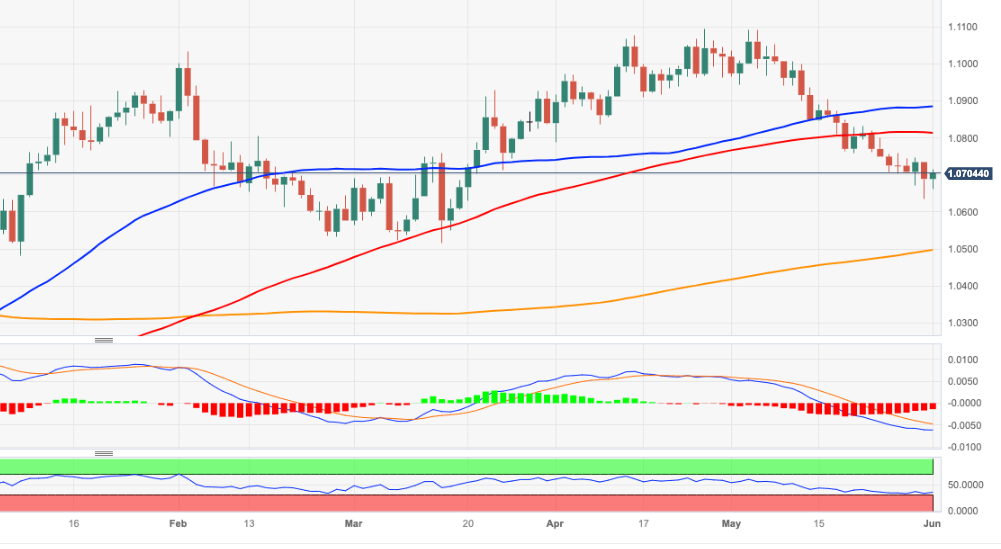

EUR/USD Price Analysis: Not out of the woods yet

- EUR/USD stages decent support to the area above 1.0700.

- The resumption of the downside could retest 1.0635.

EUR/USD rebounds from 2-month lows in the 1.0630 region and reclaims the area just beyond 1.0700 the figure on Thursday.

The pair remains under heavy pressure and a breach of the May low at 1.0635 (May 31) could pave the way to a drop to 1.0600 prior to the March low at 1.0516 (March 15).

A deeper pullback to the 2023 low at 1.0496 (January 6) would likely need a sharp deterioration of the outlook, which appears not favoured for the time being.

Looking at the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0492.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.