EUR/USD rebound loses momentum with markets bracing for the Fed's decision

- Geopolitical concerns and higher Oil prices are weighing on the Euro's recovery attempts.

- Investors' fears of higher US involvement in the Israel-Iran war keep the safe-haven US Dollar buoyed.

- EUR/USD is struggling to find acceptance above the 1.1500 level.

The EUR/USD pair is showing minor gains on Wednesday following a significant decline on the previous day. The escalating tensions in the Middle East, coupled with the ongoing uncertainty about global trade, and the sharp acceleration in Oil prices are keeping upside attempts limited.

The common currency's recovery from Tuesday's lows has stalled at the 1.1500 area, about 1% below last week's highs. Market sentiment remains frail as the war between Israel and Iran enters its sixth day, with the US taking a more aggressive tone against the Islamic Republic.

Beyond that, the Eurozone final CPI has confirmed previous estimation, pointing to slower price pressures, which has failed to provide any significant support to the Euro.

Comments from US administration officials suggesting that President Donald Trump would be considering striking Iran, to confirm a total surrender and the end of its nuclear program, have unnerved investors. The Iranian ambassador to the UN that Iran will respond to any direct attack from the US, heightening fears of further escalation of the conflict, which favours safe-haven assets, like the US Dollar.

Crude prices appreciated more than $3 on Tuesday to reach levels close to the $75.00 area, a 16% increase from May's prices, posing additional weight on the Euro. The Eurozone is a net Crude importer, and rising prices would hurt the region's growth prospects.,

The focus on Wednesday is on the Federal Reserve's (Fed) monetary policy decision and Chairman Jerome Powell's views on how to deal with weakening growth and potentially higher inflation. The US Dollar will be sensitive to changes in the economic projections or the dot plot that might alter interest rate expectations.

Euro PRICE Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the Swiss Franc.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.22% | -0.17% | -0.26% | -0.04% | -0.25% | -0.11% | 0.12% | |

| EUR | 0.22% | 0.04% | -0.08% | 0.08% | -0.13% | 0.17% | 0.34% | |

| GBP | 0.17% | -0.04% | -0.12% | 0.04% | -0.17% | 0.00% | 0.31% | |

| JPY | 0.26% | 0.08% | 0.12% | 0.25% | 0.04% | 0.39% | 0.64% | |

| CAD | 0.04% | -0.08% | -0.04% | -0.25% | -0.20% | -0.04% | 0.28% | |

| AUD | 0.25% | 0.13% | 0.17% | -0.04% | 0.20% | 0.30% | 0.50% | |

| NZD | 0.11% | -0.17% | 0.00% | -0.39% | 0.04% | -0.30% | 0.19% | |

| CHF | -0.12% | -0.34% | -0.31% | -0.64% | -0.28% | -0.50% | -0.19% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Daily digest market movers: The Euro picks up despite increasing geopolitical tensions

- Israel continued pounding Iran for the sixth consecutive day. US President Trump demanded the "unconditional surrender" of Tehran's authorities and vowed to deploy more fighter jets to support the Israeli army in a clear sign of America's higher commitment in the war.

- The Iranian Ambassador to the United Nations has reacted to Tuesday's comments by US President Trump, assuring that any direct US involvement in the war against Iran will be responded.

- Eurozone data released on Wednesday confirmed the deflationary trends anticipated by the preliminary release. Monthly inflation remained flat in May, following a 0.6% increase in April, while the yearly inflation slowed down to 1.9% from the previous 2.2% rate.

- Later today, the Federal Reserve is widely expected to leave interest rates steady at the current 4.25%-4.5% range, but the soft US data seen recently might have prompted the bank to tone down its hawkish stance. Any hint of a rate cut in the coming months is likely to send the US Dollar lower against the Euro.

- Futures markets are pricing two interest rate cuts in 2025, with a 60% chance that the first of them will take place in September, according to data released by the CME Fed Watch tool.

- US Retail Sales data from Tuesday showed a larger-than-expected decline. US consumption decreased at a 0.9% rate in May, beyond the 0.7% contraction expected, and April's reading was revised down to a 0.1% drop from the previous estimation of a 0.1% increase.

- In the Eurozone, the German ZEW Economic Sentiment Index, also released on Tuesday, improved beyond expectations, rising to 47.5 in June from 25.2 in May, exceeding the market forecasts of a 35.0 reading. The data, however, failed to provide any significant support to the Euro.

Technical analysis: EUR/USD extends its reversal with 1.1475 support in focus

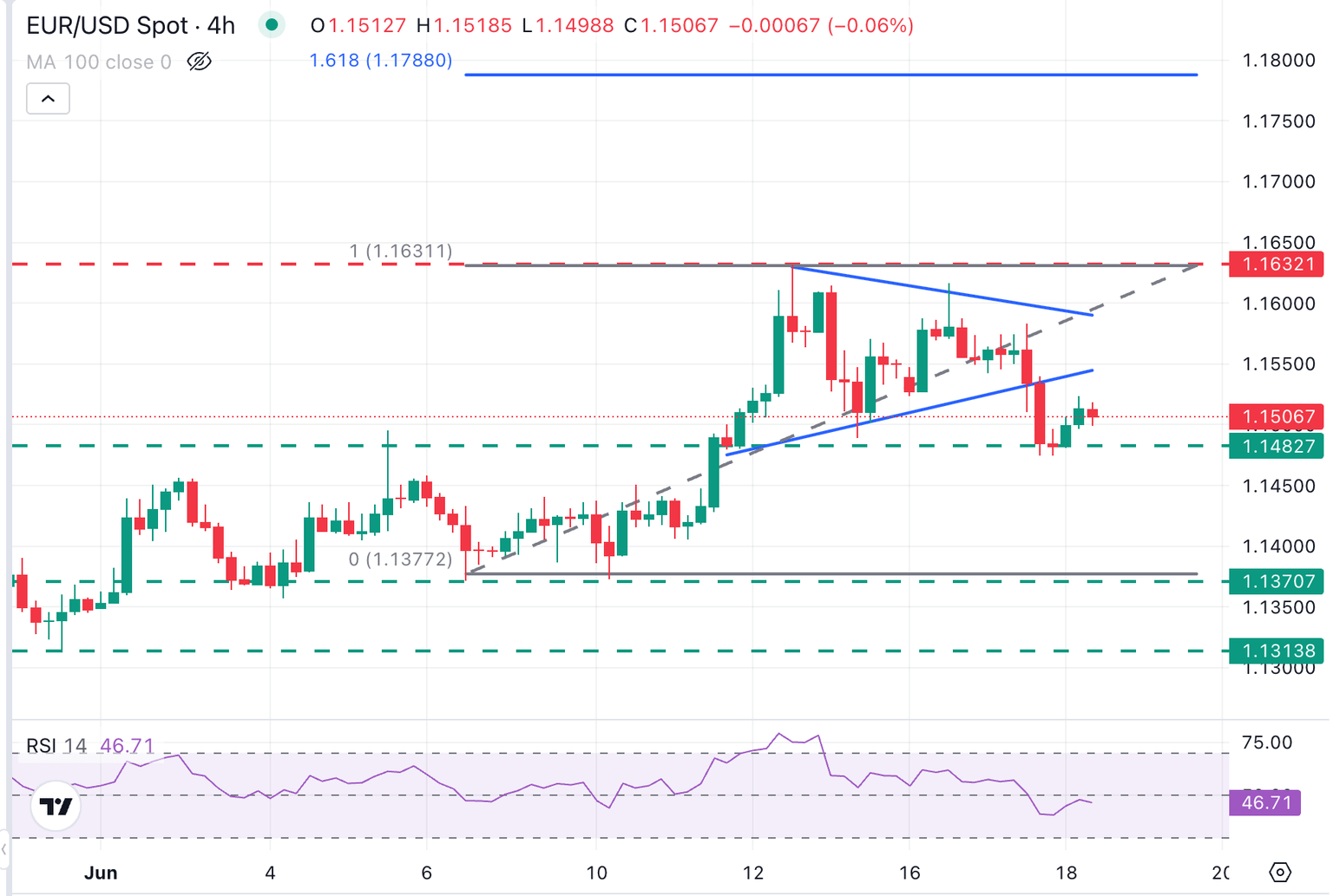

EUR/USD broke below the triangle pattern on Tuesday, confirming a deeper reversal from last week's highs, above 1.1600. The pair is pinching up on Wednesday, but the 4-hour Relative Strength Index (RSI) remains below the 50 level, suggesting that bearish momentum could grow.

The pair has returned above 1.1500 and might retest the base of the broken triangle, now at 1.1545, before extending lower. Immediate support is at Tuesday's low, 1.1477. Below here, the next targets are 1.1370 (June 6 and 10 lows) and 1.1315 (May 30 low).

On the upside, a confirmation above the mentioned 1.1545 would ease bearish pressure and bring the 1.1630-1.1640 area (June 12 and 16 highs back to the focus.

Economic Indicator

Fed Interest Rate Decision

The Federal Reserve (Fed) deliberates on monetary policy and makes a decision on interest rates at eight pre-scheduled meetings per year. It has two mandates: to keep inflation at 2%, and to maintain full employment. Its main tool for achieving this is by setting interest rates – both at which it lends to banks and banks lend to each other. If it decides to hike rates, the US Dollar (USD) tends to strengthen as it attracts more foreign capital inflows. If it cuts rates, it tends to weaken the USD as capital drains out to countries offering higher returns. If rates are left unchanged, attention turns to the tone of the Federal Open Market Committee (FOMC) statement, and whether it is hawkish (expectant of higher future interest rates), or dovish (expectant of lower future rates).

Read more.Next release: Wed Jun 18, 2025 18:00

Frequency: Irregular

Consensus: 4.5%

Previous: 4.5%

Source: Federal Reserve

Economic Indicator

Fed Monetary Policy Statement

Following the Federal Reserve's (Fed) rate decision, the Federal Open Market Committee (FOMC) releases its statement regarding monetary policy. The statement may influence the volatility of the US Dollar (USD) and determine a short-term positive or negative trend. A hawkish view is considered bullish for USD, whereas a dovish view is considered negative or bearish.

Read more.Next release: Wed Jun 18, 2025 18:00

Frequency: Irregular

Consensus: -

Previous: -

Source: Federal Reserve

Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.