EUR/USD Technical Analysis: Making an early run at 1.1300

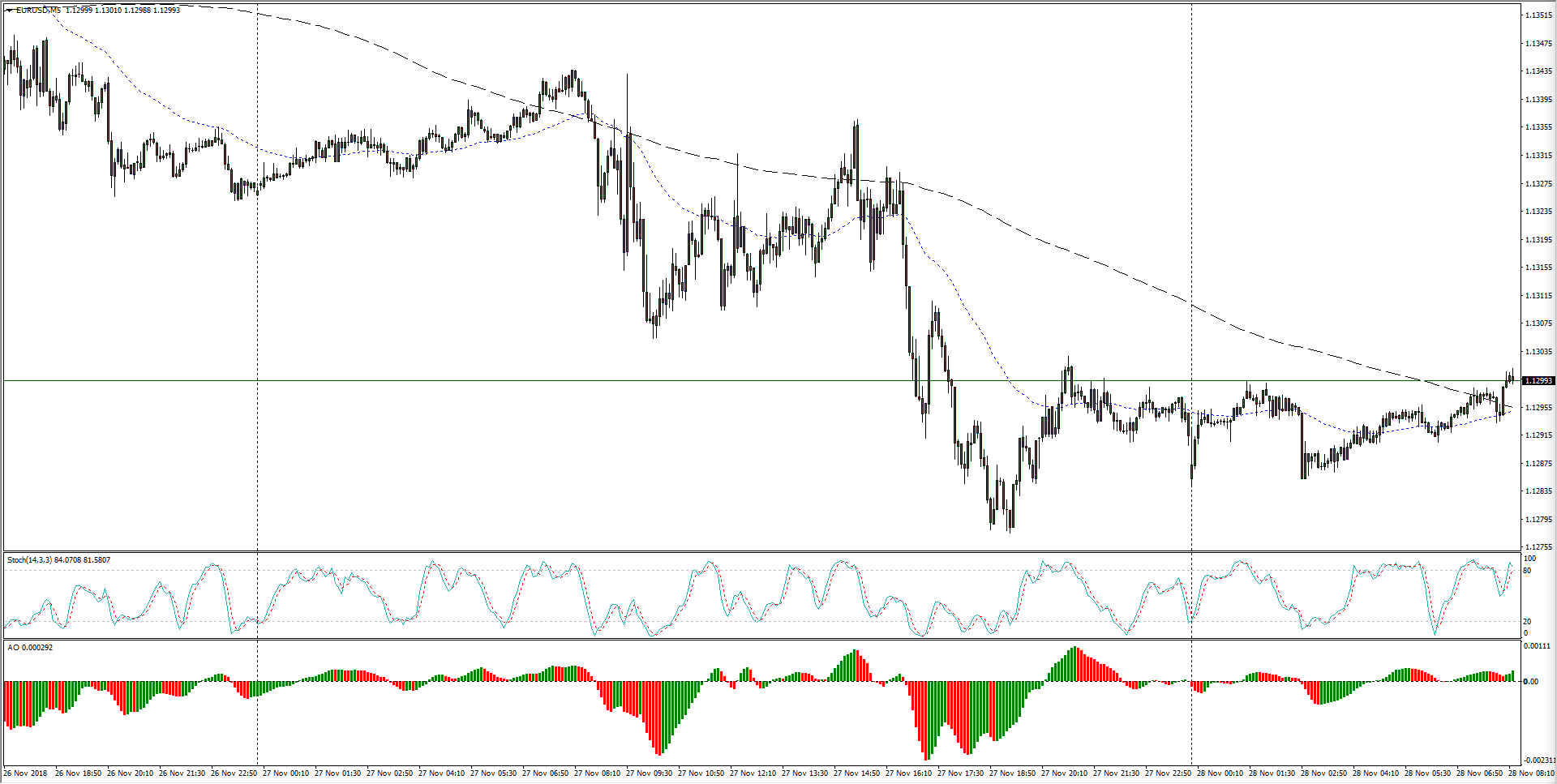

- The EUR/USD once again finds itself rising into the 200-period moving average ahead of the European market session as Fiber bulls try to reclaim the 1.1300 major handle.

EUR/USD, 5-Minute

- Going back over the past two weeks, the Fiber looks set to begin breaking into a fresh bear run after Tuesday's trading sent the EUR/USD into recent lows after the near-term saw a fresh high above 1.1450.

EUR/USD, 1-Hour

- Butting heads with the 200-period moving average is popular for the EUR/USD, with November's highs near 1.1475 getting soundly rejected from the major indicators, and medium-term resistance is building in from the 50-moving average currently resting at 1.1350.

EUR/USD, 4-Hour

EUR/USD

Overview:

Today Last Price: 1.1302

Today Daily change: 6.0 pips

Today Daily change %: 0.0531%

Today Daily Open: 1.1296

Trends:

Previous Daily SMA20: 1.1362

Previous Daily SMA50: 1.1473

Previous Daily SMA100: 1.154

Previous Daily SMA200: 1.178

Levels:

Previous Daily High: 1.1346

Previous Daily Low: 1.1277

Previous Weekly High: 1.1473

Previous Weekly Low: 1.1328

Previous Monthly High: 1.1625

Previous Monthly Low: 1.1302

Previous Daily Fibonacci 38.2%: 1.1303

Previous Daily Fibonacci 61.8%: 1.1319

Previous Daily Pivot Point S1: 1.1267

Previous Daily Pivot Point S2: 1.1238

Previous Daily Pivot Point S3: 1.1199

Previous Daily Pivot Point R1: 1.1336

Previous Daily Pivot Point R2: 1.1375

Previous Daily Pivot Point R3: 1.1404

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.