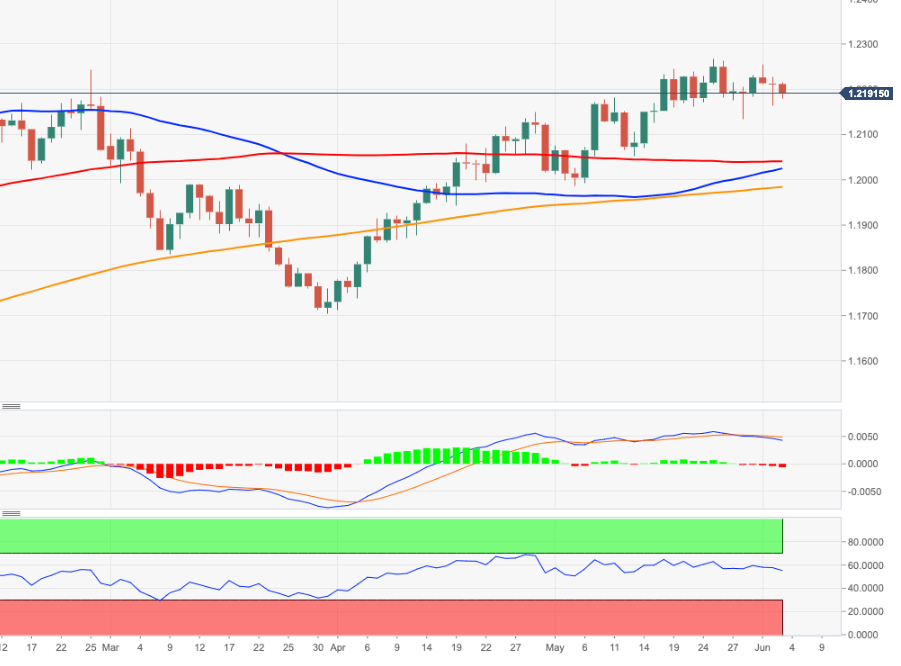

EUR/USD Price Analysis: Still room for a deeper retracement

- EUR/USD adds to Tuesday’s weakness below the 1.2200 mark.

- The next support of note emerges around 1.2130.

EUR/USD adds to Wednesday’s losses and re-visits the 1.2180/75 band on Thursday.

The continuation of the downtrend looks likely while below the short-term resistance line (off March lows) near 1.2220 and does not face any support of relevance until last week’s lows in the 1.2130 zone (May 28).

On the broader view, the constructive stance on EUR/USD is forecast to remain intact as long as it trades above the 200-day SMA, today at 1.1978.

The ongoing correction follows the recent bearish divergence in the daily RSI, as it did not confirm the recent peaks near 1.2270.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.