EUR/USD Price Analysis: Stays directed to 1.1500 despite recent pullback

- EUR/USD bulls take a breather after refreshing 2022 peak.

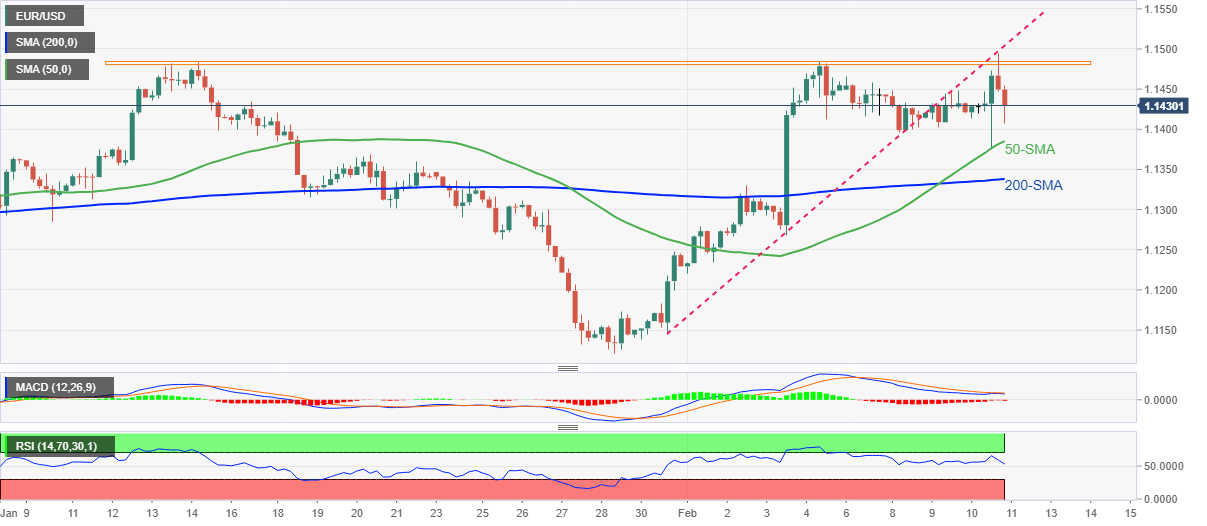

- 50-SMA, 200-SMA defend short-term buyers, two-week-old previous support guards upside.

- Sluggish MACD, firmer RSI suggests slow grind to the north.

EUR/USD braces for a fresh upside, despite stepping back from a fresh yearly high to 1.1430 during early Friday morning in Asia.

The major currency pair bounced off 50-SMA to cross the short-term horizontal area following the hot US inflation release.

However, the support-turned-resistance from January 31, around 1.1505 at the latest, restricted the pair’s upside and pulled it back towards the aforementioned SMA level of 1.1385 by the press time.

Given the mostly steady MACD and RSI line beyond 50.00, EUR/USD prices are likely to portray another bounce off the SMA support, if not then the 200-SMA level near 1.1335 will offer another chance to the pair buyers.

It should be noted, however, that the quote’s weakness past 1.1335 will welcome EUR/USD bears targeting January’s bottom surrounding 1.1120.

Alternatively, a three-month-old horizontal area surrounding 1.1480-85 preceded the previous support line near 1.1505 to challenge the EUR/USD pair’s short-term upside moves.

Adding to the upside filters is the October 2021 bottom surrounding 1.1530.

Overall, EUR/USD braces for a bumpy road to the north.

EUR/USD: Four-hour chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.