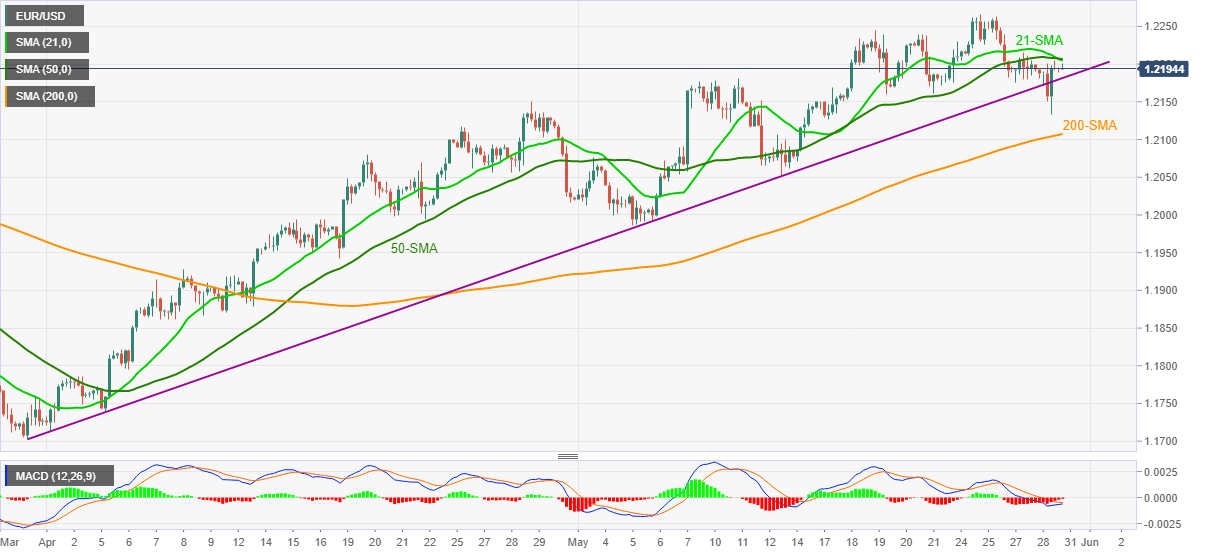

EUR/USD Price Analysis: Two-month-old support line defends bulls near 1.2200

- EUR/USD struggles to keep late Friday’s bounce off two-week low.

- Convergence of 21 and 50-SMA guards immediate upside.

- 200-SMA adds to the downside filters, MACD eases bearish bias.

EUR/USD bulls attack 1.2200 amid the early Monday morning in Asia. In doing so, the major currency pair fades the previous day’s bounce off 1.2132 below a convergence of 21 and 50-SMA. However, an upward sloping trend line from March-end joins the recently recovering MACD conditions in favor of buyers to keep bears away.

In addition to 1.2180 trend line support, 200-SMA around 1.2105, adjacent to the 1.2100 round figure also restricts the EUR/USD sellers’ entry.

It’s worth mentioning though that sustained trading below 1.2100 will drag the quote towards the mid-May lows near 1.2050 before highlighting the 1.2000 threshold and the monthly bottom surrounding the 1.1985.

Alternatively, a clear upside break of 1.2210 resistance confluence needs to cross 1.2245 and the monthly high of 1.2266 before targeting the yearly peak close to 1.2350.

In that case, the 1.2300 psychological magnet may offer an intermediate halt to EUR/USD buyers.

EUR/USD four-hour chart

Trend: Bullish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.