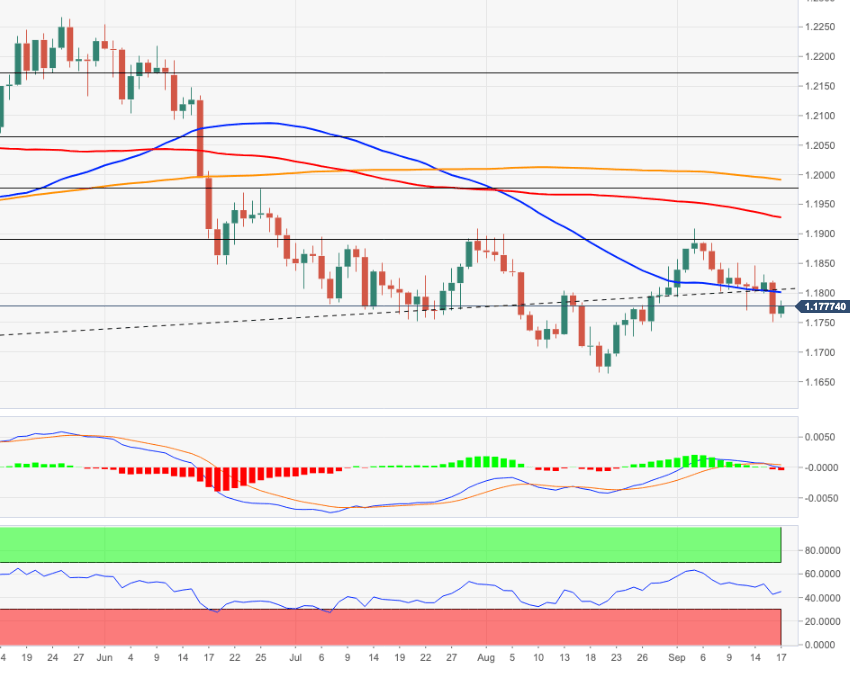

EUR/USD Price Analysis: Further losses to 1.1700 stay on the table

- EUR/USD attempts a rebound from recent lows around 1.1750.

- Next on the downside comes the 1.1700 zone.

EUR/USD trims part of the intense selloff recorded on Thursday and regains the 1.1785/90 band on Friday.

The very near-term outlook for the pair remains fragile in spite of the ongoing rebound. That said, the next support emerges at the 1.1700 region, where sits the March lows. From here, there are no significant levels until the 2021 low at 1.1663 recorded on August 20.

In the meantime, the near-term outlook for EUR/USD is seen on the negative side while below the key 200-day SMA, today at 1.1989.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.