EUR/USD Price Analysis: Rising odds for a near-term rebound

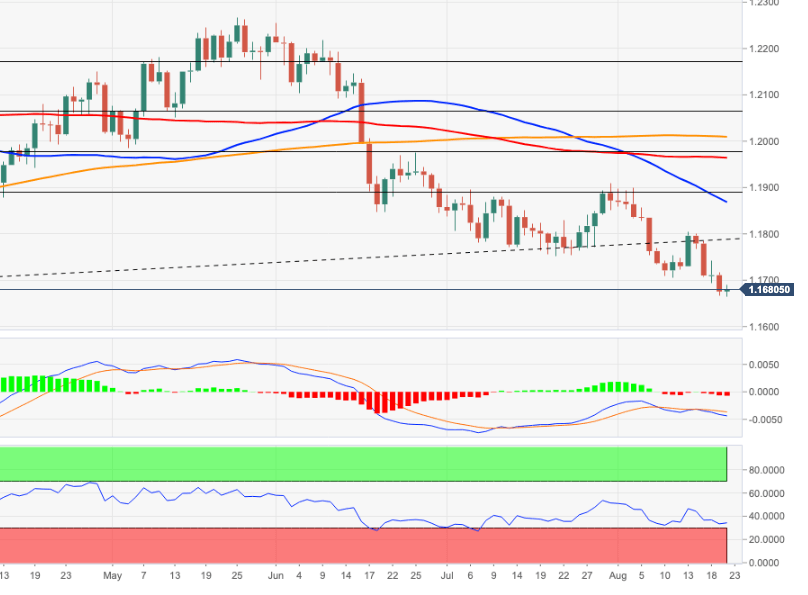

- EUR/USD navigates within a tight range around 1.1670.

- Oversold levels could spark a technical bounce.

The mood around EUR/USD remains fragile around the area of recent 2021 lows near 1.1660.

While the most likely scenario seems to point to further decline in the short-term horizon, the probability of a technical rebound has been picking up pace in light of the oversold condition of the pair, as per the daily. RSI.

Further out, the near-term outlook for EUR/USD is seen on the negative side while below the key 200-day SMA, today at 1.2003.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.