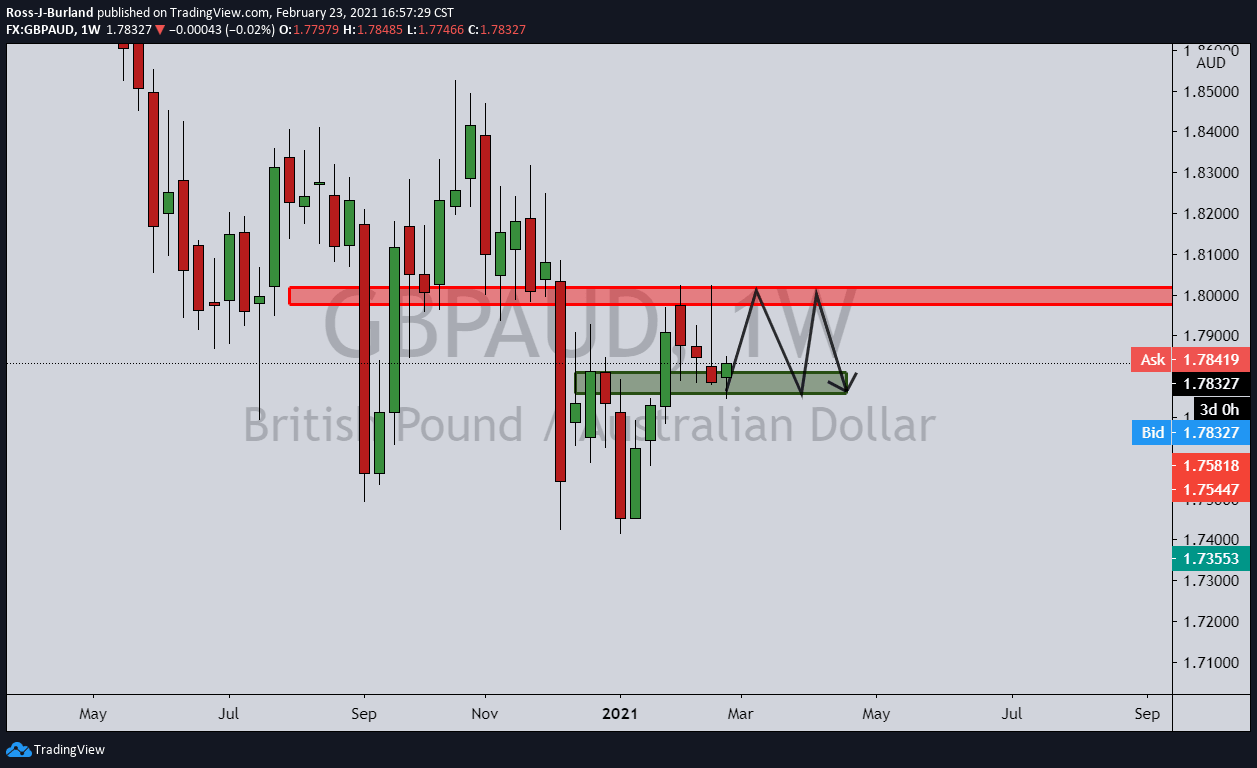

GBP/AUD Price Analysis: Bulls in control at 38.2% resistance

- GBP/AUD completes the M-formation pattern to the target.

- There is now too much weekly support to contemplate fading the rally.

As per the prior analysis, GBP/AUD Price Analysis: Monitoring for bullish structure to target 38.2% Fibo, the price has indeed moved to the target area.

Prior analysis

GBP/AUD is in the hands of the bears but there are prospects of an upside correction according to the following analysis taken from a daily M-formation and managed from an hourly chart.

Daily chart

Live market

Daily chart

The daily chart is showing that the price is resisted at this juncture and could be due for a continuation to the downside.

However, the weekly chart shows that the price is being supported and bound by weekly support and resistance:

Until the area is cleared, there is just as much likelihood that the pair can continue higher from this support area, especially given that the daily M-formation is a bullish pattern.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.

-637495539120545172.png&w=1536&q=95)

-637497174260213811.png&w=1536&q=95)