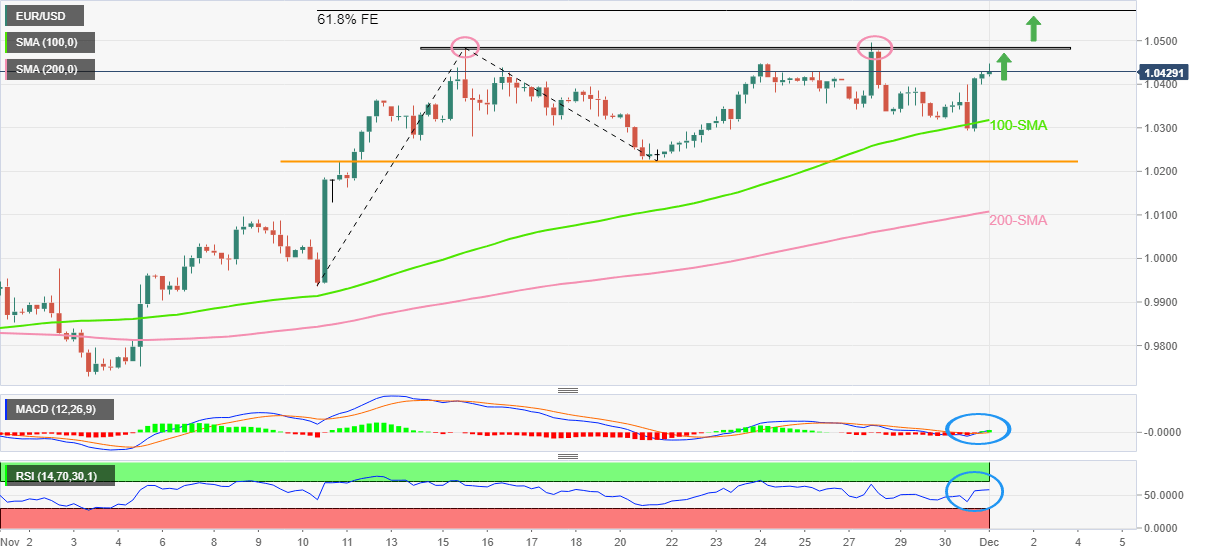

EUR/USD Price Analysis: Fades bounce off 100-SMA above 1.0400

- EUR/USD retreats from intraday high to pare daily gains.

- Bullish MACD signals, steady RSI favor the rebound from 100-SMA.

- Double tops around 1.0480 appears a tough nut to crack for bulls.

- Sellers have a bumpy road to return unless breaking 200-SMA.

EUR/USD grinds higher past 1.0400, taking rounds to 1.0430 during early Thursday, as bulls await the key data/events after posting the biggest monthly jump since September 2010.

Also read: EUR/USD bulls approach 1.0500 hurdle ahead of German Retail Sales, Fed’s preferred inflation data

In doing so, the major currency pair struggles to extend the previous day’s U-turn from the 100-SMA.

However, recent bullish signals on the MACD and steady RSI keep EU/USD buyers hopeful as they approach the 1.0480 key hurdle comprising the tops marked on November 15 and 28.

In a case where EUR/USD manages to cross the 1.0480 resistance, the 1.0500 threshold may act as an additional upside filter before directing the prices toward the 61.8% Fibonacci Expansion (FE) of the pair’s November 10-21 moves, near 1.0570. Following that, the late June peak surrounding 1.0615 will be in focus.

Alternatively, pullback remains elusive beyond the 100-SMA support level surrounding 1.0315.

Also acting as a downside filter is the horizontal support including levels marked since November 10, around 1.0225.

Should the EUR/USD bears keep the reins past 1.0225, the 200-SMA level surrounding 1.0100 could act as the last defense of the bulls.

EUR/USD: Four-hour chart

Trend: Limited upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.