EUR/USD Technical Analysis: Nearing the top end of a sideways channel at 1.1480

- EUR/USD is pinned into the high side near 1.1450 as the US Dollar continues to flag against its major peers on the heels of a broad-market sentiment recovery that sparked on Thursday, driving the Fiber up 100-someodd pips and into a new near-term trading range.

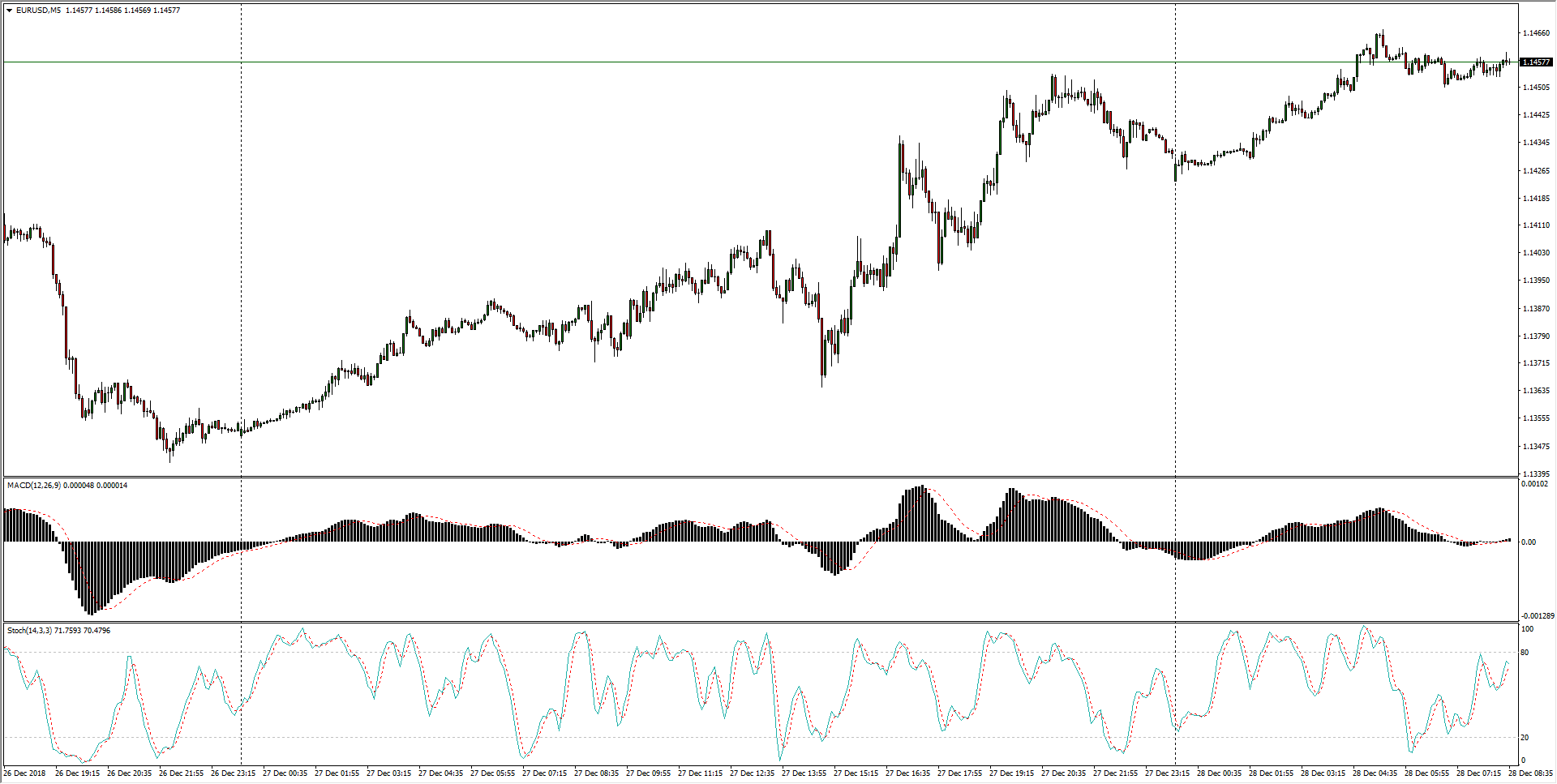

EUR/USD, 5-Minute

- Key resistance formed over the last two weeks at the 1.1490 peak, which could wind up capping any bullish extensions heading into the weekend with technical indicators beginning to threaten to rollover into sell signals.

EUR/USD, 30-Minute

- The medium-term highlights the Fiber's sideways pattern, and a rejection from the key 1.1480 region will see EUR/USD turn around and head straight back into lows near 1.1275.

EUR/USD, 4-Hour

EUR/USD

Overview:

Today Last Price: 1.1458

Today Daily change: 18 pips

Today Daily change %: 0.157%

Today Daily Open: 1.144

Trends:

Previous Daily SMA20: 1.1369

Previous Daily SMA50: 1.1374

Previous Daily SMA100: 1.1478

Previous Daily SMA200: 1.1675

Levels:

Previous Daily High: 1.1454

Previous Daily Low: 1.1348

Previous Weekly High: 1.1486

Previous Weekly Low: 1.1302

Previous Monthly High: 1.15

Previous Monthly Low: 1.1216

Previous Daily Fibonacci 38.2%: 1.1414

Previous Daily Fibonacci 61.8%: 1.1389

Previous Daily Pivot Point S1: 1.1374

Previous Daily Pivot Point S2: 1.1308

Previous Daily Pivot Point S3: 1.1268

Previous Daily Pivot Point R1: 1.148

Previous Daily Pivot Point R2: 1.152

Previous Daily Pivot Point R3: 1.1586

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.