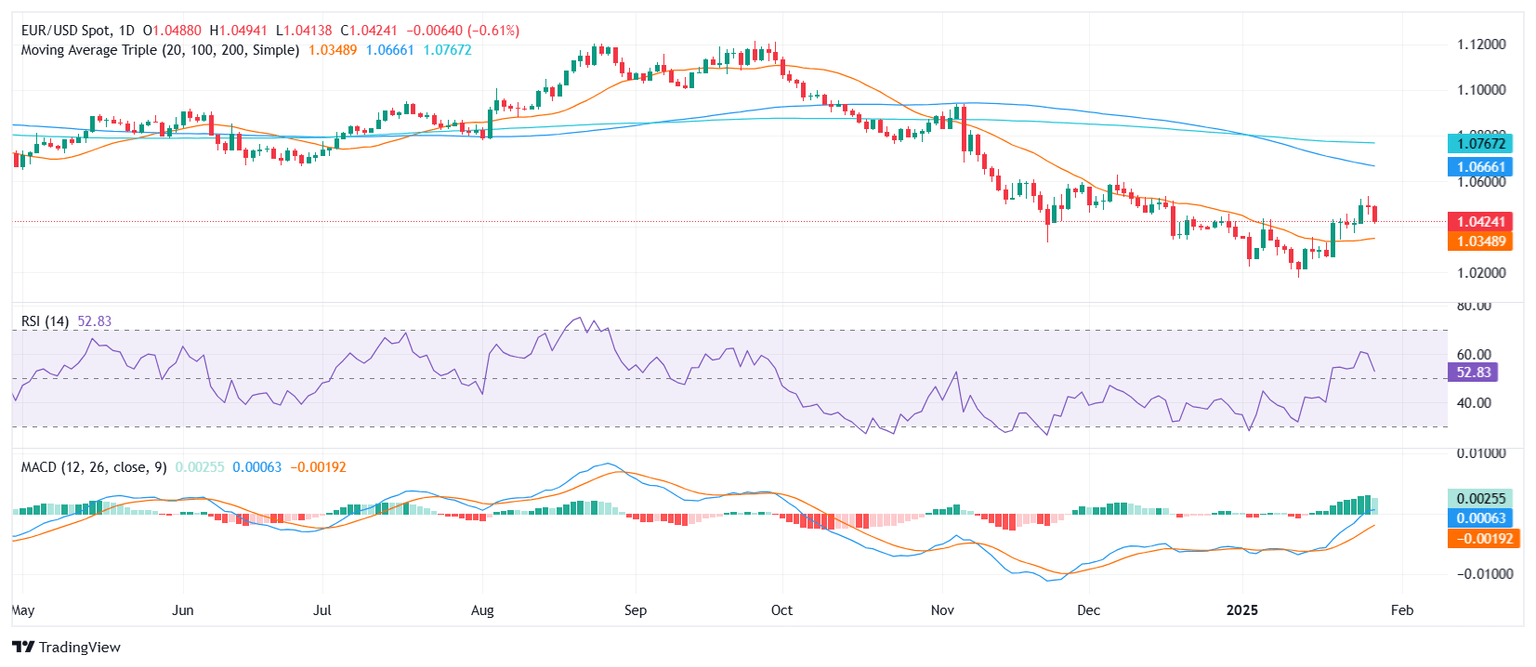

EUR/USD Price Analysis: Pair declines amid weakening bullish momentum, still above 20-day SMA

- EUR/USD drops more than 0.50% on Tuesday to land at 1.0430 after fluctuating within a narrow range.

- Momentum indicators reflect weakening bullish sentiment, hinting at potential downside risks.

The EUR/USD pair experienced a notable decline on Tuesday, slipping by 0.57% to settle at 1.0430. Despite holding within a relatively tight range in recent sessions, the pair’s inability to sustain upward traction signals waning bullish momentum and raises the likelihood of further downside in the near term.

Technical indicators underscore the bearish shift. The Relative Strength Index (RSI) has dropped sharply to 56, remaining in positive territory but signaling a potential reversal as it trends downward. Similarly, the Moving Average Convergence Divergence (MACD) histogram shows decreasing green bars, reflecting a slowdown in buying pressure and indicating a weakening upward trend. Together, these indicators suggest growing vulnerability for the pair.

From a technical perspective, the immediate support level to watch lies around 1.0400, with further downside potentially exposing the 1.0375 region (20-day Simple Moving Average). On the upside, resistance at 1.0470 would need to be overcome to reestablish bullish traction. However, unless key resistance levels are breached, the near-term outlook remains tilted to the downside.

EUR/USD daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.