FTSE100 set to post best year since 2009

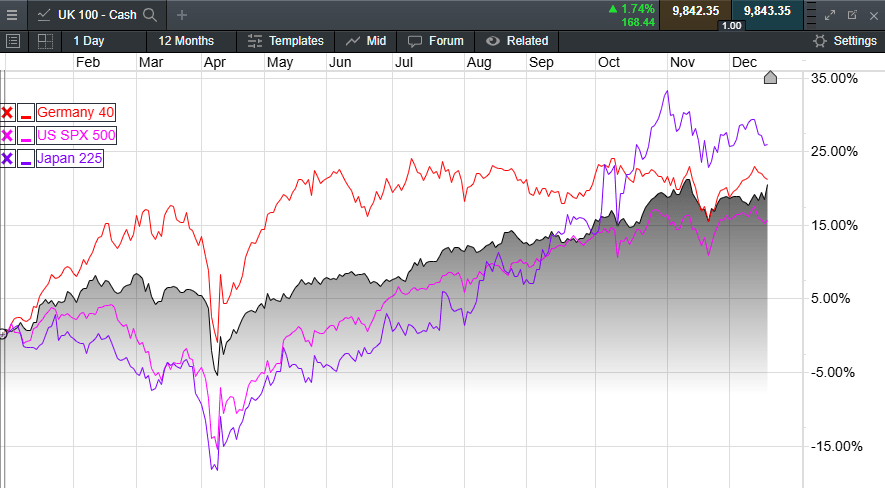

We’ve seen a remarkably strong performance from the FTSE100 this year with multiple instances of new record highs, and well in excess of expectations of a move towards and through the 9,000 level that we were hoping for at this time last year.

This year’s performance has been all the more remarkable in that the UK’s benchmark index is on course to post its best annual performance since 2009, when it gained 22%, when that rally came off the back of a calamitous performance in 2008, when it fell over 30%.

This year the FTSE100 could well see gains in excess of 18%, having come within touching distance of the 10,000 level at 9,930 at the end of October, before slipping back.

In the process it has managed to keep pace with the likes of the German DAX, no mean feat given the DAX is a total return index, unlike the FTSE100 which isn’t.

At one stage earlier this year it all looked so different in the aftermath of the so-called tariff Liberation Day in early April which saw the US government announce wholescale tariffs on over 90 countries, although at least on this occasion at least Trump managed to avoid imposing on them on imaginary countries like Wakanda, which happened in 2019.

FTSE 100 YTD vs its peers

The quick recovery in markets was only achieved after the US President stepped back from the brink, deferring the start of the new tariff regime until the beginning of August to allow further negotiations, and thus the “TACO” trade was born, TACO meaning, Trump Always Chickens Out.

While the FTSE100 has performed well, the Nikkei 225 has done even better, helped predominantly by a weak currency which has seen the Japanese yen slip back towards the lows we saw in the summer of 2024, when it posted its lowest level against the US dollar since 1990.

US markets, which have performed consistently well since their 2020 lows, saw some of the biggest declines in April, as money managers rotated capital out of US stocks into cheaper locations like the UK, and other markets in Europe like Spain and Italy, where we’ve seen gains of over 40% and 25% respectively.

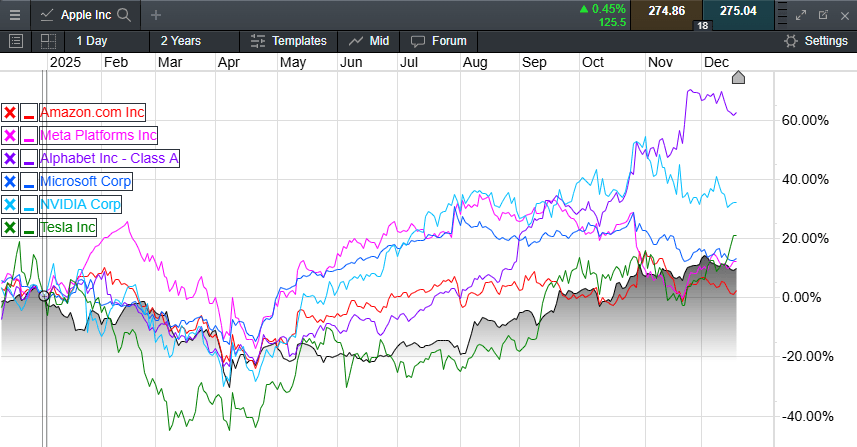

Despite this outperformance in Europe the enthusiasm for US assets quickly returned as the so-called AI trade became the latest topic du jour for investors to get their teeth into.

This about-turn prompted a strong rebound in the so-called Magnificent 7 of Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVidia and Tesla.

Magnificent 7 performance YTD

The most notable outperformance has been from the likes of Google owner Alphabet which has seen its share price surge in the last few weeks on the back of optimism that its AI solution where the company is developing its own suite of AI chips that are set to compete with market leader Nvidia, and which in some part has prompted a little bit of profit taking on that side of the AI trade.

This surge in valuations has also prompted fears of a bubble in the sector with some wild swings in recent weeks on the back of some end of year profit taking, with some chatter that 2026 could prompt a bit of a reset when it comes to AI winners, and AI losers.

Going back to the topic of the FTSE100, the gains seen so far this year are in stark contrast to the underlying pessimism surrounding the UK economy, and the UK government’s stewardship of it, which has seen borrowing costs remain elevated despite 5 rate cuts since the Labour administration came to power in July 2024.

The outperformance of the FTSE100 is no better illustrated than in the performance of the FTSE250 which is only up by just over 5% year to date, and is still below its previous record highs set in 2021.

The underperformance of the FTSE250 since those record highs, stands in stark contrast to the FTSE100s 18%+ gain this year and is particularly notable when compared to the years before Covid when the FTSE250 regularly outperformed its bigger sibling.

Since the 2008 lows, the FTSE250 is up by over 280%, compared to the FTSE100 which has risen by over 150%

The fact that we are no longer seeing this outperformance is no better reflected in the performance of the UK economy, currently struggling as it is under the weight of higher costs, whether they be higher energy prices, national insurance, wages, as well as other regulatory burdens, like the extended packaging levy.

This could well continue to be the case in 2026, as the UK economy struggles under the economic illiteracy of the current government's economic policies as firms struggle to maintain their margins.

Moving back to the FTSE100, notable outperformers this year have continued their strong gains from 2024, with the likes of defence sector stalwarts like Rolls-Royce continuing to power ahead, and Babcock and BAE Systems also performing well.

We have also had further strong performance from the banking sector, for so long a serial underperformer helping to underpin the FTSE100, with Lloyds leading the way on gains of over 75%, followed by Standard Chartered, Barclays, NatWest with HSBC lagging somewhat, but with still very healthy gains of in excess of 35% at the time of writing.

UK retailer Next has also had another solid year with share price gains of over 40% following on from a string of guidance upgrades.

The performance of the banks has been notable despite the Bank of England cutting rates further during 2025, although the effect on gilt yields has been barely noticeable, which has meant that the banks have managed to maintain and, in some cases, improve their margins.

They have also been helped by the settlement of the car finance commissions court case which appears to have been concluded, despite both Barclays and Lloyds having to increase their provisions. The recent decision by the Bank of England to loosen its capital requirement thresholds in the wake of the recent stress tests are also set to be positive for the sector, cutting the Tier 1 capital ratio from 14% to 13%.

On the downside it hasn’t been such a good year for Marks & Spencer, largely due to the cyber-attack in April, which has hit its profits hard. The retailer, along with the rest of the sector has also had to deal with additional costs in the form of higher wages as well as the ERP packaging levy, with an expectation that H2 profits would be in line with last year.

Other poor performers have been WPP, its shares set to fall out of the FTSE100, having fallen to their lowest levels since 2009. The advertising giant has delivered a bleak outlook having issued multiple profit warnings on falling revenues as well as profits, as the company struggles to adapt to a new advertising paradigm that favours Google and search.

Drinks giant Diageo, has also suffered with the shares at 10-year lows, as the company struggled to find a permanent replacement for outgoing CEO Debra Crew. Now with former Tesco CEO Dave Lewis set to take over in January there is a chance that a turnaround could be in the offing.

Other notable names to have performed poorly this year have been Premier Inn owner Whitbread, JD Sports, easyJet, and the London Stock Exchange Group.

One of the more notable trends from 2024 was the number of delisting’s that took place during that year with the departure of the primary listings for TUI, Just Eat Takeaway, CRH, Flutter Entertainment, as well as Darktrace, with Ashtead and Hargreaves Lansdown not far behind as concerns rose over who might be next.

At the time there were some concerns that Shell might be next and that remains a clear concern going forward 12 months on.

This year has been little better with the departure of Wise to the US, while Alphawave, a small Cambridge based chip and semiconductor maker, was snapped up by Qualcomm for the sum of $2.4bn, while Deliveroo also went, bought by US based DoorDash.

Not content with that, Shein, the China founded fast fashion group decided that rather than listing in London after the US turned its nose up, decided it would list in Hong Kong, while big FTSE100 company Unilever took the decision to IPO its ice cream business, the Magnum Ice Cream Company in Amsterdam this month.

While we have seen a pickup in IPO activity in recent months with the recent listings of Beauty Tech, Shawbrook and Princes Group the sums involved are tiny, and pale into comparison to missing out on the Magnum Ice Cream IPO which listed on 8th December at around €15bn.

There have also been mutterings that AstraZeneca could also move its UK primary listing to New York, a move that has been made much easier after the pharma giant seeded the ground for doing so by replacing its US ADRs with a direct listing on the NYSE.

All in all, many of the concerns that we had in 2024 about the attractiveness of London as an investment destination haven’t gone away. If anything, the concerns have become more elevated due to a UK government who appear less interested in growing the economy than in taxing it to death for ideological purposes.

That said, given the international outlook of the FTSE100, these concerns oughtn’t prevent further gains on the UK benchmark back towards 10,000 and beyond, although they might make life more difficult for the sectors that are more domestically focussed.

Nonetheless further rate cuts from the Bank of England, as well as the Federal Reserve in the US, ought to help keep a floor under markets, concerns about an AI bubble notwithstanding, and an economic outlook that currently appears uncertain, particularly here in the UK.

Author

Michael Hewson MSTA CFTe

Independent Analyst

Award winning technical analyst, trader and market commentator. In my many years in the business I’ve been passionate about delivering education to retail traders, as well as other financial professionals. Visit my Substack here.