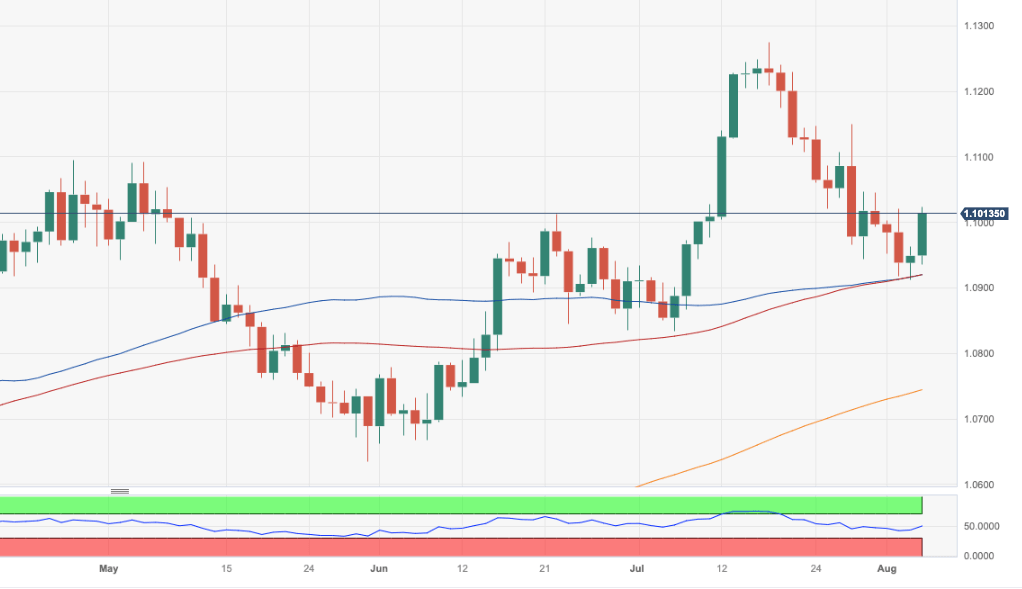

EUR/USD Price Analysis: The hunt for the 1.1150 zone

- EUR/USD rebounds sharply and reclaims the area above 1.1000.

- Next on the upside comes the weekly top around 1.1150.

EUR/USD adds to Thursday’s advance and climbs to four-day highs north of the key 1.1000 barrier on Friday.

Further gains in the pair should meet the next hurdle at the weekly peak of 1.1149 (July 27). The surpass of this level should alleviate the downside pressure and allow for a potential move to the 2023 high at 1.1275 (July 18).

Looking at the longer run, the positive view remains unchanged while above the 200-day SMA, today at 1.0743.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.