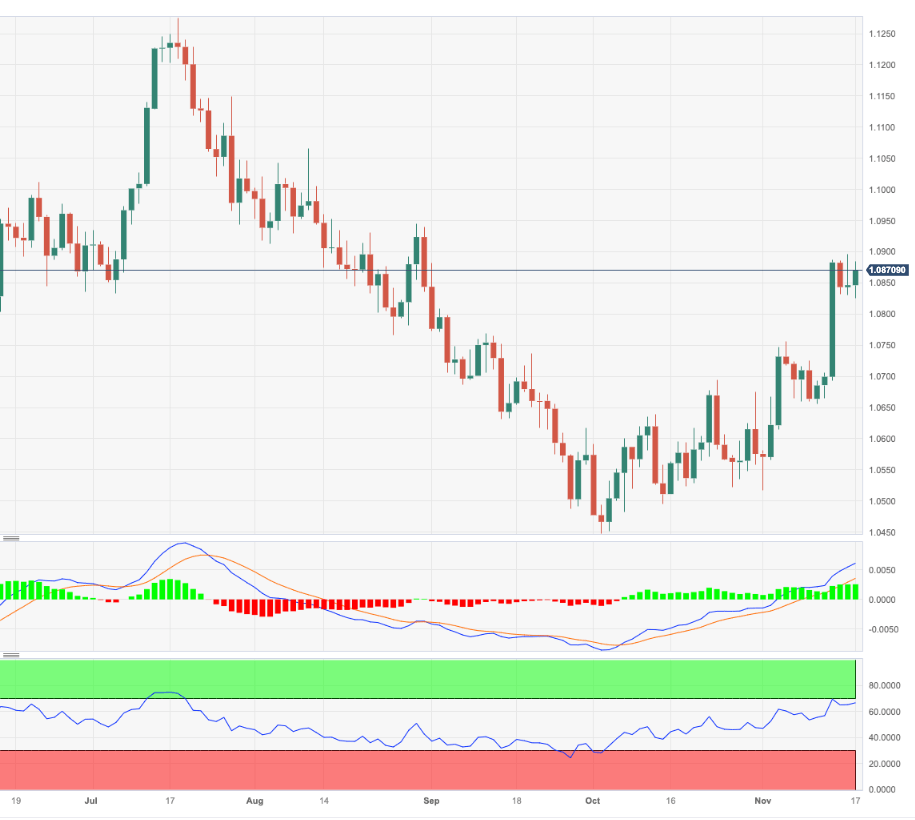

EUR/USD Price Analysis: The surpass of 1.0900 should expose 1.0945

- EUR/USD extends the trade in the upper end of the range near 1.0880 .

- Next on the upside emerges the weekly top of 1.0945.

EUR/USD adds to Thursday’s small gains and flirts with the key 1.0880 region at the end of the week.

The continuation of the upward bias could challenge the immediate up-barrier at 1.0900 ahead of the weekly high of 1.0945 (August 30). Once the latter is cleared, spot could challenge the psychological threshold of 1.1000.

So far, while above the significant 200-day SMA, today at 1.0804, the pair’s outlook should remain constructive.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.