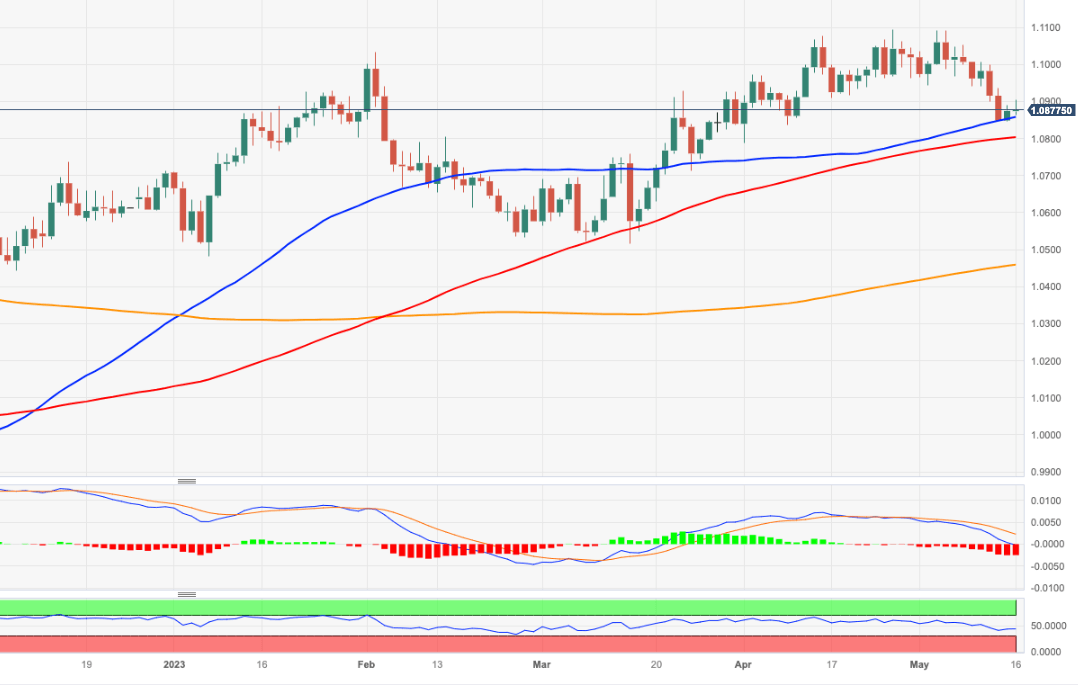

EUR/USD Price Analysis: Recovery now targets the 1.1000 barrier

- EUR/USD adds to Monday’s advance and flirts with 1.0900.

- If the rebound picks up pace, the pair should retarget the 1.1000 mark.

EUR/USD manages to grab extra impulse and trades closer to the key barrier at 1.0900 on Tuesday.

The surpass of the 1.0900 region in a convincing fashion should prompt the pair to embark on a potential visit to the psychological 1.1000 hurdle. Further upside could see the 2023 peak at 1.1095 (April 26) revisited in the not-so-distant future.

Looking at the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0457.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.