EUR/USD Price Analysis: Treads water around 1.0200 inside weekly triangle

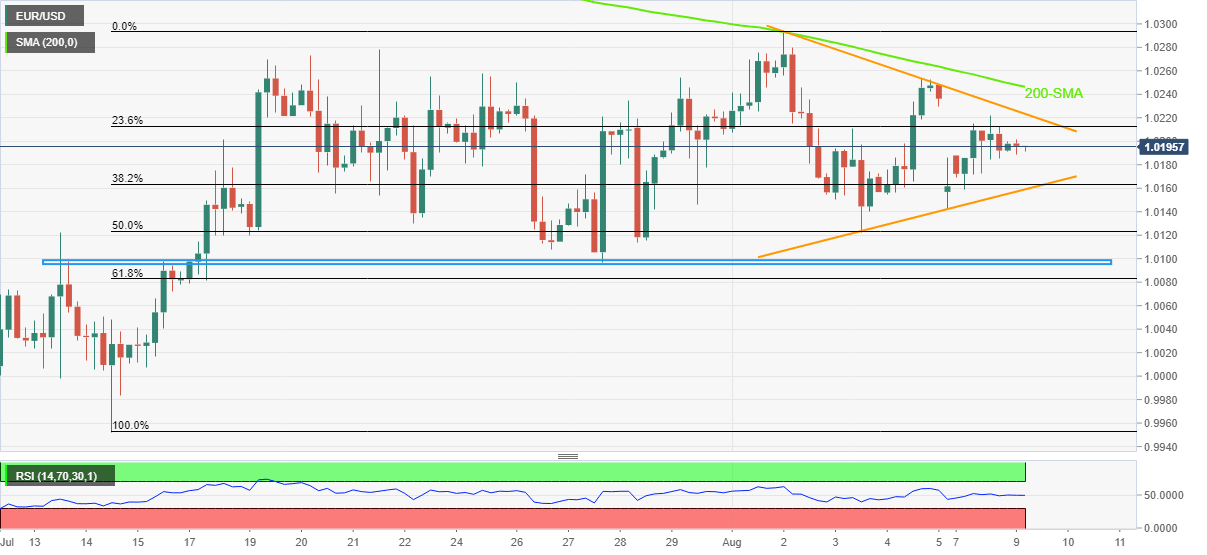

- EUR/USD remains sidelined inside one-week-old symmetrical triangle, slowly pares Friday’s losses.

- 200-SMA, monthly horizontal support add to the trading filters.

- Steady RSI hints at further grinding, monthly peak appears last defense for bears.

EUR/USD treads water around 1.0200 heading into Tuesday’s European session, keeping Monday’s mildly positive outlook amid sluggish markets.

However, a one-week-old symmetrical triangle restricts immediate EUR/USD moves amid steady RSI.

Other than the stated triangle’s extremes around 1.0225 and 1.0160, the 200-SMA and a horizontal area including multiple levels marked since July 13 will also challenge EUR/USD moves around 1.0250 and 1.0100-0095.

That said, the monthly peak near the 1.0300 psychological magnet and the 61.8% Fibonacci retracement of July 14 to August 02 upside, near 1.0080, are extra filters for trading the major currency pair.

It’s worth noting that the market’s indecision ahead of the US Consumer Price Index (CPI), up for publishing on Wednesday, also appears to challenge the EUR/USD pair traders. Even so, the recent increase in the hawkish Fed bets and the recently firmer US jobs report, keeps sellers hopeful.

Also read: EUR/USD Forecast: In wait-and-see mode ahead of US CPI

In that case, the parity level and the latest multi-month bottom surrounding 0.9950 should gain major attention.

Meanwhile, recovery moves remain elusive until cross June’s low near 1.0360.

EUR/USD: Four-hour chart

Trend: Sideways

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.