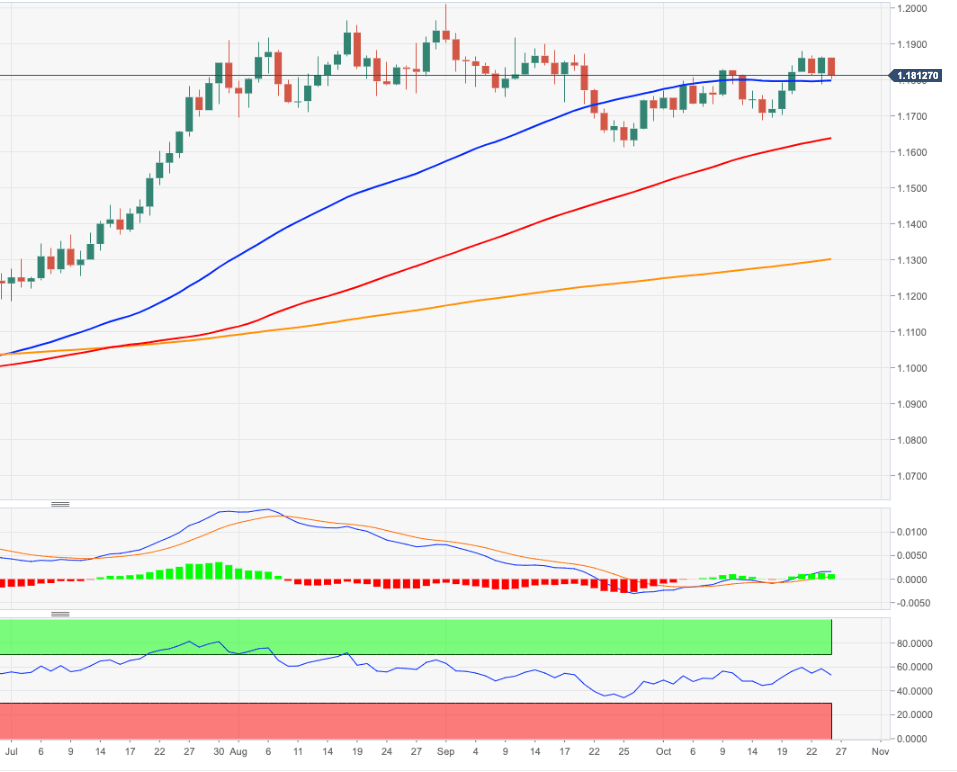

EUR/USD Price Analysis: The 55-day SMA holds the downside…for now

- EUR/USD meets daily contention in the 1.1800 neighbourhood so far.

- Extra losses appear contained near 1.1790 for the time being.

The upside momentum in EUR/USD appears to have met a decent barrier at monthly highs in the 1.1880 region (October 21).

The continuation of the side-lined mood seems underpinned by the 55-day SMA and last week’s lows in the 1.1790 zone. A break of this consolidative range in either direction is expected to risk a deeper pullback to the 1.1700 area, while the resumption of the bull trend is seen facing a key hurdle at 1.1880 initially.

Looking at the broader scenario, the bullish view on EUR/USD is expected to remain unchanged as long as the pair trades above the critical 200-day SMA, today at 1.1300.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.