Forex Today: Gold corrects from record-high, focus shifts to Powell speech

Here is what you need to know on Tuesday, October 14:

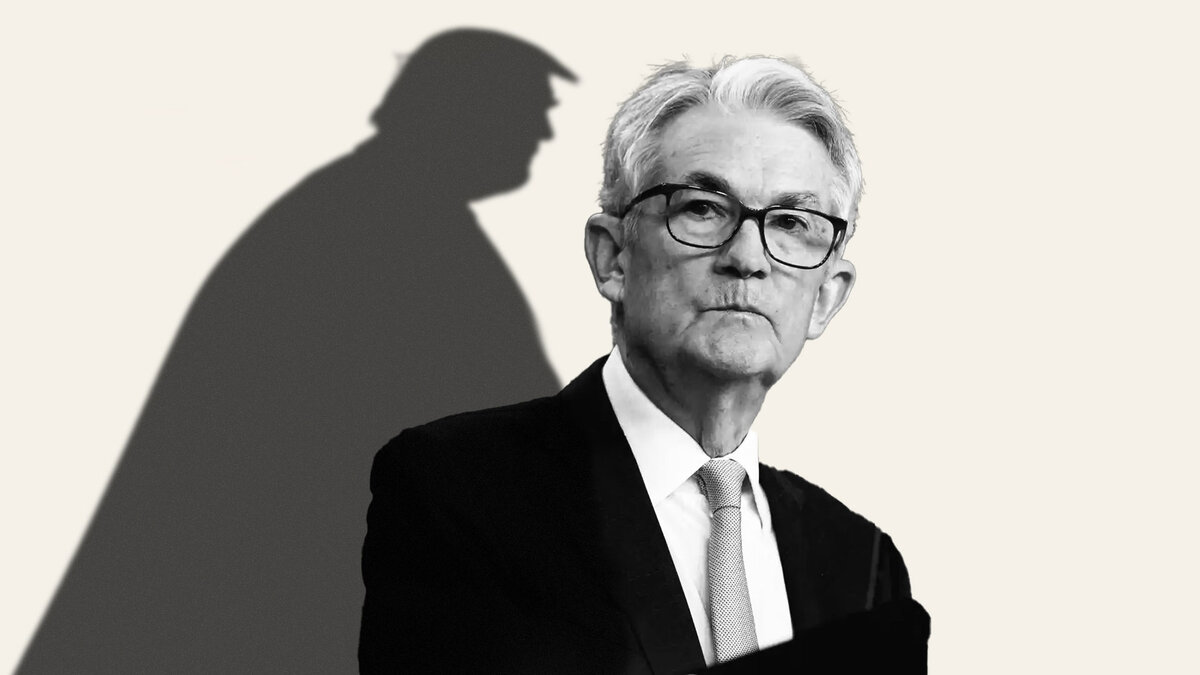

Markets quiet down early Tuesday following Monday's volatile action. Business sentiment data from Germany and the United States (US) will be featured in the economic calendar later in the day. More importantly, Federal Reserve (Fed) Chairman Jerome Powell will speak on the Economic Outlook and Monetary Policy at the National Associations for Business Economics (NABE) Annual Meeting in Philadelphia.

US Dollar Price This week

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.46% | 0.63% | -0.02% | 0.44% | 0.69% | 0.86% | 0.36% | |

| EUR | -0.46% | 0.17% | -0.44% | -0.03% | 0.30% | 0.40% | -0.11% | |

| GBP | -0.63% | -0.17% | -0.54% | -0.20% | 0.12% | 0.23% | -0.31% | |

| JPY | 0.02% | 0.44% | 0.54% | 0.41% | 0.65% | 0.91% | 0.32% | |

| CAD | -0.44% | 0.03% | 0.20% | -0.41% | 0.21% | 0.44% | -0.11% | |

| AUD | -0.69% | -0.30% | -0.12% | -0.65% | -0.21% | 0.12% | -0.43% | |

| NZD | -0.86% | -0.40% | -0.23% | -0.91% | -0.44% | -0.12% | -0.54% | |

| CHF | -0.36% | 0.11% | 0.31% | -0.32% | 0.11% | 0.43% | 0.54% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

The US Dollar (USD) staged a rebound on Monday as investors reassessed the US-China trade conflict after US President Donald Trump announced at the end of the previous week that they were planning to impose additional 100% tariffs on Chinese imports. US Treasury Secretary Scott Bessent told Fox Business on Monday that he believes China is open to discussions and added that 100% tariff doesn't have to happen. Wall Street's main indexes ended the day with significant gains and the USD Index rose 0.4% on the day, erasing a large portion of Friday's losses.

Early Tuesday, China's Commerce Ministry said that the US needs to correct its ‘wrong practices’ as soon as possible and noted that the US cannot have talks while threatening to intimidate and introduce new restrictions, which is not the right way to get along with China. The USD Index holds steady above 99.00 early Tuesday, while US stock index futures lose between 0.5% and 1%, reflecting a souring risk mood.

The minutes of the Reserve Bank of Australia's (RBA) September monetary policy meeting showed that board members agreed that the policy is still a little restrictive but it's also difficult to determine because of the considerable uncertainty about the global outlook, US tariffs and the Chinese economy. AUD/USD stays under heavy bearish pressure early Tuesday and trades at its lowest level since late August near 0.6470.

The UK's Office for National Statistics (ONS) reported on Tuesday that the ILO Unemployment Rate edged higher to 4.8% in the three months to August from 4.7%. Other details of the publication showed that the Employment Change was +91K in this period, compared to the 232K increase recorded previously. GBP/USD stays on the back foot after posting small losses on Monday and trades below 1.3300.

Japanese Finance Minister Katsunobu Kato said on Tuesday that he has recently seen one-sided and rapid moves in the foreign exchange and reiterated that it’s important for currencies to move in a stable manner, reflecting fundamentals. After rising in the Asian session on Tuesday, USD/JPY lost its traction and was last seen trading in negative territory below 152.00.

EUR/USD fluctuates in a narrow channel below 1.1600 after closing in the red on Monday. French Prime Minister Sebastien Lecornu is expected to present the budget proposal later in the day, which will reportedly target a total cut costs of around €31 billion.

Gold's relentless rally continued on Monday and the yellow metal gains more than 2% to register its highest daily close ever above $4,110. After hitting a new record peak near $4,180 early Tuesday, XAU/USD corrected lower and was last seen trading at around $4,130.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.