EUR/USD corrects as Trump signals optimism on US-EU trade deal

- EUR/USD faces selling pressure above 1.1400 as the US Dollar rebounds on increased hopes of a quick bilateral trade deal between the US and the EU.

- European officials asked domestic companies to provide details on US investment proposals.

- Inflation in France cools down in May, potentially increasing the odds of interest rate cuts in June.

EUR/USD trades lower to near 1.1350 during North American trading hours on Tuesday after correcting from the monthly high of 1.1425 posted the previous day. The major currency pair faces selling pressure as the US Dollar (USD) strengthens on signs of quick progress in trade talks between the United States (US) and the European Union (EU).

The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, claws back its initial losses and rises 0.4% to near 99.35.

During North American trading hours, comments from US President Donald Trump in a post on Truth.Social indicated that the EU is speeding up the process towards reaching a trade deal with them.

"I was extremely satisfied with the 50% Tariff allotment on the European Union, especially since they were “slow walking". I have just been informed that the EU has called to quickly establish meeting dates. This is a positive event, and I hope that they will," Trump wrote.

Earlier in the day, EU officials asked domestic business owners to submit their US investment plans, Reuters reported, a move that reflected significant efforts from the old continent to speed up the formation of a trade proposal.

The de-escalation in trade tensions between the EU and the US stemmed from US President Trump postponing proposed 50% tariffs on the trading bloc until July 9, following a “good phone call” with European Commission President Ursula von der Leyen over the weekend. Ursula assured quick trade negotiations, urged for some time to reach a good deal.

On the domestic front, the US Durable Goods Orders data has declined by 6.3% in April after expanding at a robust pace of 7.6% in March, downwardly revised from 9.2%. Economists expected the cost of fresh orders for durable goods to have declined at a faster pace of 7.9%.

Daily digest market movers: EUR/USD weakens as ECB officials guide rate cuts in June

- EUR/USD faces selling pressure after the release of the preliminary France Consumer Price Index (CPI) (EU norm) data for May. The CPI report showed that price pressures cooled down significantly as inflation declined by 0.2% on a monthly basis after expanding strongly by 0.7% in April. Year-on-year, the CPI rose at a slower pace of 0.6%, compared to a 0.9% increase seen in April.

- Soft France’s inflation data is expected to encourage European Central Bank (ECB) officials to lean towards easing the monetary policy further. After the inflation data, ECB policymaker and French central bank chief François Villeroy de Galhau mentioned in a speech that a 0.6% inflation rate is a “very encouraging sign of disinflation in action” and guided a dovish stance on the interest rate outlook, Reuters reported. “Policy normalization in the Euro area is probably not complete”, Villeroy said.

- Separately, ECB Governing Council member and Lithuania's central bank Governor Gediminas Šimkus has warned of downside risks to inflation in the wake of a stronger Euro (EUR) and trade frictions with the US. Šimkus sees scope for an “interest rate reduction in June”.

- On the contrary, ECB Governing Council member and Austrian Central Bank Governor Robert Holzmann doesn't see any reason to lower interest rates in the policy meetings in June and July, said in an interview with Financial Times (FT) during European trading hours. "Moving [interest rates] further south would be more risky than staying where we are and waiting until September, as there will be no effect on the economic activity," Holzmann said.

- Meanwhile, financial market participants have fully priced in that the ECB will reduce its Deposit Facility Rate by 25 basis points (bps) to 2% in the monetary policy meeting next week.

- Ahead of the ECB meeting, officials would also have the flash inflation data for May from Germany and its six states, Spain, and Italy on Friday, and the broader Eurozone on June 3.

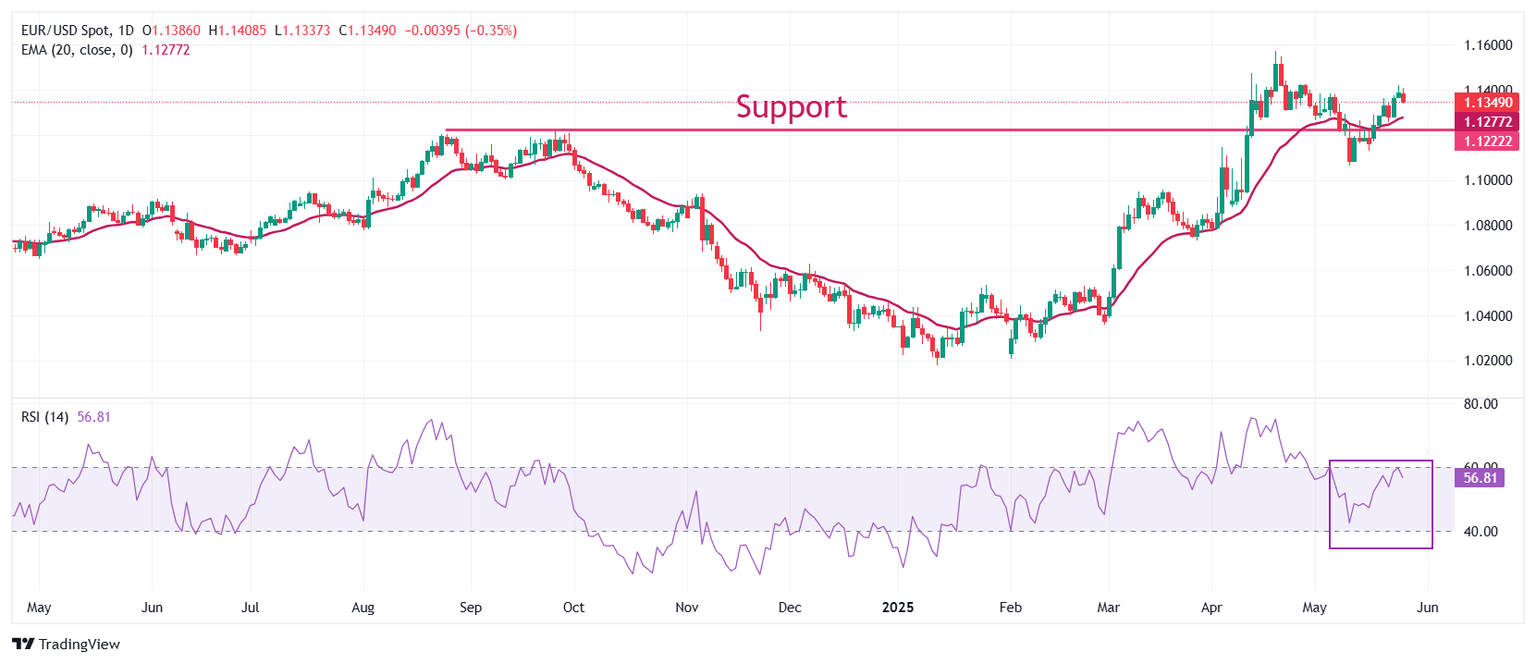

Technical Analysis: EUR/USD holds 1.1300

EUR/USD corrects from the month high of 1.1420, trading near 1.1350 at the time of writing on Tuesday. However, the near-term outlook of the pair remains bullish as it holds the 20-day Exponential Moving Average (EMA), which is around 1.1277.

The 14-period Relative Strength Index (RSI) struggles to break above 60.00. Bulls would come into action if the RSI breaks above that level.

Looking up, the April 11 high of 1.1475 will be the major resistance for the pair. Conversely, the September 25 high of 1.1215 will be a key support for the Euro bulls.

Economic Indicator

Durable Goods Orders

The Durable Goods Orders, released by the US Census Bureau, measures the cost of orders received by manufacturers for durable goods, which means goods planned to last for three years or more, such as motor vehicles and appliances. As those durable products often involve large investments they are sensitive to the US economic situation. The final figure shows the state of US production activity. Generally speaking, a high reading is bullish for the USD.

Read more.Last release: Tue May 27, 2025 12:30

Frequency: Monthly

Actual: -6.3%

Consensus: -7.9%

Previous: 9.2%

Source: US Census Bureau

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.