Euro shifts its focus to 1.0900 and beyond

- Euro picks up some pace and looks to retake 1.0900.

- Stocks markets in Europe en route to close the worst week in three months.

- EUR/USD rebounds from multi-session lows near 1.0840.

- Disheartening prints in the euro docket sent spot lower.

- The USD Index keeps the recovery intact around 103.00.

The Euro (EUR) and other assets with risk associations remain on the defensive, although EUR/USD manages to regain some balance and seems to have set sail to the 1.0900 region following the opening bell in Wall Street on Friday.

Since reaching its highest point above the psychological barrier of 1.1000 earlier this month, the currency pair has already dropped by more than one cent.

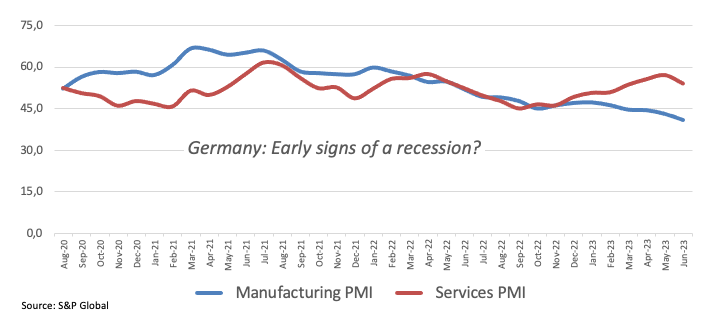

The Euro's decline was intensified by disappointing figures from the advanced Manufacturing and Services Purchasing Managers' Indices (PMIs) in France, Germany and the broader Euroland for June. These poor results reignited concerns about a possible recession in the region.

On the other hand, the US Dollar (USD) gained strength as the USD Index (DXY) reached new highs just above the 103.00 mark. This was supported by the prevailing bearish sentiment in the risk-linked galaxy and the consistent hawkish stance of Federal Reserve officials, including Chief Jerome Powell.

The focus of the macroeconomic discussion revolves around the potential future actions of both the Federal Reserve and the European Central Bank as they work towards normalizing their monetary policies. This comes amidst increasing speculation about an economic slowdown on both sides of the Atlantic.

In the US data space, the flash Manufacturing and Services PMIs are expected to ease to 46.3 and 54.1, respectively, in June. Next on tap in the calendar comes the speech by Cleveland Fed's Loretta Mester (voter in 2024, hawkish).

Daily digest market movers: Risk-off mood prevails among traders

- The US Dollar’s recovery gathers fresh steam amidst risk-off mood.

- Flash Manufacturing and Services PMIs in the core Eurozone disappoint in June.

- Recession concerns, Chinese lagged recovery hurt traders’ sentiment.

- ECB Board member De Cos reiterates that Core inflation remains sticky.

- ECB Board member Lane does not see a wage price spiral.

- Fed's Bostic expects the jobless rate to increase from current record low levels.

- Fedspeak underpins the view of extra tightening in the near future.

Technical Analysis: Euro needs to clear the June high to allow for extra gains

EUR/USD comes under heavy downside pressure, and the breakdown of the 1.0900 support has opened the door to a probable test of the interim 100-day SMA at 1.0807. The loss of the latter exposes a deeper pullback to the May low of 1.0635 (May 31) ahead of the March low of 1.0516 (March 15) and the 2023 low of 1.0481 (January 6).

If Euro bulls regain the upper hand, the next hurdle is then expected at the June peak of 1.1012 (June 22) prior to the 2023 high of 1.1095 (April 26), which is closely followed by the round level of 1.1100. North from here emerges the weekly top of 1.1184 (March 31, 2022), which is supported by the 200-week SMA at 1.1181, just before another round level at 1.1200.

The constructive view of EUR/USD appears unchanged as long as the pair trades above the crucial 200-day SMA, today at 1.0563.

Interest rates FAQs

What are interest rates?

Interest rates are charged by financial institutions on loans to borrowers and are paid as interest to savers and depositors. They are influenced by base lending rates, which are set by central banks in response to changes in the economy. Central banks normally have a mandate to ensure price stability, which in most cases means targeting a core inflation rate of around 2%.

If inflation falls below target the central bank may cut base lending rates, with a view to stimulating lending and boosting the economy. If inflation rises substantially above 2% it normally results in the central bank raising base lending rates in an attempt to lower inflation.

How do interest rates impact currencies?

Higher interest rates generally help strengthen a country’s currency as they make it a more attractive place for global investors to park their money.

How do interest rates influence the price of Gold?

Higher interest rates overall weigh on the price of Gold because they increase the opportunity cost of holding Gold instead of investing in an interest-bearing asset or placing cash in the bank.

If interest rates are high that usually pushes up the price of the US Dollar (USD), and since Gold is priced in Dollars, this has the effect of lowering the price of Gold.

What is the Fed Funds rate?

The Fed funds rate is the overnight rate at which US banks lend to each other. It is the oft-quoted headline rate set by the Federal Reserve at its FOMC meetings. It is set as a range, for example 4.75%-5.00%, though the upper limit (in that case 5.00%) is the quoted figure.

Market expectations for future Fed funds rate are tracked by the CME FedWatch tool, which shapes how many financial markets behave in anticipation of future Federal Reserve monetary policy decisions.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.