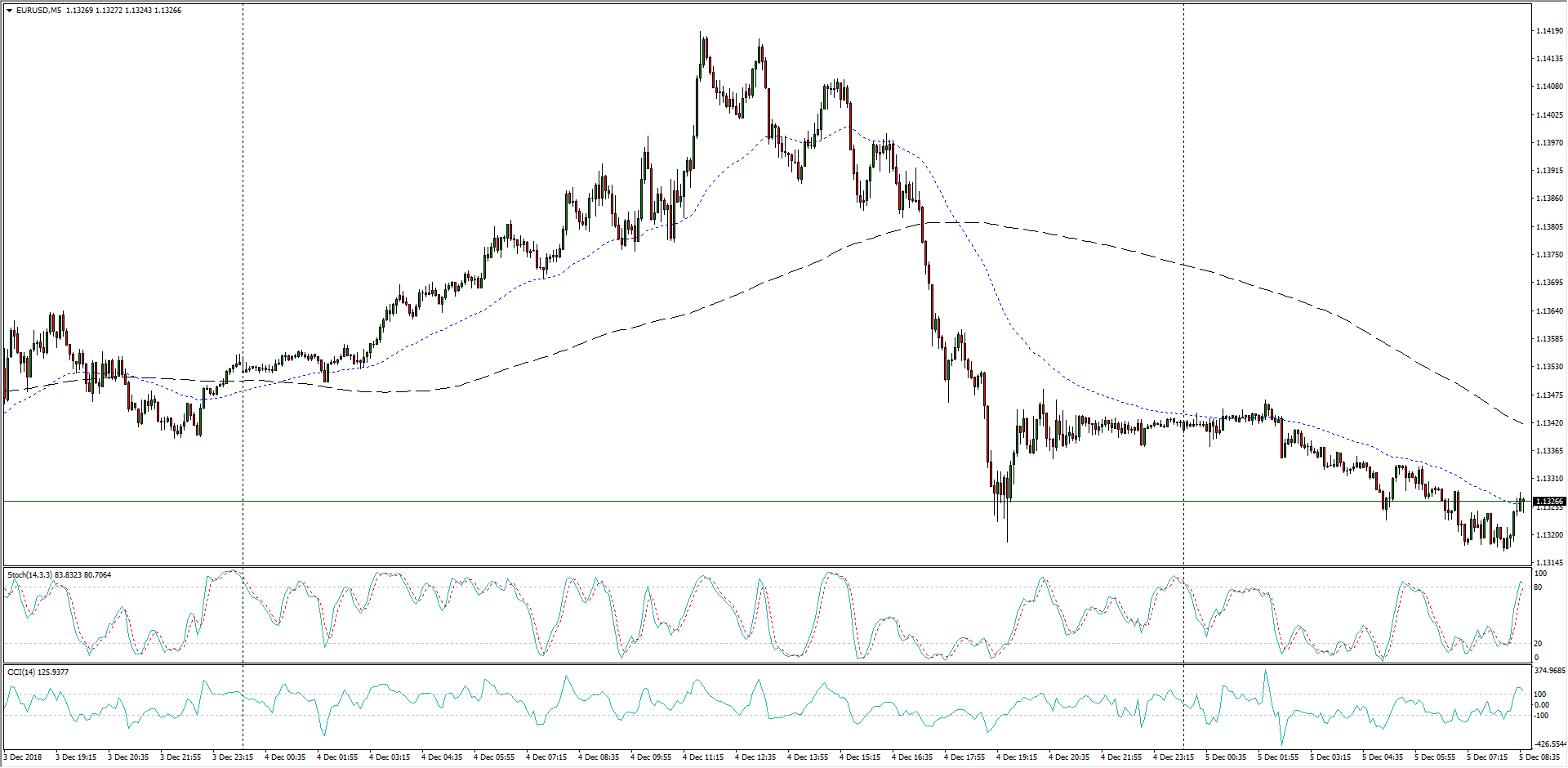

EUR/USD Technical Analysis: Set for a bounce to the upside on a sideways wedge from 1.1300

- EUR/USD has again returned to a bearish intraday setup, running into resistance at the 50-period moving average on 5-minute candles with further intraday resistance capped at the 200-period MA at 1.1340; a break of this level could see the Fiber twist into another hesitant bull day.

EUR/USD, 5-Minute

- Volatility plays over the past two weeks have left the pair with higher highs in the near-term, but plays towards the downside leave the Fiber strung out across the 200-period MA on higher timeframes as the middle ground on EUR/USD continues to open up with little directional bias baked in.

EUR/USD, 30-Minute

- Looking further out on the 4-hour candlesticks, EUR/USD is primed for a break of a constraining sideways wedge as the Fiber continues to cycle around the 1.1300 handle.

EUR/USD, 4-Hour

EUR/USD

Overview:

Today Last Price: 1.1325

Today Daily change: -13 pips

Today Daily change %: -0.115%

Today Daily Open: 1.1338

Trends:

Previous Daily SMA20: 1.1353

Previous Daily SMA50: 1.1434

Previous Daily SMA100: 1.1523

Previous Daily SMA200: 1.1755

Levels:

Previous Daily High: 1.1419

Previous Daily Low: 1.1318

Previous Weekly High: 1.1402

Previous Weekly Low: 1.1267

Previous Monthly High: 1.15

Previous Monthly Low: 1.1216

Previous Daily Fibonacci 38.2%: 1.1357

Previous Daily Fibonacci 61.8%: 1.138

Previous Daily Pivot Point S1: 1.1298

Previous Daily Pivot Point S2: 1.1258

Previous Daily Pivot Point S3: 1.1197

Previous Daily Pivot Point R1: 1.1398

Previous Daily Pivot Point R2: 1.1459

Previous Daily Pivot Point R3: 1.1499

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.