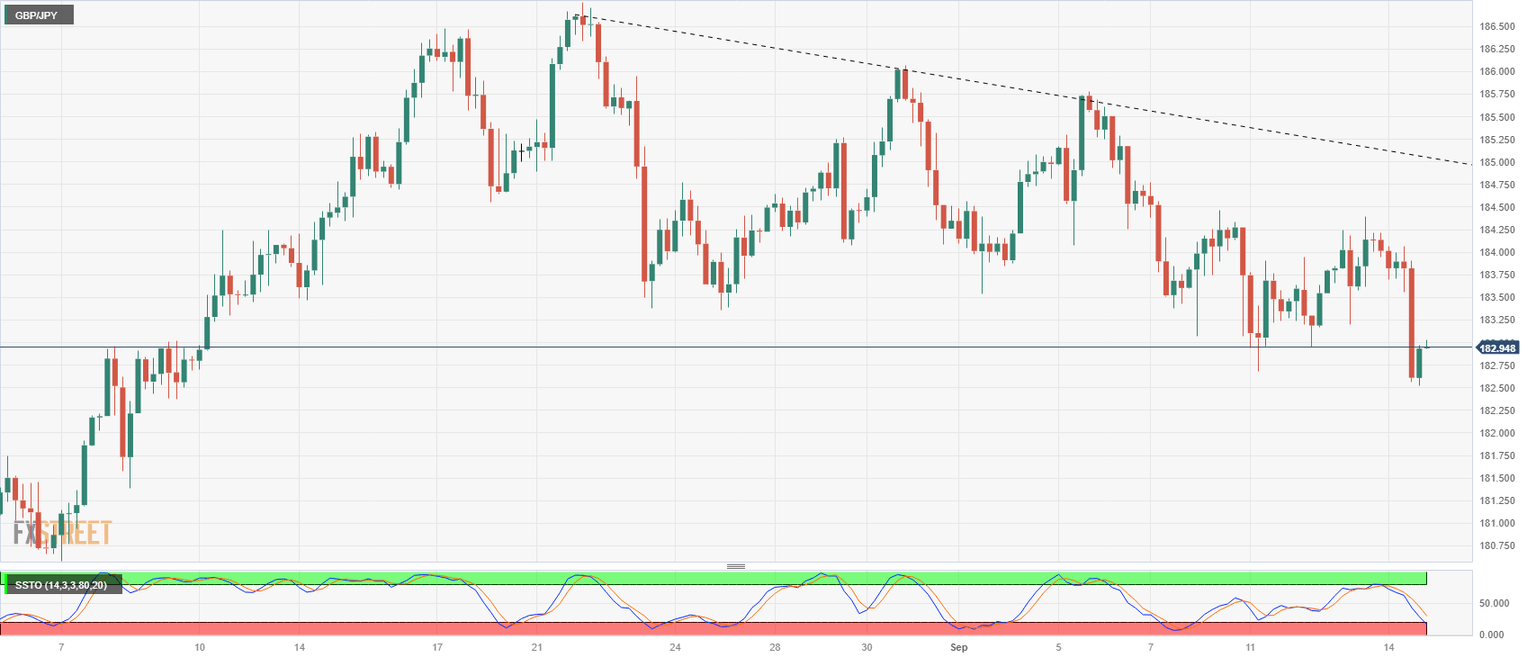

The Guppy is struggling to find bullish momentum on the 4-hour candles, with the pair reaching lower lows, and a relief rally from this level will see declining resistance from a falling trendline currently parked near 185.00, and the last swing high near 184.25.

On the downside, little near-term support remains, and an extended break will see the pair all set to make a challenge of 182.00 down below, though traders will want to keep an eye out for technical exhaustion. The Slow Stochastic Oscillator is moving into oversold territory, and an extended rebound could see Guppy traders waiting for a bounce before piling in for another leg lower.

GBP/JPY 4-hour chart

GBP/JPY technical levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.