EUR/USD trying to hold above 1.0800, sees limited recovery after Monday backslide

- The EUR/USD is down half a percent on Monday after an early decline.

- 1.0800 is the level for bears to beat ahead of Friday’s US NFP.

- US ISM Services PMI due on Tuesday, EU Retail Sales on Wednesday.

The EUR/USD shed half a percent as broader markets tossed aside sentiment and flipped risk averse to kick off the new trading week. The Euro (EUR) slipped two-thirds of a percent from Monday’s high of 1.0876 against the US Dollar (USD), setting into a fresh two-week low for the EUR/USD near 1.0804.

The EUR/USD’s latest drop brings the pair into challenging range of the 1.0800 handle, and the trading week sees Eurozone Retail Sales on Wednesday following an update on the US’ ISM Services Purchasing Managers’ Index (PMI) on Tuesday.

US Factory Orders saw a worse-than-expected decline on Monday, helping to drive back market sentiment and sour the mood, keeping the US Dollar well-bid across the board. US Factory Orders in October missed the market forecast of -2.6%, declining to -3.6% and September’s Factory Orders also saw a downside revision from 2.8% to 2.3%.

The US ISM Services PMI on Tuesday is forecast to see a slight improvement from 51.8 to 52.0 in November, On the EU side, the Eurozone Retail Sales figure for the annualized period into October is expected to improve, but still remain negative at -0.9% compared to September’s YoY print of -2.9%.

The trading week will wind up tighter the closer we get to Friday’s US Nonfarm Payrolls (NFP), and investors will be keeping a close eye on the US’ monthly labor report with the Federal Reserve (Fed) abandoning forward guidance and leaving markets to roil on a case-by-case basis with US economic data.

EUR/USD Technical Outlook

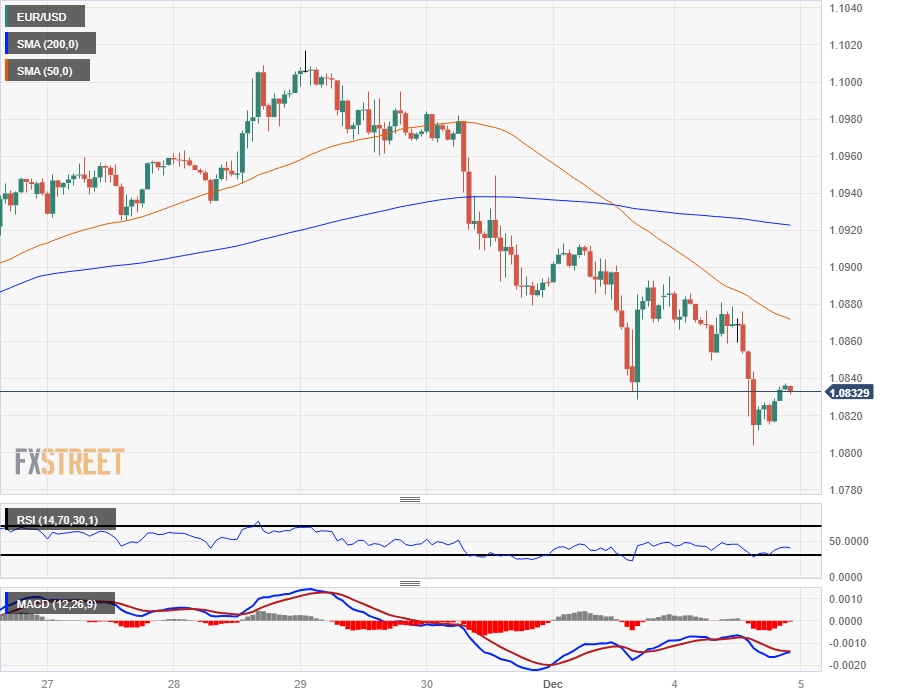

The EUR/USD’s half-percent backslide on Monday sees a fresh two-week low for the pair, and near-term price action is capped off by a 200-hour Simple Moving Average (SMA) NEAR 1.0920.

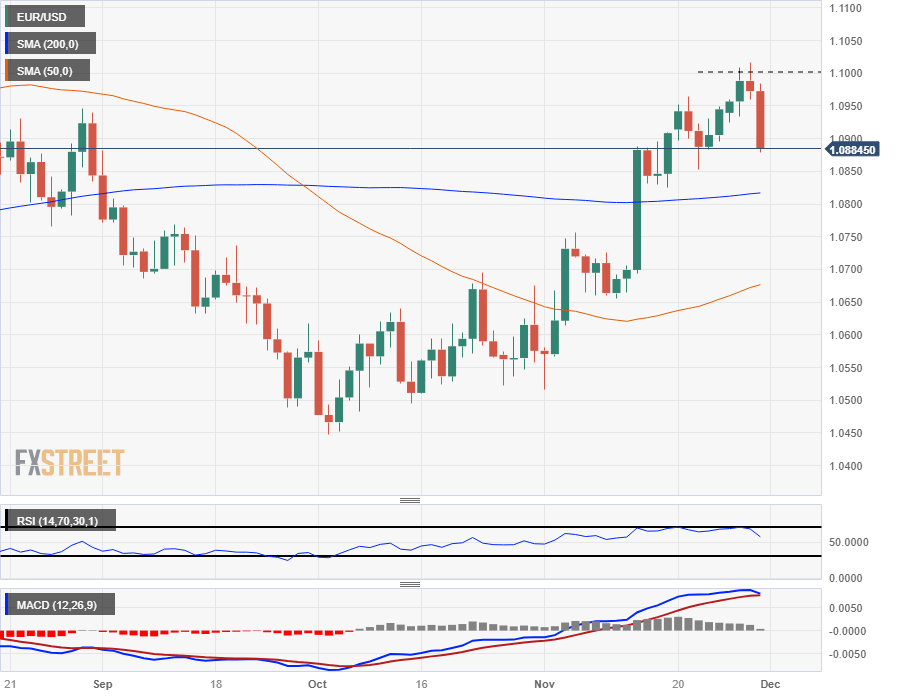

Despite the EUR/USD notching in a fourth-straight down day, the pair is set up for a bounce from the 200-day SMA just above 1.0800 if bulls are able to collect enough momentum to price out a technical correction towards the upside.

The near-term ceiling on daily candlesticks sits just north of the 1.1000 handle that the EUR/USD saw a clean rejection from last week, while an extended breakdown from here will see bears taking a run at the 50-day SMA turning bullish just below the 1.0700 handle.

EUR/USD Hourly Chart

EUR/USD Daily Chart

EUR/USD Technical Levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.