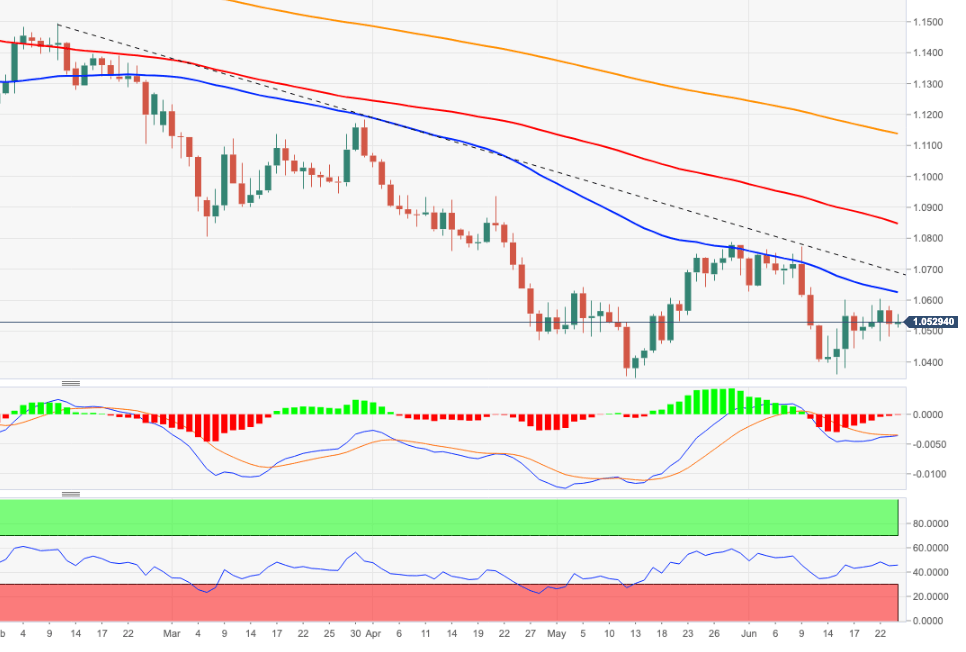

EUR/USD Price Analysis: Sustained gains seen above 1.0670/80

- EUR/USD keeps the erratic activity well in place this week.

- The 1.0670/80 band continues to cap the upside so far.

EUR/USD resumes the upside bias past the 1.0500 mark following Thursday’s decent pullback.

So far, and as long as the 4-month line in the 1.0670/80 band limits the upside, extra pullbacks in the pair should remain on the cards in the near term. The surpass of this area, however, could spark a bull run to the June top at 1.0773 and the May peak at 1.0786.

In the longer run, the pair’s bearish view is expected to prevail as long as it trades below the 200-day SMA at 1.1136.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.