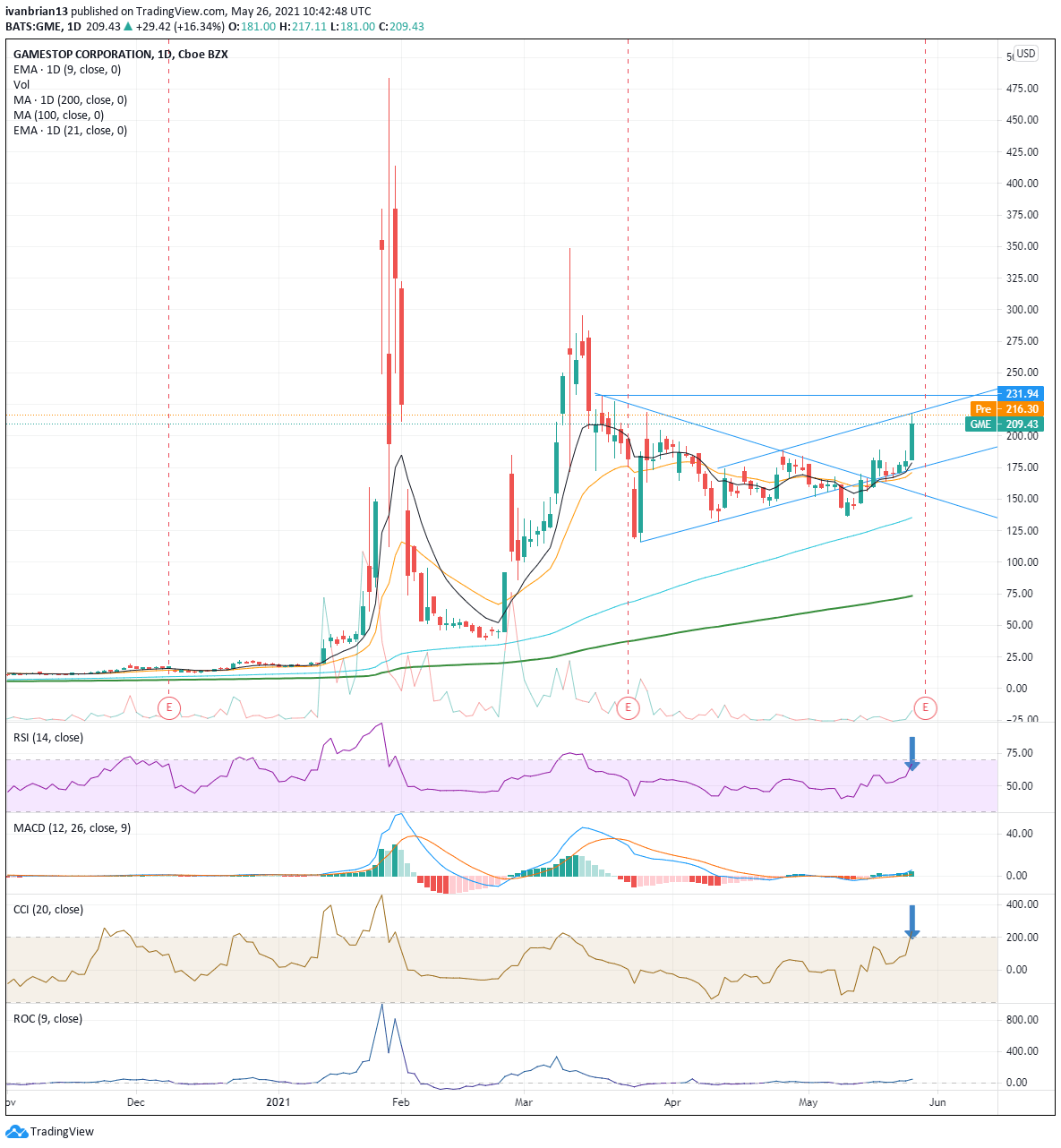

Gamestop (GME) Stock Price and Forecast: GME in sight of key $231.94 resistance with RSI overbought

- GME shares are back to loving volatility with an explosive move.

- GameStop rumoured to be starting a Non Fungible Token (NFT) platform.

- GME set for further gains with Wednesday's premarket indicating higher.

GME, AMC, KOSS – it is like January all over again with some stellar gains on Tuesday. Bitcoin's recent struggles have definitely seen some retail traders switch attention back to their favoured meme stocks, but some key technical levels and news flow has certainly helped. AMC results were poor, but a cash raise and strong attendance numbers helped the stock to strong gains over the last number of sessions, and GameStop shares are not to be left behind. GameStop (GME) shares surged over 16% on Tuesday to close at $209.43. The gains look set to continue on Wednesday as GME is trading at $219 in the premarket. The catalyst appears to be news that GameStop is launching a Non Fungible Token platform.

GameStop is or was a struggling brick and mortar retailer that caught the attention of the R/WallStreetBets forum and saw shares surge as retail investors battled short sellers in an epic that is due to be made into a blockbuster movie (a nice tie-in with AMC there).

GME stock forecast

The moves in GME have been nothing short of incredible and must be a nightmare for volatility traders to hedge. But GME has actually been displaying some nice technical viewpoints from which traders can trade around and use key levels to manage their risk. GameStop has been holding the bottom trend line of the triangle formation since mid-March. GME did stage a false breakout or a bear trap before rallying back and using the trend line repeatedly to find support. The fact that this has corresponded to the 9-day moving average makes for a nice confluence of support factors, always reinforcing. Resistance at $231.91 is next in the crosshairs for GME bulls, this being the March 17 high. The move may struggle to continue with the same explosiveness going forward as the momentum oscillators are both close to or in overbought territory. The Relative Strength Index (RSI) is close to overbought, and the premarket move has likely ticked the RSI into overbought territory. The Commodity Channel Index (CCI) has traded into overbought levels as well. GME remains bullish until a break of $136.50, so there is plenty of room for consolidation without hurting the bullish formation of higher lows and higher highs. Shorter term, the bullish trend is held in place by the 9-day moving average, curently at $179.

| Support | 179 9-day MA | 175 trendline | 136.50 May 11 low | 116.90 March 25 low | |

| Resistance | 220 trendline | 231.94 March 17 high | 283 | 348.50 | 483 |

At the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Errors and omissions excepted.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.