EUR/USD wavers near highs with ECB, Fed speakers on focus

- The Euro remains steady at the mid-range of the 1.1600s after a three-day rally.

- French Prime Minister Sébastien Lecornu passed two no-confidence votes on Thursday.

- US-China escalating trade tensions and Fed monetary easing hopes are weighing on the US Dollar.

EUR/USD is trading higher for the third consecutive day on Thursday and changes hands at 1.1645 at the time of writing. Investors' concerns about the escalating trade tensions between the US and China keep weighing on the US Dollar, with the focus turning to a slew of Federal Reserve (Fed) and European Central Bank (ECB) speakers, including President Christine Lagarde, to take the stage on Thursday.

In France, Prime Minister Lecornu unexpectedly survived the second and final no-confidence vote on Thursday. The motion, put forward by Marine Le Pen, obtained only 144 votes, way short of the 289 needed to topple the government, as left-wing party La France Insoumise refused to join the far right. The Prime Minister ditched Macron's controversial pensions reform plan, which has provided him with a lifeline, although he still faces the challenge of approving a belt-tightening budget amid a very divided parliament.

Meanwhile, tensions between the US and China have continued escalating, as President Donald Trump affirmed in a TV interview that the US is already in a trade war with China. On Thursday, comments by Treasury Secretary Scott Bessent calling the Chinese Trade negotiator "unhinged "wolf have failed to ease nerves. Markets, however, keep some hopes that things will return to normal after next week's summit between Trump and his Chinese counterpart Xi Jinping, although the US Dollar is likely to remain on the defensive until that moment.

Euro Price Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the Australian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.14% | -0.10% | 0.02% | -0.08% | 0.17% | -0.34% | -0.10% | |

| EUR | 0.14% | 0.04% | 0.14% | 0.05% | 0.23% | -0.22% | 0.00% | |

| GBP | 0.10% | -0.04% | 0.16% | 0.02% | 0.16% | -0.26% | -0.01% | |

| JPY | -0.02% | -0.14% | -0.16% | -0.09% | 0.21% | -0.37% | -0.11% | |

| CAD | 0.08% | -0.05% | -0.02% | 0.09% | 0.26% | -0.28% | -0.06% | |

| AUD | -0.17% | -0.23% | -0.16% | -0.21% | -0.26% | -0.44% | -0.35% | |

| NZD | 0.34% | 0.22% | 0.26% | 0.37% | 0.28% | 0.44% | 0.24% | |

| CHF | 0.10% | -0.01% | 0.00% | 0.11% | 0.06% | 0.35% | -0.24% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Daily digest market movers: Mounting US-China trade tensions keep hurting the US Dollar

- The US Dollar remains on its back foot. Concerns that the escalation of the tensions will take the trade relationships between the world's two major economies to a point of no return are undermining confidence in the US Dollar.

- Investors remain hopeful that next week's meeting between Trump and Chinese Prime Minister Xi Jinping may bring things back to normal, meaning a further extension of the trade truce, which ends on November 1, but the Greenback might remain vulnerable up to that moment.

- ECB committee member and Belgian central bank governor, Pierre Wunsch, said earlier on Thursday that he is not uncomfortable with markets pricing a further rate cut, but also affirmed that the possibilities of that scenario have receded.

- Somewhat later, ECB's governor, Martin Kocher has reiterated that view, assuring that "we are at the end of the rate cutting cycle or very close to it".

- On Wednesday, the Federal Reserve assessed that US economic activity remained resilient over the last months, while consumer spending inched down. Employment demand remained muted amid economic uncertainty and higher prices due to rising import costs.

- Eurostat data reported that the Eurozone's Industrial Production contracted at a 1.2% pace in August following a 0.3% increment in July. These figures improve the 1.6% decline forecasted by market analysts and, therefore, the impact on the Euro was minimal.

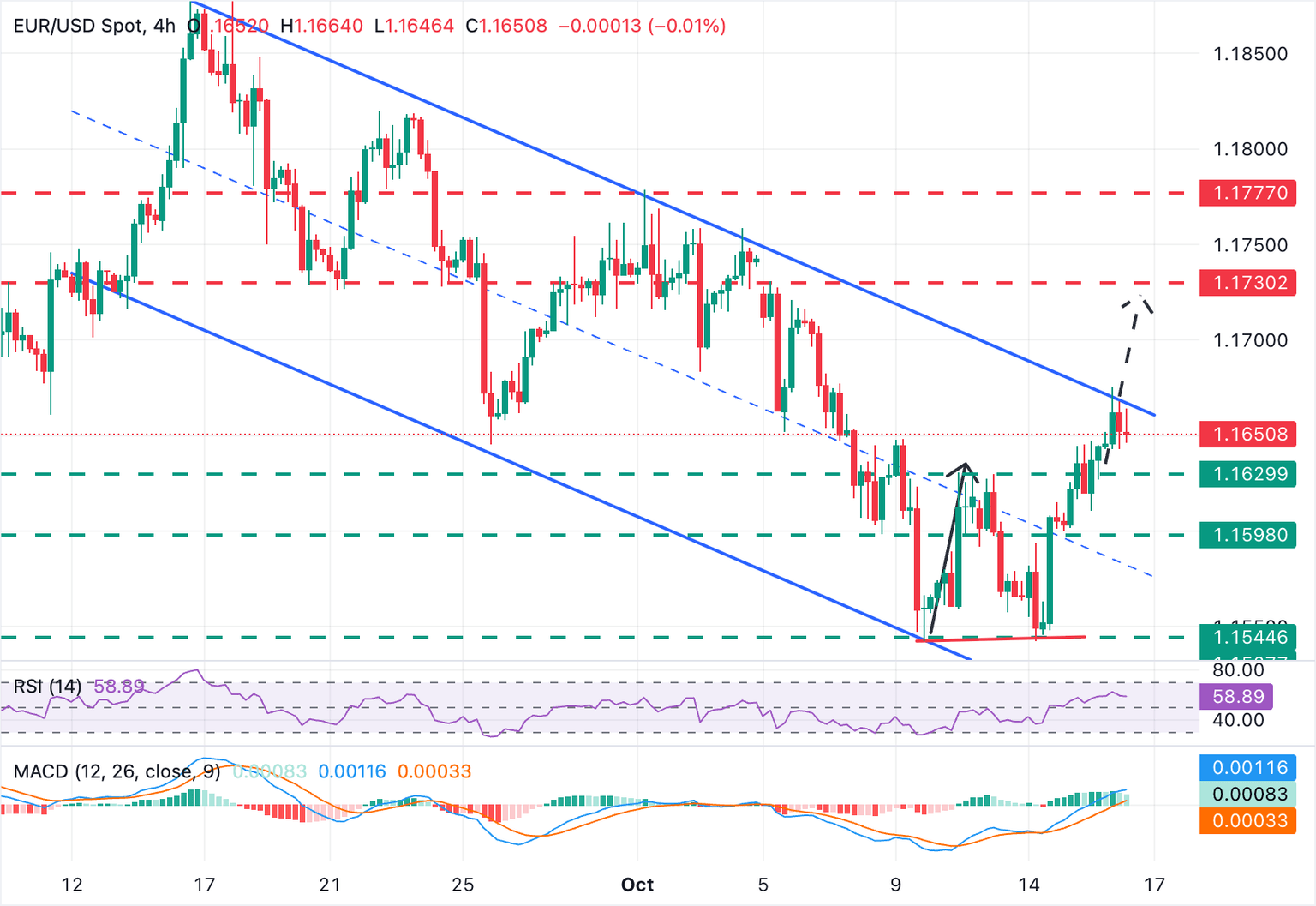

Technical Analysis: EUR/USD is testing the channel top at 1.1670

EUR/USD's bullish momentum improved on Wednesday as price action breached the neckline of a Double Bottom pattern at 1.1635. This is often a signal of a trend shift, but bulls will need to break the top of the descending channel at the 1.1670 area, which is under pressure at the moment.

The measured target of the Double Bottom pattern is at the October 6 high, near 1.1730. Further up, the next resistance would be the October 1 high, near 1.1780, although that one seems too far a target for this Thursday.

To the downside, the previous resistance, at 1.1630 is likely to act as support ahead of Wednesday's low in the area of 1.1600. A bearish move below these levels would bring the October 9, and 14 lows at 1.1542 back into focus.

Economic Indicator

Fed's Miran speech

Stephen Miran is a member of the Board of Governors of the Federal Reserve system, taking office from September 2025 to fill the vacancy left by Adriana Kugler. Miran, who was nominated by President Donald Trump, has served as the chair of the Council of Economic Advisers.

Read more.Next release: Thu Oct 16, 2025 13:00

Frequency: Irregular

Consensus: -

Previous: -

Source: Federal Reserve

Economic Indicator

Fed's Bowman speech

Michelle W. Bowman" is an American attorney and the Vice Chair for Supervision on the Board of Governors of the Federal Reserve. Bowman has served as a member of the Board of Governors since taking office on November 26, 2018, and her term ends on January 31, 2034.

Read more.Next release: Thu Oct 16, 2025 14:00

Frequency: Irregular

Consensus: -

Previous: -

Source: Federal Reserve

Economic Indicator

ECB's President Lagarde speech

The European Central Bank's President Christine Lagarde, born in 1956 in France, has formerly served as Managing Director of the International Monetary Fund, and minister of finance in France. She began her eight-year term at the helm of the ECB in November 2019. As part of her job in the Governing Council, Lagarde holds press conferences in detailing how the ECB observes the current and future state of the European economy. Her comments may positively or negatively the Euro's trend in the short term. Usually, a hawkish outlook boosts the Euro (bullish), while a dovish one weighs on the common currency (bearish).

Read more.Next release: Thu Oct 16, 2025 16:00

Frequency: Irregular

Consensus: -

Previous: -

Source: European Central Bank

Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.