Ford slashes jobs, as Tesla's political risk premium surges

There is an interesting dynamic in the stock market performance of the biggest global car makers right now. As some big names struggle, including Ford and VW, Tesla is powering ahead. The macro back drop is challenging for car manufacturers, there is an oversupply issue and legacy car makers poured into the EV market just as demand peaked and as government subsidy programmes came to an end around the world. However, there is one stand -out performer: Tesla.

The Elon effect

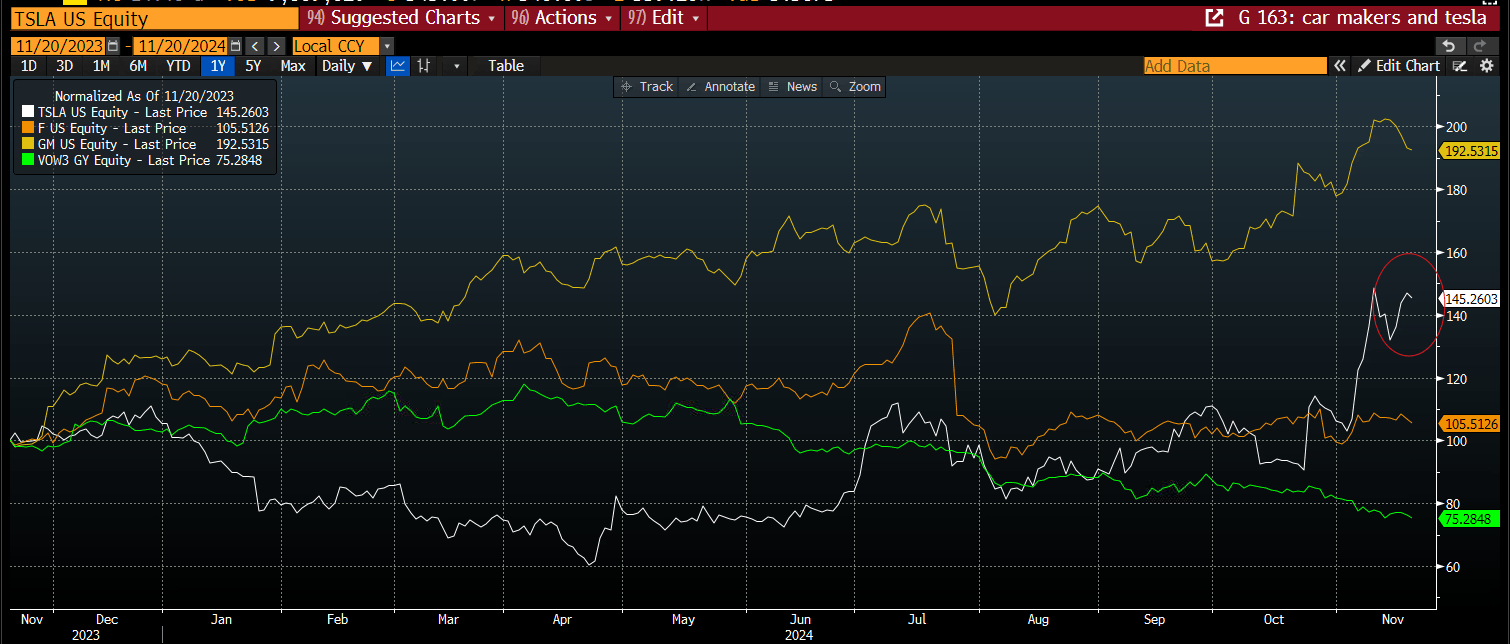

The Elon Musk effect is propelling the Tesla share price to a record high, and to a market capitalization of more than $1.1trillion. Musk’s close relationship with President elect Trump and his inclusion in the new administration has had a massive effect on Tesla’s share price, as you can see below. This chart shows Tesla, GM, Ford and VW. Their performances have been normalized to show how they move together. As you can see, Tesla was a clear under performer until October, when it started to gain traction. Although Tesla beat earnings estimates and delivered more cars than expected last quarter, we believe that the election of President Trump has had a huge impact on Tesla’s stock price, and the US EV maker is a key plank of the Trump trade.

Global car makers and Tesla

Source: XTB and Bloomberg

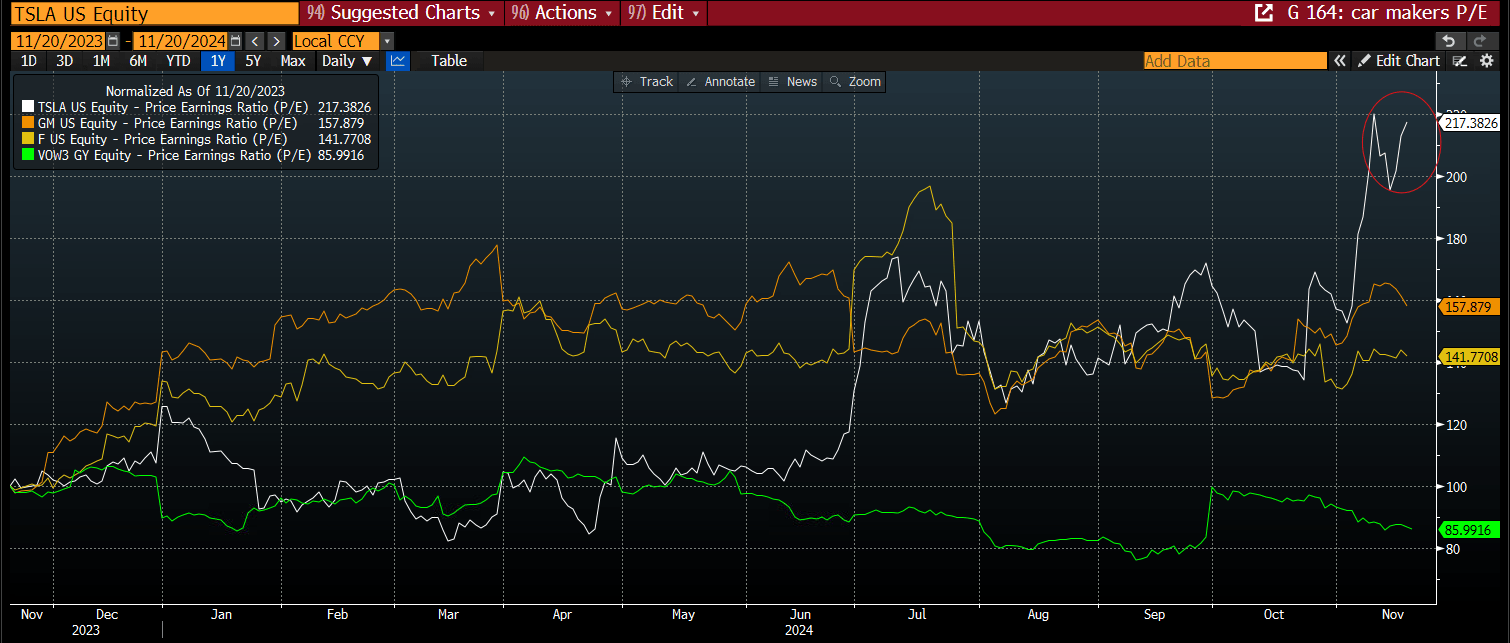

The second chart looks at the P/E ratios of the same car makers. Compared to its peers, who have seen declines in their P/E rations in recent weeks, Tesla’s P/E ratio has surged. Thus, Tesla is looking extremely expensive to its peers.

Arguably, Tesla has delivered less bad news than its peers in recent months. Ford announced 4,000 job losses in Europe, as demand for EVs dries up. VW’s woes are also well known. In contrast, Musk’s position at the front of the Trump administration is benefitting Tesla. Already, the Trump administration has said that it will direct the Transport Department to make it easier to get fully self-driving cars on the roads in the US.

The market is pricing in a hefty positive political premium for Tesla. Musk will need to stay on Trump’s good side to ensure this premium does not get eroded. For now, Tesla is likely to continue to outperform its legacy peers, however, over the long term, share prices tend to mean revert. Added to this, if Tesla’s future earnings cannot justify its high valuation, then fundamentals could come back to bite it.

Global car makers by P/E ratio

Source: XTB and Bloomberg

Author

Kathleen Brooks

XTB UK

Kathleen has nearly 15 years’ experience working with some of the leading retail trading and investment companies in the City of London.