EUR/USD Price Analysis: Next hurdle comes in at 1.2200

- EUR/USD fades Tuesday’s negative pullback and looks to 1.2200.

- Extra gains seen above the mid-1.2200s near-term.

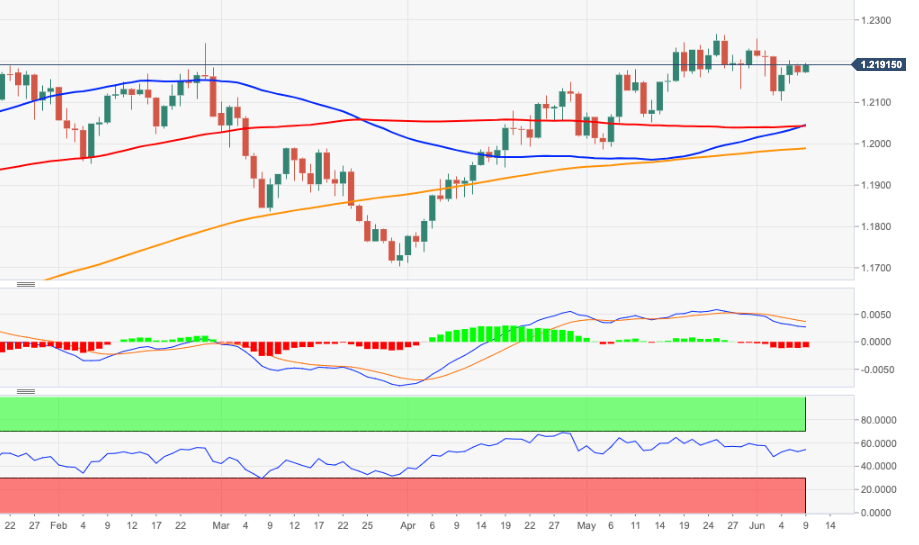

Bulls regain the upper hand and push EUR/USD back to the vicinity of 1.2200 the figure on Wednesday.

A move above the weekly highs around 1.2200 should expose the short-term resistance line (off March lows) around 1.2260. This area is also coincident with monthly peaks (May 25). Above this region, the pair should resume the upside bias and target the 1.2300 yardstick.

On the broader view, the constructive stance on EUR/USD is forecast to remain intact as long as it trades above the 200-day SMA, today at 1.1984.

The ongoing correction follows the recent bearish divergence in the daily RSI, as it did not confirm the recent peaks near 1.2270.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.