EUR/USD flatlines after Fed minutes, trade war clouds hover

- Euro steadies near 1.1715 as dovish Fed tone offsets renewed global tariff tensions.

- FOMC minutes show most officials favor at least one cut this year.

- Some Fed members are open to a July cut if data support it.

The EUR/USD finished Wednesday’s session with decent gains of over 0.17% after the Federal Open Market Committee (FOMC) released its June monetary policy meeting minutes, which showed that some officials are eyeing at least one interest rate cut. As the Asian session begins, the pair trades at 1.1715, virtually unchanged, at the time of writing.

The Federal Reserve’s meeting minutes revealed that most policymakers view a rate cut later this year as a suitable option. At the same time, a few officials indicated that a reduction as early as July could be warranted, provided that incoming data aligns with their estimates.

Aside from this, Washington resumed sending tariff letters to the Philippines, Moldova, Algeria, Iraq, Libya, Brunei, Sri Lanka, and Brazil, with duties set within the 20% to 50% range.

The Euro dipped despite news that revealed that the White House didn’t target the European Union (EU) with additional tariffs and that it could secure some exceptions of the baseline rate of 10%.

Daily digest market movers: Euro trades sideways as Fed minutes hinted at just one rate cut

The strength of the Greenback pressures the EUR/USD. The US Dollar Index (DXY), which tracks the buck’s value against a basket of six currencies, finished Wednesday’s session flat at 97.51.

Wednesday’s main driver remains trade news. Washington unveiled tariffs to the Philippines (20%), Moldova (25%), Algeria (30%), Iraq (30%), Libya (30%), Brunei (25%), Sri Lanka (30%), and lastly Brazil (50%).

Alongside this, market participants digested the latest FOMC Minutes, which showed that some Fed officials do not see a rate cut in 2025. They cited that inflation pressures remain high, along with inflation expectations edging up and ongoing economic resilience. All participants viewed the current policy rate as appropriate. Participants agreed that stagflationary risks had diminished, though they remain elevated.

Washington unveiled tariffs to the Philippines (20%), Moldova (25%), Algeria (30%), Iraq (30%), Libya (30%), Brunei (25%), Sri Lanka (30%), and lastly Brazil (50%).

Trump added that he could have been harsher on trade and announced that he would impose duties on pharmaceuticals, semiconductors, and copper, which he said would result in tariffs of around 50%.

The EU stated that there has been some progress on a framework trade deal with the United States (US), according to EU spokesman Olof Gill. He indicated that Ursula Von der Leyen held a call with Trump on Sunday, saying that “They had a good exchange.”

Euro PRICE This week

The table below shows the percentage change of Euro (EUR) against listed major currencies this week. Euro was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.50% | 0.47% | 1.46% | 0.66% | 0.34% | 1.02% | 0.03% | |

| EUR | -0.50% | -0.01% | 0.72% | 0.13% | -0.10% | 0.51% | -0.48% | |

| GBP | -0.47% | 0.01% | 0.72% | 0.17% | -0.08% | 0.53% | -0.58% | |

| JPY | -1.46% | -0.72% | -0.72% | -0.57% | -0.90% | -0.22% | -1.36% | |

| CAD | -0.66% | -0.13% | -0.17% | 0.57% | -0.29% | 0.37% | -0.76% | |

| AUD | -0.34% | 0.10% | 0.08% | 0.90% | 0.29% | 0.72% | -0.50% | |

| NZD | -1.02% | -0.51% | -0.53% | 0.22% | -0.37% | -0.72% | -1.11% | |

| CHF | -0.03% | 0.48% | 0.58% | 1.36% | 0.76% | 0.50% | 1.11% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

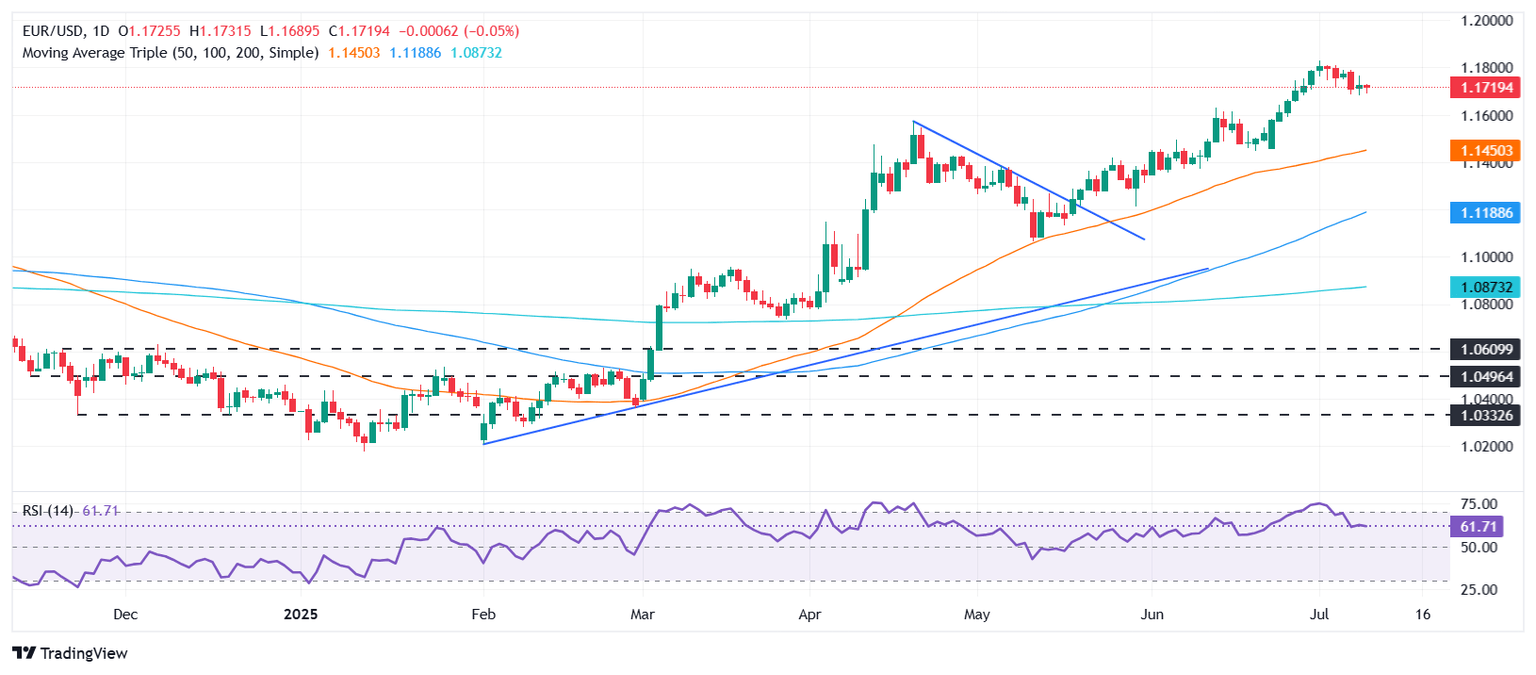

Euro technical outlook: EUR/USD clings to 1.1700 as the pair consolidates

The EUR/USD trades sideways within the 1.1700-1.1720 range, with traders still unable to break key support at 1.1700. The Relative Strength Index (RSI) shows that buyers remain in charge but are losing some momentum in the near term.

For a bullish continuation, the EUR/USD must break 1.1720 before testing the July 7 high of 1.1789. The overhead lies at 1.1800 and the year-to-date (YTD) high of 1.1829.

Conversely, if EUR/USD tumbles below 1.1700, this will expose the 20-day Simple Moving Average (SMA) as the first support level at 1.1649. A breach of the latter will expose the 1.1600 figure, followed by the 50-day SMA at 1.1448.

US-China Trade War FAQs

Generally speaking, a trade war is an economic conflict between two or more countries due to extreme protectionism on one end. It implies the creation of trade barriers, such as tariffs, which result in counter-barriers, escalating import costs, and hence the cost of living.

An economic conflict between the United States (US) and China began early in 2018, when President Donald Trump set trade barriers on China, claiming unfair commercial practices and intellectual property theft from the Asian giant. China took retaliatory action, imposing tariffs on multiple US goods, such as automobiles and soybeans. Tensions escalated until the two countries signed the US-China Phase One trade deal in January 2020. The agreement required structural reforms and other changes to China’s economic and trade regime and pretended to restore stability and trust between the two nations. However, the Coronavirus pandemic took the focus out of the conflict. Yet, it is worth mentioning that President Joe Biden, who took office after Trump, kept tariffs in place and even added some additional levies.

The return of Donald Trump to the White House as the 47th US President has sparked a fresh wave of tensions between the two countries. During the 2024 election campaign, Trump pledged to impose 60% tariffs on China once he returned to office, which he did on January 20, 2025. With Trump back, the US-China trade war is meant to resume where it was left, with tit-for-tat policies affecting the global economic landscape amid disruptions in global supply chains, resulting in a reduction in spending, particularly investment, and directly feeding into the Consumer Price Index inflation.

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.