EUR/USD surges above 1.1000 on weak US NFP, and the Euro sets to finish on a high note

- Following weak US data, EUR/USD climbs to a new weekly high above 1.1004.

- The July US Nonfarm Payrolls report gave mixed signals, with fewer people adding to the workforce while wages increase.

- Germany reported strong factory orders for June, but soft Retail Sales in the EU came in at -0.3% MoM, dampening rate hike expectations.

EUR/USD rallied sharply above the 1.1000 figure on Friday, reversing its earlier losses of 0.80%, and set to close the week in an upbeat tone and about to break above key technical indicators. Factors like US Dollar (USD) weakness, spurred by soft US economic data, bolstered the EUR/USD to new weekly highs of 1.1041. At the time of writing, the EUR/USD is trading at 1.1024, gains 0.69%.

Disappointing Nonfarm Payrolls from the US have spurred a sharp rally in EUR/USD

The US Department of Labor revealed jobs data in the form of the Nonfarm Payrolls report for July, which showed the economy added just 187K people to the workforce, below estimates of 200K. Additionally, the Unemployment Rate hit 3.6%, above 3.5%. Although the data portrays the labor market as easing, it shows signs of resilience. It remains one of the main reasons that keep inflation at around 3%, making the US Federal Reserve (Fed) job more difficult. However, it’s too early to declare victory as wages edged up, with Average Hourly Earnings climbing to 4.4% YoY, exceeding estimates of 4.2%.

The EUR/USD strengthened on the report, as the market punished the greenback and US Treasury bond yields plunged. The US Dollar Index, a measure of the buck’s value against a basket of peers, dives 0.70% and trades at 101.766.

On the Eurozone (EU) front, Germany reported solid factory orders in June but was outweighed by soft Retail Sales amongst the whole bloc. June Retail Sales came at -0.3% MoM, below 0.2% estimates, and trailed May’s 0.6% upward revision. Following the data, interest rate probabilities for the European Central Bank (ECB) are subdued, with odds at a 35% chance of a 25 bps hike in September. But October and November estimations remain high at 60% and 70%, suggesting the ECB could follow the Fed’s path of skipping monetary policy meetings.

All in all, central banks, the Fed, and the ECB and in data-dependant mode, but the strength of the US economy, could send the EUR/USD’s drifting lower, despite Fitch’s recent US credit downgrade. Next week’s inflation releases in the US and Germany could give some clues regarding the actual status of prices. Soft readings could prevent both institutions from raising rates at their September meetings.

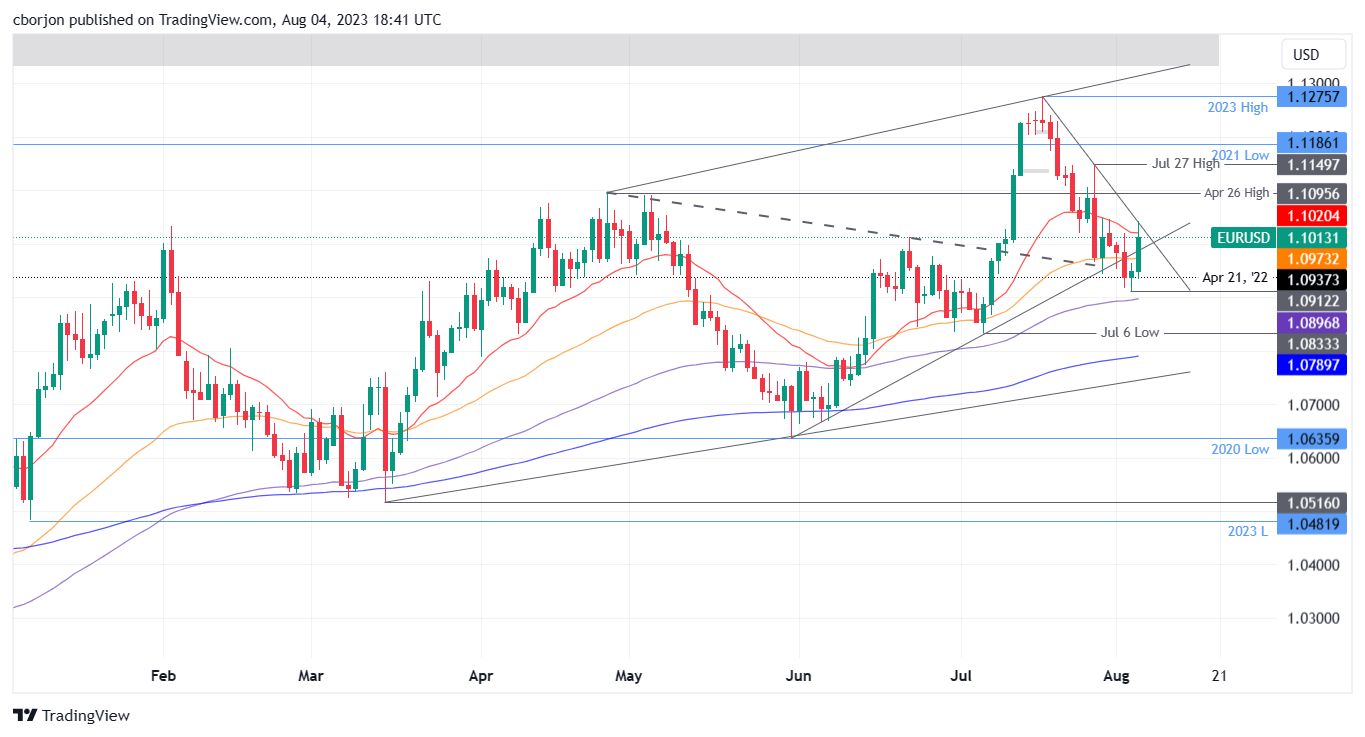

EUR/USD Price Analysis: Technical outlook

The EUR/USD is neutral to downward biased, despite reversing most of its losses and claiming the 20-day Exponential Moving Average (EMA) at 1.1021. To shift its bias to neutral, EUR/USD buyers must reclaim the April 26 low-turned resistance at 1.1095, followed by the 1.1100 mark. Break above will expose the July 27 daily high at 1.1149, followed by the 2021 daily low of 1.1186 and the 1.1200 mark. On the flip side, EUR/USD key support levels would be 1.1000, followed by the 50-day EMA at 1.0973. The break below will expose the August 3 low of 1.0912.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.