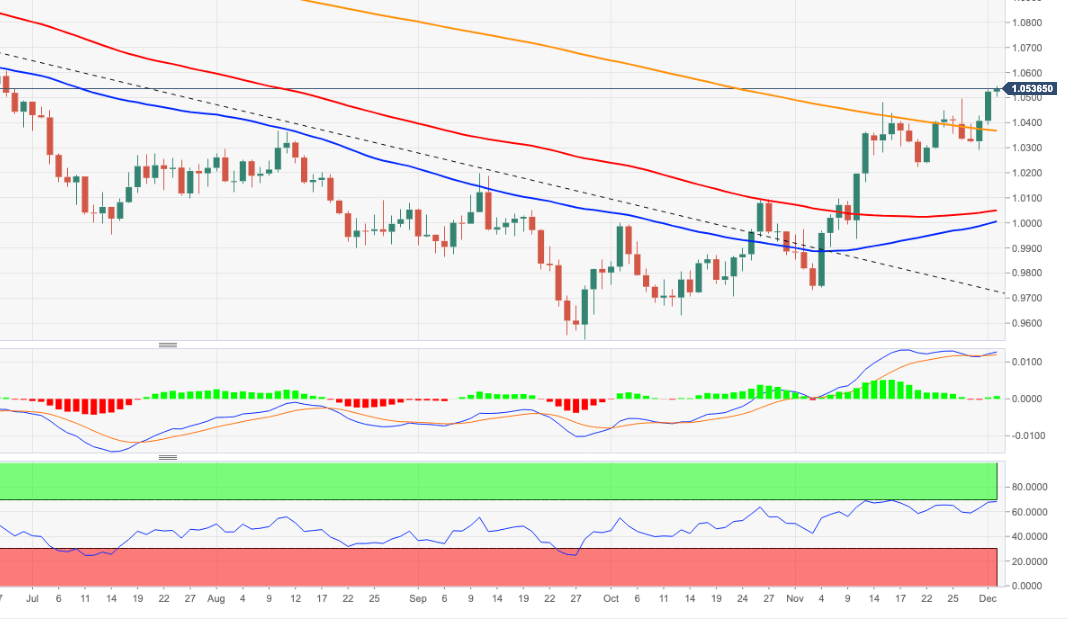

EUR/USD Price Analysis: Scope for extra gains near term

- EUR/USD advances further to fresh 6-month peaks near 1.0550.

- Further upside could put the 1.0614 level back on the radar.

EUR/USD keeps the optimism well and sound and advances to new highs near 1.0550, an area last seen back in late June.

Gains in the pair are now likely to pick up pace following the breakout of the 200-day SMA and the 10-month resistance line. Against that, there are no resistance levels of note until the June high at 1.0614 (June 27).

Further upside in EUR/USD remains on the cards while above the 200-day SMA, today at 1.0365.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.