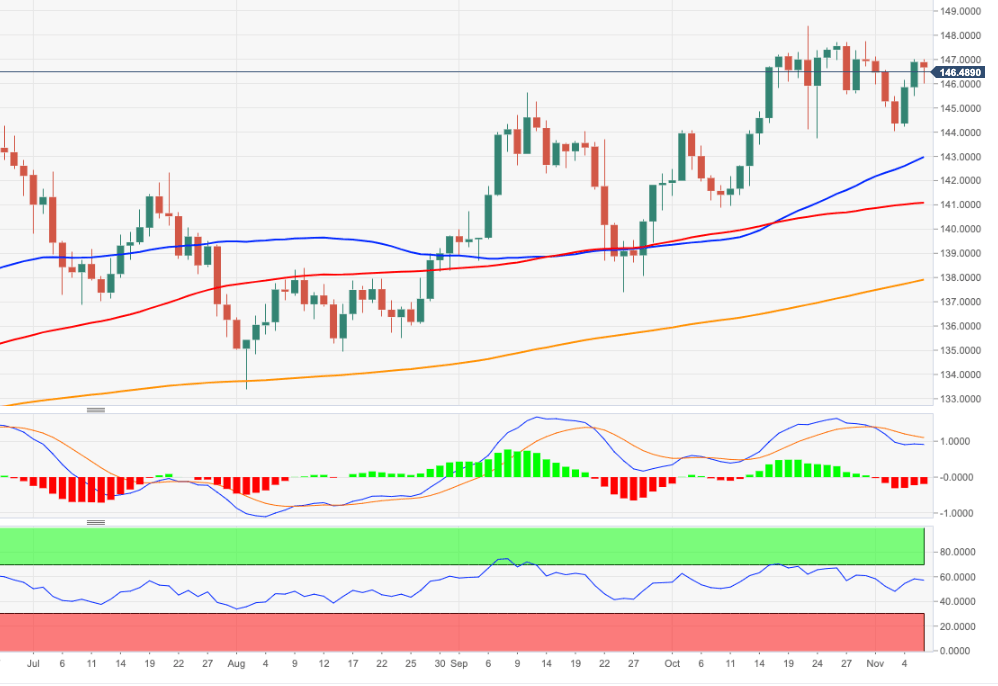

EURJPY Price Analysis: Further consolidation appears likely below 147.00

- EURJPY adds to Tuesday’s decline, always below the 147.00 region.

- Extra range bound should not be ruled out in the near term.

EURJPY loses further momentum following the rejection from the 147.00 neighbourhood earlier in the week.

The cross seems to have embarked on a consolidative phase, with the upper end of the range limited by the 147.00 area. A breakout of the latter should open the door to extra gains to, initially, the 2022 top at 148.40 (October 21) ahead of the round level at 150.00.

In the short term the upside momentum is expected to persist while above the October lows near 141.00.

In the longer run, while above the key 200-day SMA at 137.96, the constructive outlook is expected to remain unchanged.

EURJPY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.