EUR/USD Price Analysis: Immediately to the upside comes 1.1150

- EUR/USD looks to add to Friday’s advance north of 1.1000.

- Extra upside faces the next barrier at the weekly top around 1.1150.

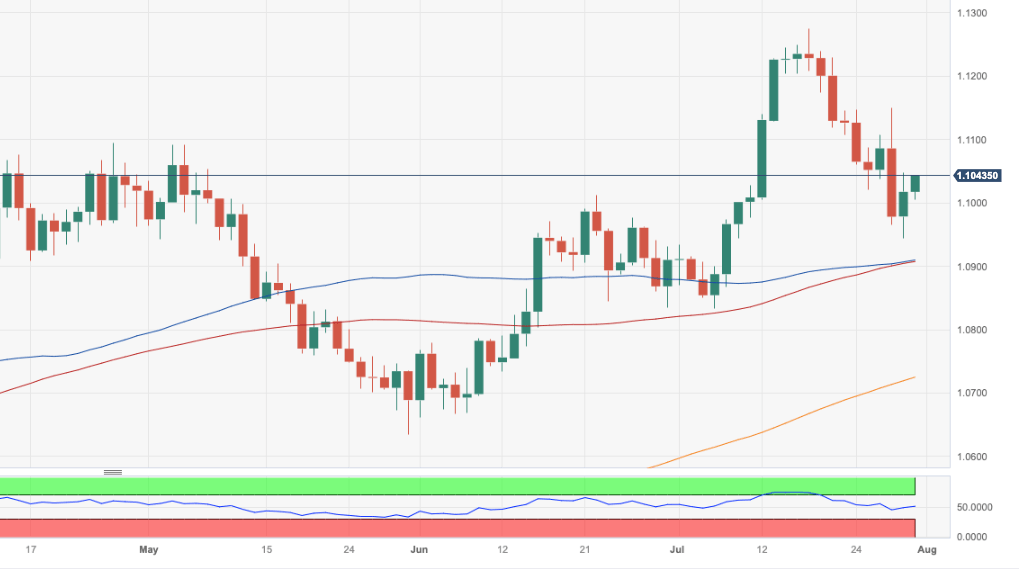

EUR/USD climbs further and revisits the 1.1040 region, or daily highs, at the beginning of the week.

In light of the recent price action, the pair could see its selling pressure somewhat mitigated on a breakout of the weekly low of 1.1149 (July 27). Once this level is cleared, spot could the attempt a challenge of the 2023 top at 1.1275 (July 18).

Looking at the longer run, the positive view remains unchanged while above the 200-day SMA, today at 1.0723.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.