EUR/USD tumbles below 1.0600, hits new yearly low

- EUR/USD falls sharply, driven by increased demand for the Dollar following Trump’s hawkish cabinet appointments.

- US Dollar Index reaches a six-month high of 106.15, boosted by risk aversion in equity markets.

- Upcoming US inflation data eyed; potential reacceleration of inflation could influence Fed’s policy direction.

The Euro plummets sharply against Greenback, cracks below the 1.0600 figure for the first time since November 2023, refreshes new yearly lows at 1.0594. At the time of writing, the EUR/USD trades at 1.0598.

EUR/USD dips below 1.0600, hitting 1.0594 as traders flock to the safety of the US Dollar

Risk aversion keeps US equities pressured, while investors seeking safety, ditch the shared currency, and bought the US Dollar. The US Dollar Index (DXY) which tracks the performance of the buck against six peers, climbs to a six-month high of 106.15 up by over 0.60%.

US President Elect Donald Trump appointed Mike Waltz as National Security Advisor and Marco Rubio as Secretary of State, who are known to have a tough stance on China. This increased fears amongst traders, as tariffs looming, could spark a reacceleration of inflation as the Federal Reserve, embarked to ease monetary policy.

Traders are also eyeing the release of US inflation data on November 13. Estimates suggest that headline and core inflation is expected to remain halt its disinflation process, due in part to the robustness of the US economy.

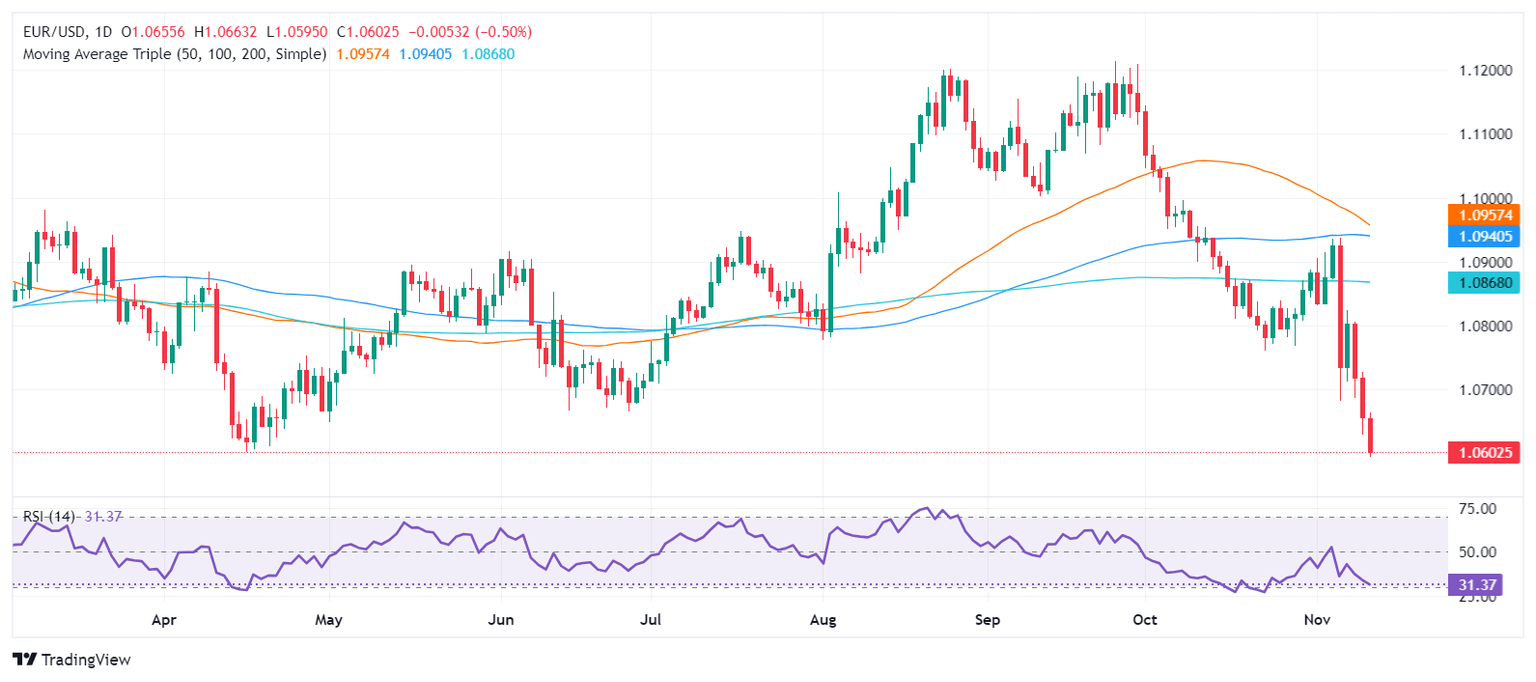

EUR/USD Price Forecast: Technical outlook

Once the EUR/USD has cleared 1.0600, further downside is seen. The next support would be the November 1, 2023 daily low at 1.0516, before testing the 1.0500 figure. Conversely, if buyers emerge and lift the exchange rate above 1.0600 the next resistance would be the November 11 daily low of 1.0628, followed by 1.0700.

Indicators such as the Relative Strength Index (RSI), indicates bears are in charge.

Euro PRICE Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the British Pound.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.51% | 1.08% | 0.81% | 0.20% | 0.85% | 0.86% | 0.27% | |

| EUR | -0.51% | 0.56% | 0.30% | -0.31% | 0.34% | 0.34% | -0.24% | |

| GBP | -1.08% | -0.56% | -0.26% | -0.86% | -0.22% | -0.23% | -0.80% | |

| JPY | -0.81% | -0.30% | 0.26% | -0.60% | 0.06% | 0.05% | -0.52% | |

| CAD | -0.20% | 0.31% | 0.86% | 0.60% | 0.65% | 0.65% | 0.07% | |

| AUD | -0.85% | -0.34% | 0.22% | -0.06% | -0.65% | 0.02% | -0.58% | |

| NZD | -0.86% | -0.34% | 0.23% | -0.05% | -0.65% | -0.02% | -0.59% | |

| CHF | -0.27% | 0.24% | 0.80% | 0.52% | -0.07% | 0.58% | 0.59% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.