EUR/USD Technical Analysis: Continuing to spiral around 1.1350

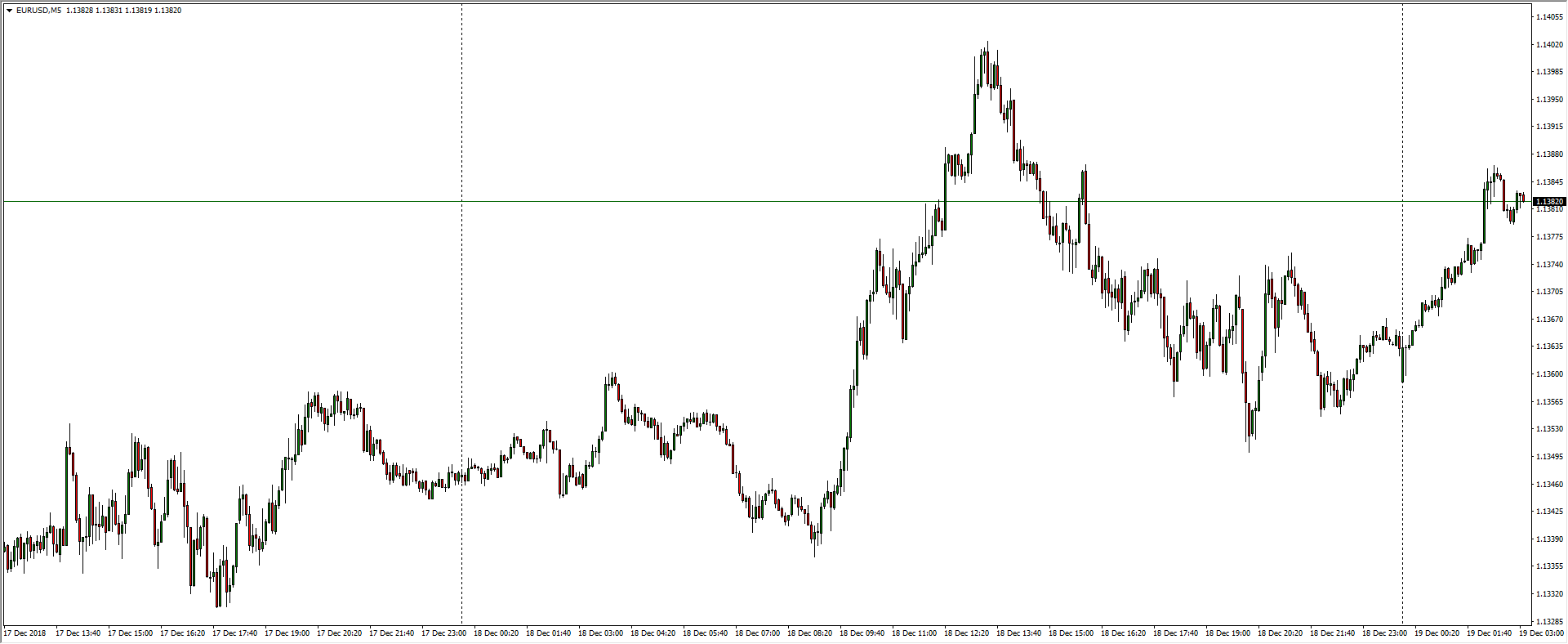

- EUR/USD is catching a bid in the early Pacific session for Wednesday, lifting back into 1.1380 as the EUR recovers from mid-Tuesday's decline from the 1.1400 handle.

EUR/USD, 5-Minute

- The last two weeks sees the Fiber constrained in a rough sideways pattern, roiling in thinning December markets as market fears run the gamut from European political fears, US-China trade angst, Brexit concerns, and a global growth slowdown, keeping the EUR capped as the greenback whips back and forth.

EUR/USD, 30-Minute

- The Euro's lateral moves can be seen on 4-hour candles, with the pair likely to remain constrained heading into the new year.

EUR/USD, 4-Hour

EUR/USD

Overview:

Today Last Price: 1.1383

Today Daily change: 19 pips

Today Daily change %: 0.167%

Today Daily Open: 1.1364

Trends:

Previous Daily SMA20: 1.1354

Previous Daily SMA50: 1.1394

Previous Daily SMA100: 1.1491

Previous Daily SMA200: 1.1708

Levels:

Previous Daily High: 1.1404

Previous Daily Low: 1.1337

Previous Weekly High: 1.1444

Previous Weekly Low: 1.1269

Previous Monthly High: 1.15

Previous Monthly Low: 1.1216

Previous Daily Fibonacci 38.2%: 1.1378

Previous Daily Fibonacci 61.8%: 1.1362

Previous Daily Pivot Point S1: 1.1332

Previous Daily Pivot Point S2: 1.1301

Previous Daily Pivot Point S3: 1.1265

Previous Daily Pivot Point R1: 1.1399

Previous Daily Pivot Point R2: 1.1435

Previous Daily Pivot Point R3: 1.1466

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.