EUR/USD wavers within previous ranges ahead of the US-China talks

- The Euro regains lost ground with the US Dollar on retreat ahead of the US-China trade talks.

- ECB's Kazimir suggested on Monday that the ECB's easing cycle might be done

- The US Dollar rallied on Friday after strong NFP figures.

EUR/USD keeps minor gains on Monday after having eased from intra-day highs at 1.1440. The pair trades right above 1.1400 at the moment of writing, up from 1.1370 lows on Friday, as, a softer US Dollar (USD) and hawkish comments by the European Central Bank member, Peter Kazimir, provided some support to the common currency..

The Eurozone economy is still facing downside risk, said Kazimir, but inflationary pressures are increasing, which, according to the ECB official, suggests that the bank would already be done with monetary easing, "if not at the end of the cycle." In the absence of relevant releases, these comments have contributed to the Euro recovery,

The US Dollar (USD), on the other hand, is losing most of the ground taken after Friday's upbeat US Nonfarm Payrolls (NFP) report. Data from the US Bureau of Labour Statistics showed on Friday that the US economy created more jobs than expected in May. The Unemployment Rate remained unchanged, and so did wage inflation.

These figures offset the gloomy market expectations, which followed a downbeat ADP employment report and soft manufacturing and services activity data seen earlier during the week. While some data in the employment report continued to highlight that the jobs market is cooling – the previous two months’ gains, for example, were downwardly revised – investors sent the US Dollar higher across the board.

The focus has turned to a US-China meeting, due later on Monday in London, where representatives from the world's two economies will try to revive the spirit of Geneva's talks last month, which led to a significant reduction of the reciprocal tariffs and to a significant relief rally in financial markets.

The highlight of the week will be Wednesday’s US Consumer Price Index (CPI) release, which is expected to show the first impact of US President Donald Trump’s tariff policy on inflation and might help to determine the Federal Reserve’s (Fed) interest-rate path.

Euro PRICE Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.27% | -0.30% | -0.48% | -0.12% | -0.35% | -0.51% | -0.20% | |

| EUR | 0.27% | -0.05% | -0.23% | 0.14% | -0.06% | -0.26% | 0.05% | |

| GBP | 0.30% | 0.05% | -0.08% | 0.19% | 0.00% | -0.21% | 0.10% | |

| JPY | 0.48% | 0.23% | 0.08% | 0.36% | 0.08% | -0.10% | 0.15% | |

| CAD | 0.12% | -0.14% | -0.19% | -0.36% | -0.25% | -0.40% | -0.09% | |

| AUD | 0.35% | 0.06% | 0.00% | -0.08% | 0.25% | -0.20% | 0.11% | |

| NZD | 0.51% | 0.26% | 0.21% | 0.10% | 0.40% | 0.20% | 0.31% | |

| CHF | 0.20% | -0.05% | -0.10% | -0.15% | 0.09% | -0.11% | -0.31% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Daily digest market movers: Strong US employment data eased recession fears on Friday

- US Nonfarm Payrolls increased by 139,000 in May, slightly beating market expectations of a 130,000 reading. Unemployment remained steady, at 4.2%, tackling fears of an increase to 4.3%, and wage inflation was unchanged at 3.9% against expectations of a decline to 3.7%.

- The overall picture shows a tight labor market with sticky wage inflation, which endorses the Federal Reserve’s most hawkish sector and dampens expectations of a rate cut in the coming months. This view is likely to limit the US Dollar’s weakness.

- The Federal Reserve is on its blackout period ahead of next week’s monetary policy meeting. Futures markets are not foreseeing significant chances of a rate cut: the next one isn’t seen at least until September, and markets expect between one and two cuts in the rest of the year, according to data from the CME Group’s Fed Watch Tool.

- In the Eurozone, also on Friday, the final reading of the first quarter’s Gross Domestic Product was revised higher to a 0.6% quarterly growth and a 1.5% yearly performance from previous estimations of 0.3% and 1.2%, respectively.

- Beyond that, Retail Sales figures showed that consumption grew by 0.1%, in line with expectations, and by 2.3% year-on-year, beating the market consensus of a 1.4% increase. The impact on the Euro, however, was marginal, as all eyes were on the US payrolls report.

- The calendar today is light with only the Eurozone Sentix Investors’ Confidence Index and some ECB policymakers providing some guidance for the Euro.

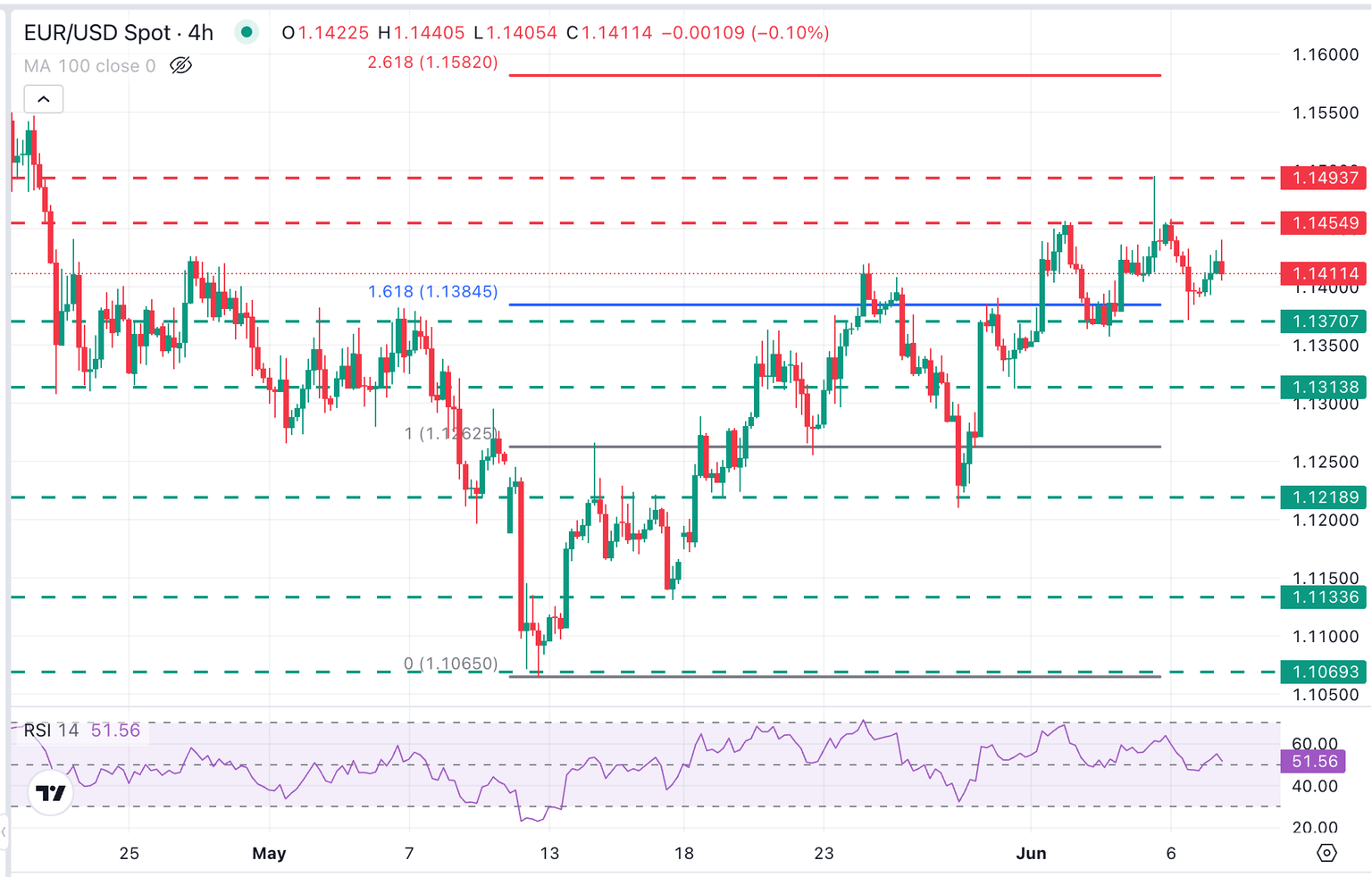

Technical analysis: EUR/USD looks for direction above 1.1400

EUR/USD is trading on a positive trend, printing higher highs and higher lows since mid-May, but the rejection at around 1.1500 seen last week and a bearish divergence on the 4-hour chart suggest that bulls might be losing steam.

Price action is heading higher on Monday, with bulls likely to be challenged at the June 3 high at 1.1455 ahead of the 1.1500 level.

On the downside, a bearish move below 1.1400 and the June 6 low at 1.1371 would give bears hopes of a deeper correction with potential targets at 1.1315 (May 30 low) and the 1.1215-1.1220 (May 20 and 28 lows).

Tariffs FAQs

Tariffs are customs duties levied on certain merchandise imports or a category of products. Tariffs are designed to help local producers and manufacturers be more competitive in the market by providing a price advantage over similar goods that can be imported. Tariffs are widely used as tools of protectionism, along with trade barriers and import quotas.

Although tariffs and taxes both generate government revenue to fund public goods and services, they have several distinctions. Tariffs are prepaid at the port of entry, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and businesses, while tariffs are paid by importers.

There are two schools of thought among economists regarding the usage of tariffs. While some argue that tariffs are necessary to protect domestic industries and address trade imbalances, others see them as a harmful tool that could potentially drive prices higher over the long term and lead to a damaging trade war by encouraging tit-for-tat tariffs.

During the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy and American producers. In 2024, Mexico, China and Canada accounted for 42% of total US imports. In this period, Mexico stood out as the top exporter with $466.6 billion, according to the US Census Bureau. Hence, Trump wants to focus on these three nations when imposing tariffs. He also plans to use the revenue generated through tariffs to lower personal income taxes.

Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.