EUR/USD rallies toward 1.0400 as the Fed prepares to slow the pace of rates

- The Euro appreciated as the US Dollar weakened on the release of the Federal Reserve November minutes.

- Federal Reserve officials agreed to slow the rate hikes, weakening the US Dollar.

- EUR/USD Price Analysis: Daily close above 1.0400 can exacerbate a rally to 1.0500.

The Euro (EUR) jumped against the US Dollar (USD) following the release of the Federal Reserve (Fed) monetary policy minutes showed that policymakers agreed to slow the pace of rate hikes at the Federal Reserve’s (Fed) November meeting. At the time of writing, the EUR/USD is volatile, trading at around 1.0396, testing the 200-day Exponential Moving Average (EMA) at 1.0396.

Remarks of the Federal Reserve Open Market Committee (FOMC) November minutes

As mentioned above, Fed officials agreed to slow the rate hikes spurred US Dollar weakness, as the EUR/USD advanced towards its daily high of 1.0400. Furthermore, policymakers expressed that monetary policy is approaching a “sufficiently restrictive” level, acknowledging that the Federal Funds rate (FFR) peak is more important than the rate itself.

Regarding inflation, Fed policymakers agreed that there were few signs of easing inflationary pressures, though they emphasized that inflation risks were skewed to the upside.

Officials expressed a high level of uncertainty about the peak of the FFR. However, several predicted interest rates would peak at a higher level, as the Federal Reserve Chairman Jerome Powell expressed at the monetary policy press conference.

In the meantime, money market interest-rate futures odds for a 50 bps hike increased to 79% in the December meeting after the release of the FOMC minutes.

The US Dollar Index (DXY), a gauge of the greenback’s value against a basket of six currencies, extended its losses to almost 1%, down at 106.161, while US Treasury bond yields retreated.

EUR/USD Price Analysis: Technical outlook

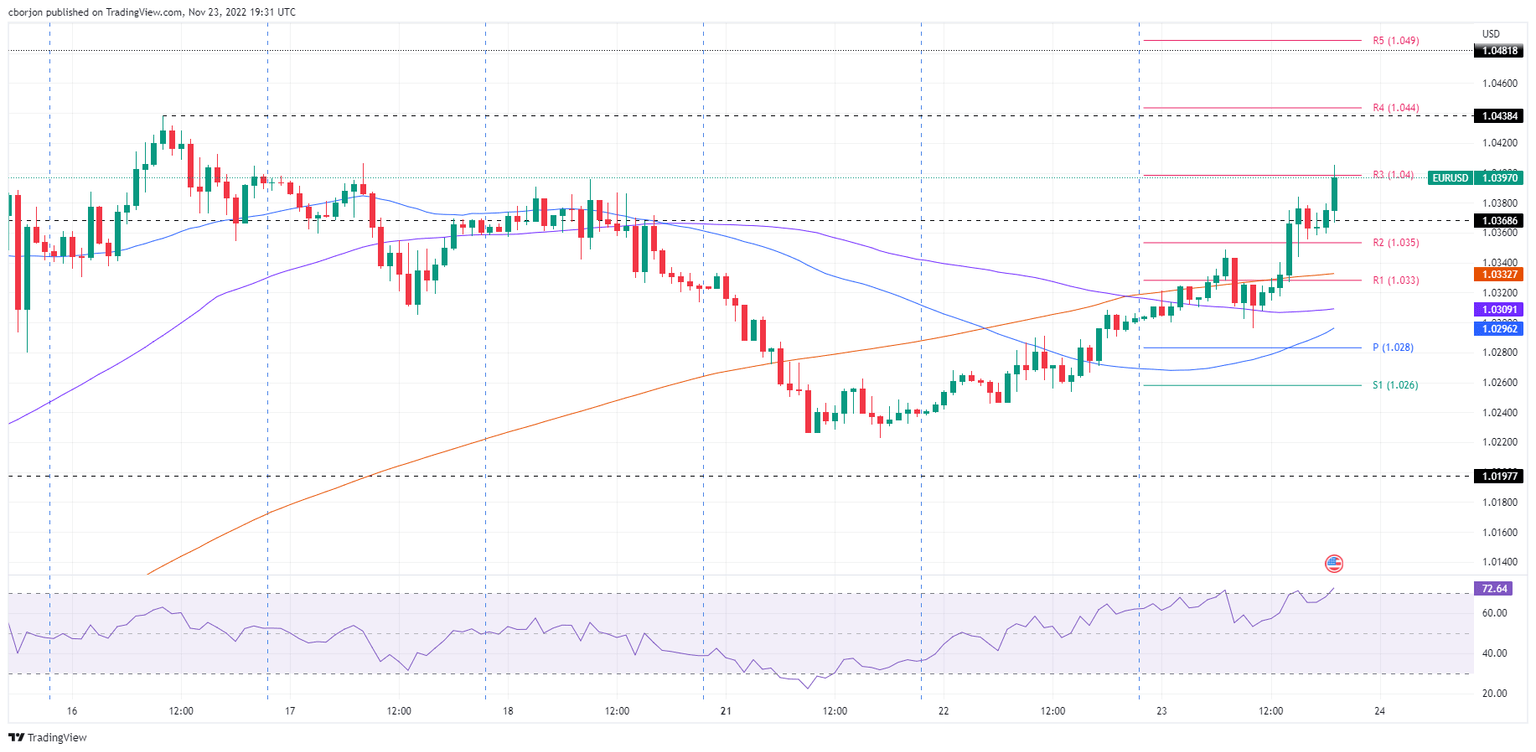

The EUR/USD is upward biased, as shown by the 1-hour chart, after breaking above the 100 and 200-Exponential Moving Averages (EMAs). Additionally, on its way north, the EUR/USD cleared the R1, R2 and is testing the R3 daily pivot point at around 1.0400. If the Euro clears the latter, the major could rally towards 1.0500.

Hence, the EUR/USD first resistance would be the November 16 daily high at 1.0438, ahead of the R4 pivot level at 1.0440, followed by the R5 pivot point at 1.0490 ahead of the psychological 1.0500 mark.

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.