EUR/USD Price Analysis: Neutral stance around 1.0930 as momentum stalls

- EUR/USD was seen stabilizing around the 1.0930 zone after the European session, showing neutral movement.

- Indicators remain in overbought territory, suggesting that the pair may consolidate before choosing a clear direction.

- Support stands around 1.0850 and resistance is near 1.1000, with price action lacking strong directional momentum.

EUR/USD is trading steadily on Tuesday after the European session, hovering around the 1.0930 area without clear direction. Following last week's rally, the pair has struggled to find fresh momentum, with buyers and sellers maintaining a cautious stance.

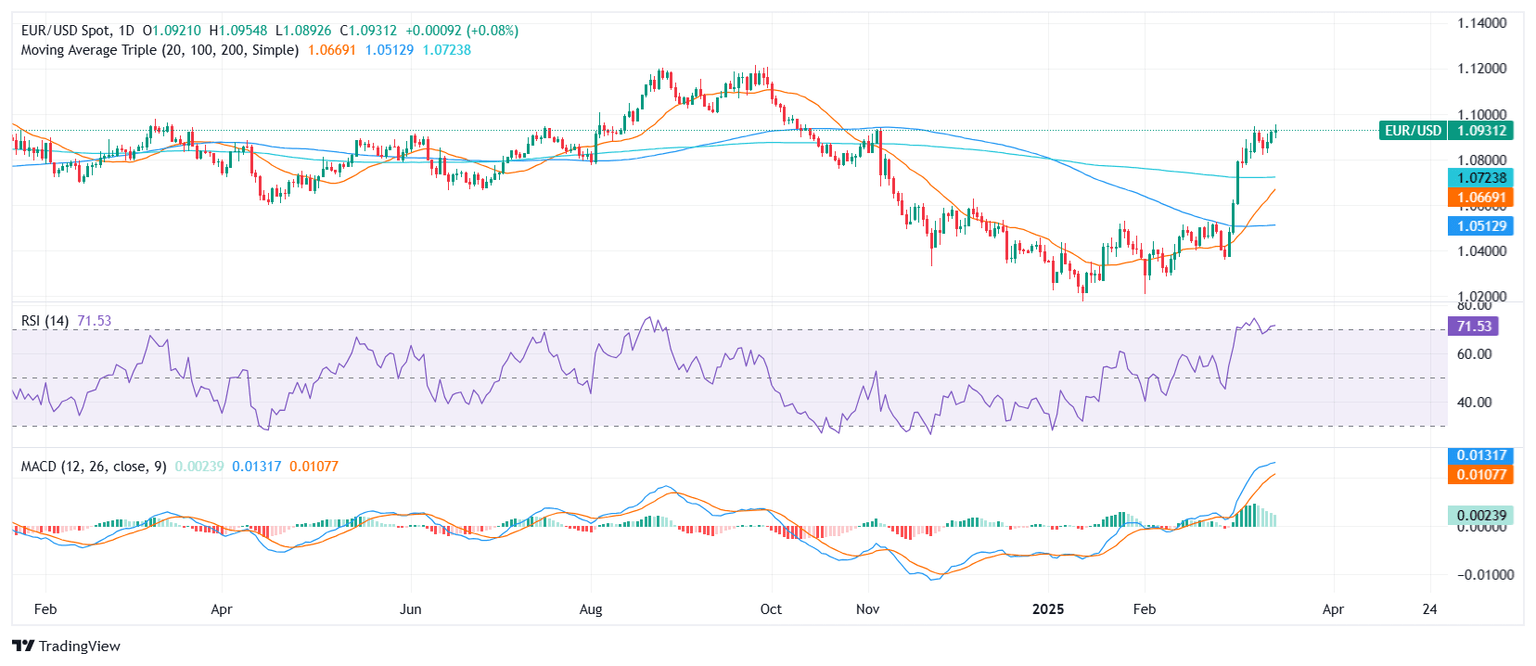

From a technical perspective, the Relative Strength Index (RSI) remains in overbought territory at 73 but is showing signs of flattening, reflecting waning bullish momentum. Meanwhile, the Moving Average Convergence Divergence (MACD) prints flat green bars, signaling a lack of strong trend conviction. These indicators suggest that the pair may enter a consolidation phase before making a decisive move.

Looking ahead, resistance remains at the 1.1000 mark, which has historically acted as a key barrier. On the downside, initial support is located near 1.0850, with stronger footing around the 20-day moving average near 1.0800. A break below these levels could trigger a corrective move, while sustained trading above 1.0900 keeps the broader bullish outlook intact.

EUR/USD daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.