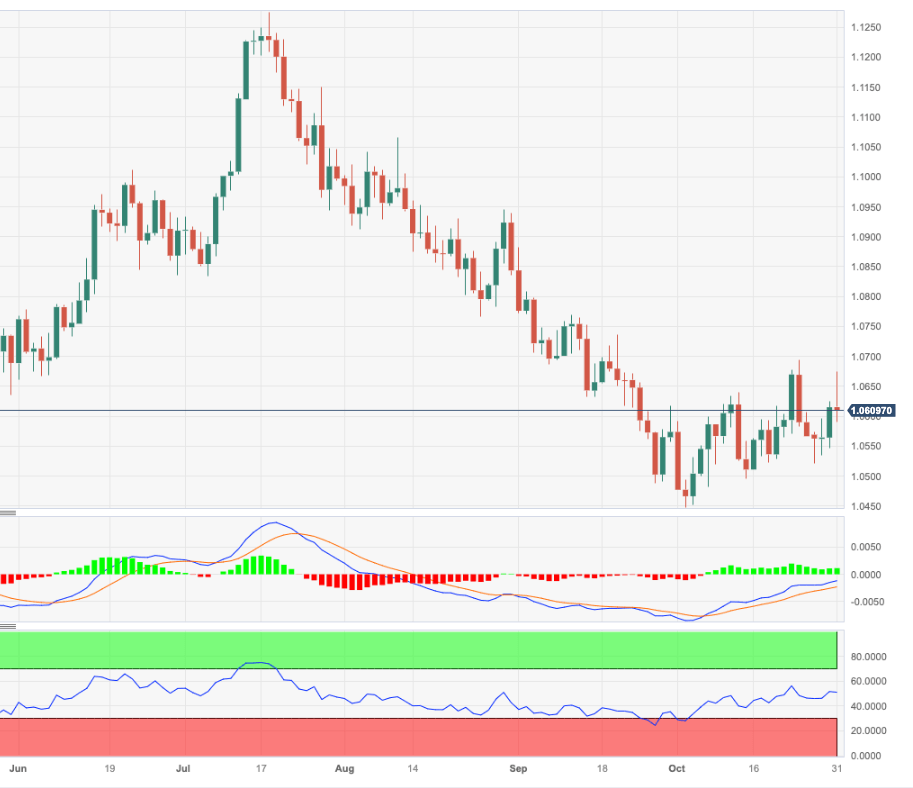

EUR/USD Price Analysis: Immediately to the upside aligns 1.0700

- EUR/USD advances further and retests the 1.0670/75 band.

- Further gains could see the 1.0700 region revisited in the near term.

EUR/USD comes under some pressure soon after hitting multi-day highs around 1.0675 on Tuesday, a region where the interim 55-day SMA also sits.

In case bulls push harder, the pair should meet the next hurdle at the monthly high of 1.0694 (October 24), which comes just ahead of the round level of 1.0700 and prior to the weekly peaks of 1.0736 (September 20) and 1.0767 (September 12).

In the meantime, while below the 200-day SMA at 1.0809, the pair’s outlook should remain negative.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.