EUR/USD Price Analysis: Further upside still looks favoured

- EUR/USD sees its upside bias dented somewhat on Tuesday.

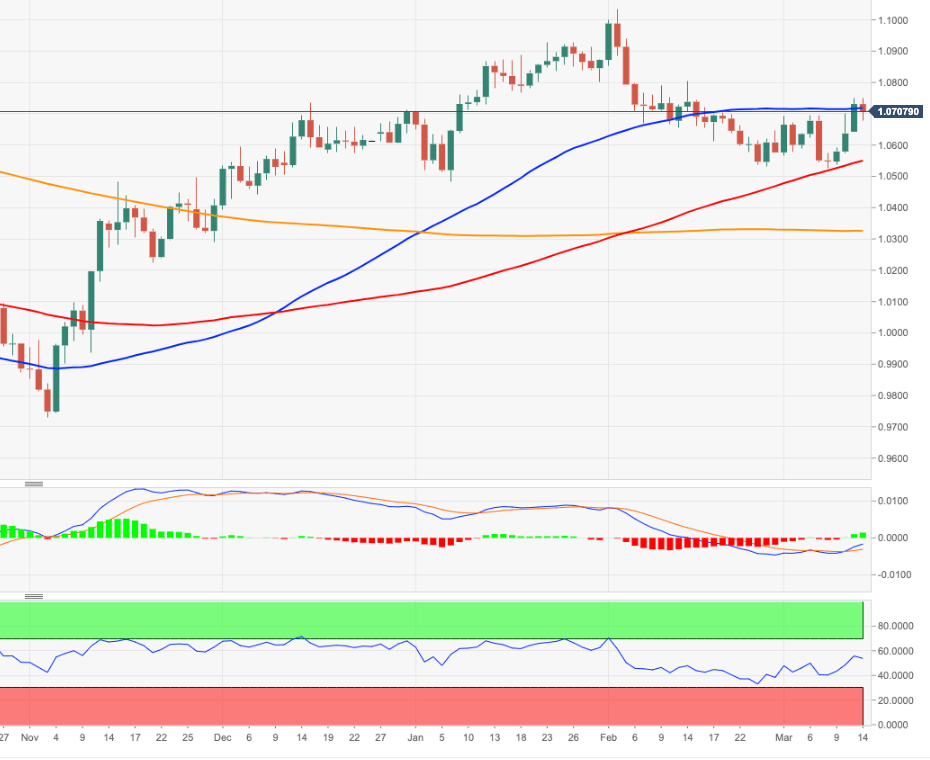

- The 1.0804 level still emerges as the next up-barrier so far.

EUR/USD comes under fresh downside pressure following recent multi-week highs near 1.0750.

The continuation of the uptrend appears in store for the time being. Against that, a convincing move above 1.0750 should open the door the weekly high at 1.0804 (February 14). Further up, there are no resistance levels of note until the 2023 peak at 1.1032 (February 2).

Looking at the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0324.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.