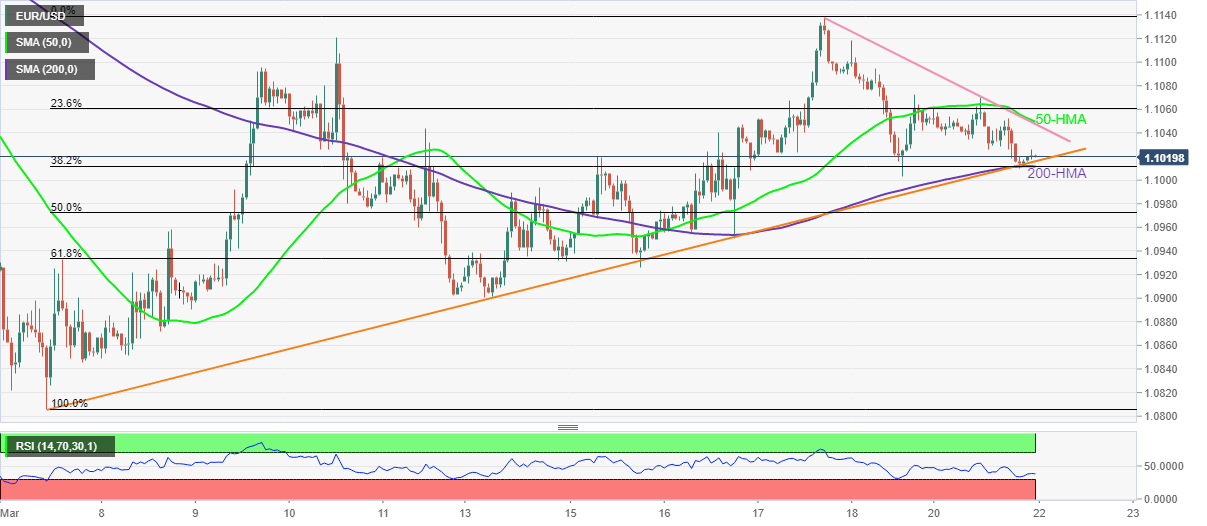

EUR/USD Price Analysis: Fades bounce off 1.1010 support confluence

- EUR/USD struggles to defend the corrective pullback from 200-HMA, fortnight-long support line.

- Downbeat RSI joins short-term descending resistance line, 50-HMA to keep sellers hopeful.

- Bulls need validation from monthly high, sellers may aim for a mid-March swing low under 1.1010.

EUR/USD bears take a breather around 1.1020 during the initial Asian session on Tuesday, following a U-turn from short-term key support a few hours back.

The major currency pair’s rebound from a convergence of the 200-HMA and an upward sloping trend line from March 07 failed to gain support from the RSI, which in turn suggests another attempt to conquer the 1.1010 crucial support levels.

Following that, Friday’s bottom surrounding the 1.1000 psychological magnet may act as a validation point for the EUR/USD south-run targeting the March 14 swing low near 1.0900.

Meanwhile, the pair’s further recovery will aim for the 1.1050 resistance level comprising the 50-HMA and descending trend line from Thursday.

That said, the EUR/USD bull’s ability to cross the 1.1050 hurdle isn’t a guarantee to the pair’s rally as the early March’s top near 1.1120 and the monthly peak surrounding 1.1140 will act as additional filters to challenge the upside momentum.

Overall, EUR/USD prices are likely to consolidate the previous week’s recovery moves.

EUR/USD: Hourly chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.