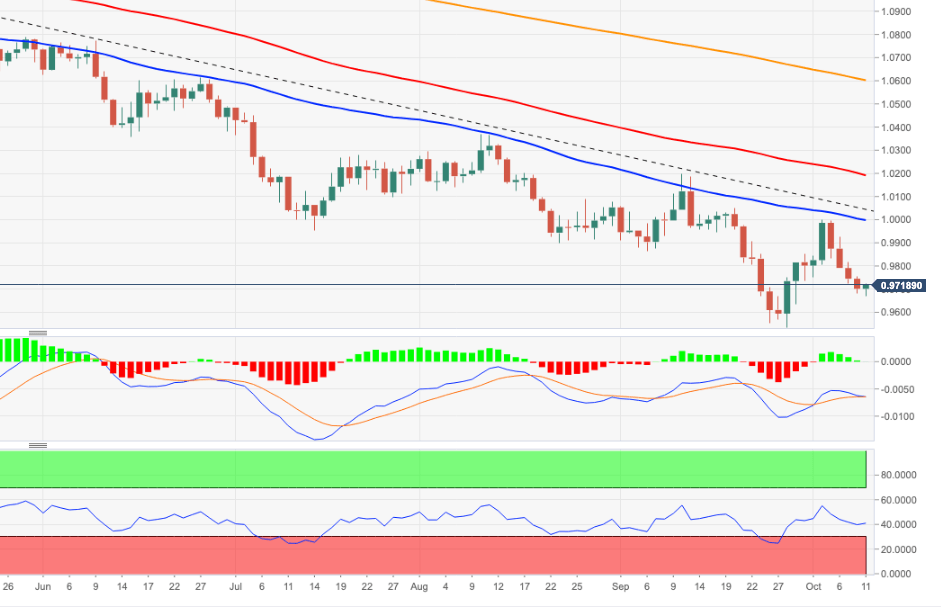

EUR/USD Price Analysis: The continuation of the downside could visit the YTD low

- EUR/USD attempts a mild recovery just above the 0.9700 barrier.

- If bears push harder, the pair could see the 2022 low retested.

EUR/USD finally sees some respite to the persistent decline and rebounds from lows near 0.9670 on Tuesday.

Despite the bounce, further losses remain well in the pipeline for the time being. That said, further weakness could drag the pair to revisit the 2022 low at 0.9535 (September 28) in the near term ahead of the round level at 0.9500.

In the longer run, the pair’s bearish view should remain unaltered while below the 200-day SMA at 1.0600.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.